The Home Depot, Inc.’s HD second-quarter fiscal 2025 results show that while earnings per share held steady, margin pressure remains a key issue. The company reported earnings of $4.58, marginally down from $4.60 per share a year ago. Similarly, adjusted earnings came in at $4.68, a minimal increase from $4.67 last year. While these numbers align with the company’s expectations, they draw attention to potential pressure on margins.

The second-quarter gross margin came in at 33.4%, a slight improvement from the prior year and in line with management’s expectations. However, the stability at the gross margin level was not maintained down the income statement. The operating margin decreased to 14.5% from 15.1% in the second quarter of fiscal 2024, with the adjusted operating margin also contracting to 14.8% from 15.3%.

The primary reason behind this compression was a 65-basis-point increase in operating expenses, as a percentage of sales, which reached 18.9%. This jump in expenses, while expected, raises questions about HD's ability to improve profitability if sales growth moderates. During the quarter, SG&A expenses climbed 8.7%, outpacing sales growth of 4.9%, which limited operating income growth to just 0.3%.

Home Depot reaffirmed its fiscal 2025 guidance, which includes a gross margin of approximately 33.4% and an adjusted operating margin of roughly 13.4%. Management expects adjusted earnings to decline about 2% from $15.24 per share in fiscal 2024.

If costs continue to rise faster than sales, it may hurt the bottom line, unless productivity initiatives and higher ticket sizes offset the drag from expenses in the coming quarters.

Home Depot Competitor Analysis: LOW & FND on Margins

Lowe's Companies, Inc. LOW demonstrated stronger performance in the second quarter of fiscal 2025, with adjusted earnings per share increasing 5.6% to $4.33. Lowe’s reported an adjusted gross margin of 33.8%, up 37 basis points, and an adjusted operating margin of 14.7%, which was up 23 basis points from the prior year. This suggests that Lowe's is effectively managing costs and driving productivity initiatives.

Floor & Decor Holdings, Inc. FND also saw an increase in its second-quarter earnings, which rose 11.5% to 58 cents a share. Management stated that it is actively managing the gross margin rate and profitability despite external pressures like tariffs. Floor & Decor believes that its direct global sourcing network and competitive pricing strategy provide a significant advantage. Overall, both Lowe's and Floor & Decor appear to be navigating the current market with some success.

What the Latest Metrics Say About Home Depot

Home Depot shares have risen 10.4% in the past year compared with the industry’s growth of 7.4%.

Image Source: Zacks Investment Research

From a valuation standpoint, Home Depot trades at a forward price-to-earnings ratio of 26.16, higher than the industry’s 23.50. HD carries a Value Score of D.

Image Source: Zacks Investment Research

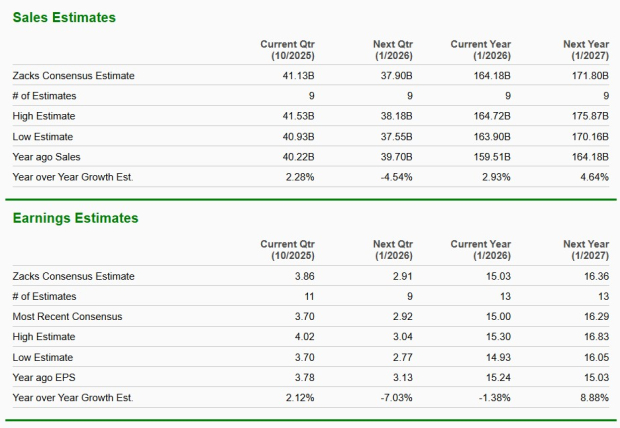

The Zacks Consensus Estimate for Home Depot’s current financial-year sales implies year-over-year growth of 2.9%, while the same for earnings per share suggests a decline of 1.4%.

Image Source: Zacks Investment Research

Home Depot currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Floor & Decor Holdings, Inc. (FND) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.