Howmet Aerospace Inc. HWM recently inked a deal with Stanley Black & Decker, Inc. SWK to acquire its business unit, Consolidated Aerospace Manufacturing LLC (“CAM”). The deal carries a cash value of about $1.8 billion. This move marks a pivotal move in strengthening HWM’s long-term growth strategy.

CAM is engaged in producing and supplying aerospace components, including fluid fittings, precision fasteners and other advanced engineered products, for aerospace and defense platforms. The latest buyout is in sync with Howmet’s policy of acquiring businesses to strengthen its market share and customer base. CAM’s well-known brands, engineering expertise and strong customer relationships are expected to strengthen HWM’s aerospace fastening solutions portfolio. By adding CAM, Howmet will be able to offer more comprehensive solutions to the aerospace and defense customers.

In 2026, CAM is expected to post revenues of about $485-$495 million and maintain adjusted EBITDA margin above 20% before the acquisition completes. Subject to customary closing conditions, the acquisition is expected to close in the first half of 2026.

The CAM acquisition is expected to give Howmet access to well-known brands, skilled engineering teams and strong customer relationships, allowing it to offer a wider range of products and services. As global aircraft production and defense spending remain robust, the addition of CAM positions HWM to enhance its fastening systems portfolio and strengthen its competitive position in the aerospace and defense industry.

Expansion Efforts of HWM’s Peers

Among its major peers, in July 2025, RBC Bearings Incorporated RBC completed the acquisition of VACCO Industries from ESCO Technologies for about $275 million in cash. The inclusion of VACCO’s expertise in engineered valves, regulators and manifolds, supported by its strong designing, engineering and production capabilities, enables RBC Bearings to expand its customer offerings in the defense, space and commercial markets. In the fiscal second quarter of 2026 (ended September 2025), VACCO contributed $24.7 million in net sales to the RBC Bearings’ Aerospace & Defense segment.

Its another peer, HEICO Corp.’s HEI disciplined acquisition strategy has been driving its overall performance. In November 2025, HEICO agreed to acquire Axillon Aerospace's Fuel Containment Business from affiliates of SK Capital Partners, LP. This buyout is expected to strengthen HEICO’s position across key U.S. military and commercial aircraft platforms.

HWM's Price Performance, Valuation and Estimates

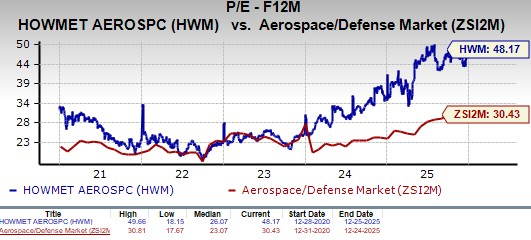

Shares of Howmet have surged 90.7% in the past year compared with the industry’s growth of 31.7%.

Image Source: Zacks Investment Research

From a valuation standpoint, HWM is trading at a forward price-to-earnings ratio of 48.17X, above the industry’s average of 30.43X. Howmet carries a Value Score of D.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for HWM’s 2025 earnings has remained steady over the past 30 days.

Image Source: Zacks Investment Research

Howmet currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

RBC Bearings Incorporated (RBC) : Free Stock Analysis Report

Heico Corporation (HEI) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.