The Home Depot, Inc.’s HD third-quarter fiscal 2025 results highlight the growing importance of its Pro customer base as DIY demand remains uneven. While total sales grew 2.8% to $41,352 million, management noted that an expected demand surge failed to materialize amid persistent consumer uncertainty and housing pressures. Against these DIY headwinds, the Pro segment is emerging as a stabilizing force. Both Pro and DIY comparable sales were positive and relatively in line this quarter, yet the company is disproportionately investing in tools to capture more complex professional projects.

The recent acquisition of GMS, a specialty distributor of building products, contributed roughly $900 million in sales during the quarter. This move complements the existing SRS Distribution business, which maintained flat comparable sales despite double-digit declines in the broader roofing market. Home Depot is further fortifying its Pro ecosystem with new digital tools, including blueprint takeoffs, designed to simplify material estimation and procurement.

Pro engagement helped sustain higher-value purchases. Average ticket rose 1.8% during the quarter, reflecting an increased mix of higher ticket items. We note that big-ticket comp transactions of more than $1,000 increased 2.3% year over year. Home Depot noted strength in Pro-heavy categories such as gypsum, insulation, siding and plumbing.

Management acknowledged that housing turnover is at multi-decade lows and that consumer uncertainty continues to weigh on renovation activity. These same dynamics are affecting Pros, particularly those tied to larger financed projects, as backlog visibility has begun to soften. DIY trends remain challenged as customers pull back on discretionary spending, and management confirmed that the expected second-half demand pickup did not materialize. Pro strength is providing cushion, but not driving meaningful acceleration.

Are FND and LOW Seeing a Structural Demand Reset?

Floor & Decor Holdings, Inc. FND continues to face industry-wide softness, with third-quarter 2025 comparable store sales down 1.2% as transactions remain pressured. Despite better Pro engagement and category innovation, Floor & Decor repeatedly acknowledged that the hard-surface flooring market remains in a trough and that demand recovery is uncertain. This suggests Floor & Decor is navigating similar structural headwinds as Home Depot.

Lowe's Companies, Inc. LOW posted third-quarter fiscal 2025 comparable sales at 0.4% but also cited an anxious consumer and continued pressure on big-ticket discretionary spending. While Pro, appliances and online improved, Lowe's emphasized that affordability constraints and macro uncertainty remain barriers to any broad rebound. Overall, Lowe's also appears constrained by the same structural demand backdrop limiting large-project activity.

What the Latest Metrics Say About Home Depot

Home Depot shares have fallen 12% in the past year compared with the industry’s decline of 17.4%.

Image Source: Zacks Investment Research

From a valuation standpoint, Home Depot trades at a forward price-to-earnings ratio of 22.94, higher than the industry’s 20.87. HD carries a Value Score of C.

Image Source: Zacks Investment Research

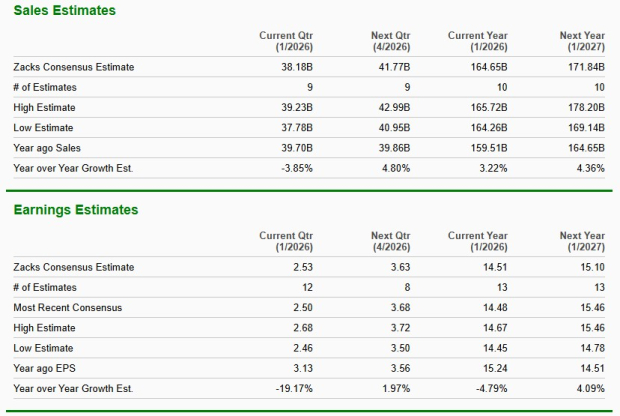

The Zacks Consensus Estimate for Home Depot’s current financial-year sales implies year-over-year growth of 3.2%, while the same for earnings per share suggests a decline of 4.8%.

Image Source: Zacks Investment Research

Home Depot currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Floor & Decor Holdings, Inc. (FND) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.