It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Computer Task Group (NASDAQ:CTG), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Computer Task Group's Improving Profits

In the last three years Computer Task Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Computer Task Group's EPS soared from US$0.59 to US$0.95, over the last year. That's a impressive gain of 61%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Computer Task Group reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

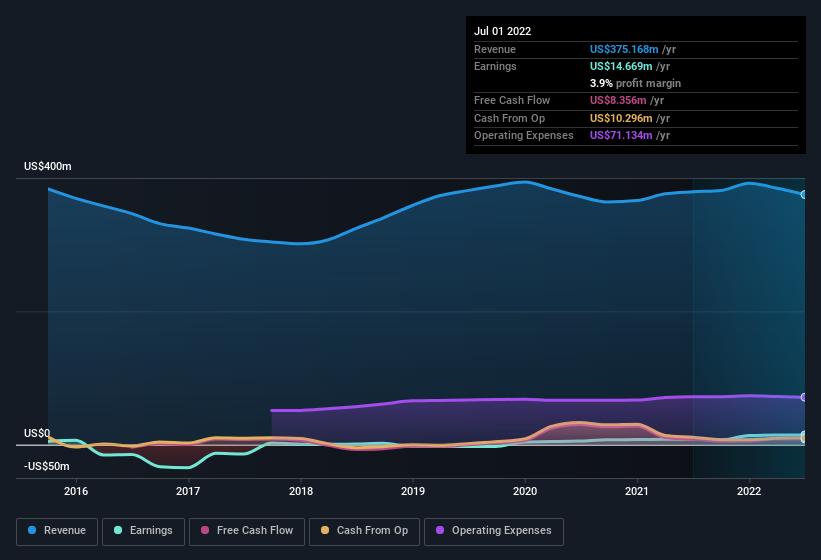

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Computer Task Group is no giant, with a market capitalisation of US$118m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Computer Task Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the US$87k that Independent Chairman James Helvey spent buying shares (at an average price of about US$8.71). Purchases like this clue us in to the to the faith management has in the business' future.

Should You Add Computer Task Group To Your Watchlist?

You can't deny that Computer Task Group has grown its earnings per share at a very impressive rate. That's attractive. The growth rate should be enticing enough to consider researching the company, and the insider buying is a great added bonus. So on this analysis, Computer Task Group is probably worth spending some time on. We don't want to rain on the parade too much, but we did also find 1 warning sign for Computer Task Group that you need to be mindful of.

The good news is that Computer Task Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.