Deerfield, Illinois-based Baxter International Inc. (BAX) is a leading healthcare company committed to transforming lives through innovative medical products and therapies. With a market cap of $14.3 billion, BAX delivers critical solutions in renal care, pharmaceuticals, and advanced surgical technologies. It is likely to release its Q1 earnings on Thursday, May 1.

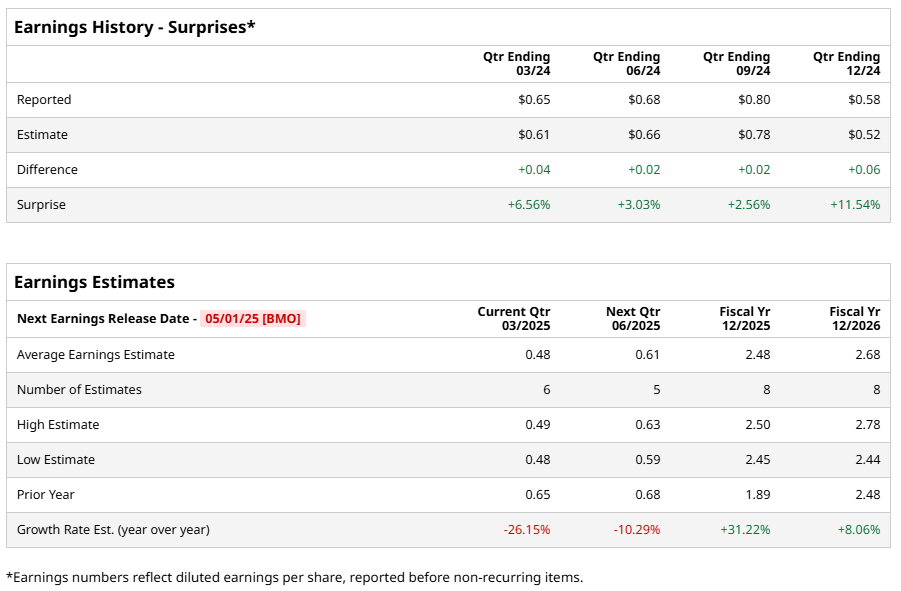

Ahead of the event, analysts forecast the healthcare titan to post a profit of $0.48 per share, down 26.2% from $0.65 per share in the same quarter last year. The company has consistently surpassed Wall Street's bottom-line estimates in the past four quarters.

More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

For fiscal 2025, analysts expect BAX to report EPS of $2.48, a 31.2% rise from $1.89 in fiscal 2024.

Baxter International's shares have declined 29.7% over the past year, significantly trailing the S&P 500 Index's ($SPX) 4.4% gain and the Health Care Select Sector SPDR Fund's (XLV) 1.7% fall during the same period.

BAX’s grim price momentum can be attributed to a combination of declining sales and profitability. Over the past two years, its sales have dropped 14.4% annually, while earnings per share fell by 10.7% annually, indicating worsening profitability. Additionally, weak constant currency growth and challenges in maintaining market share have compounded the company’s struggles. It has also faced margin pressures from rising costs and soft performance in key segments like HST and MPT.

However, Baxter International’s shares jumped 8.5% on Feb. 20 following stronger-than-expected Q4 results. Overall revenue edged up marginally to $2.75 billion, topping Street estimates by 3.4%. Adjusted EPS came in at $0.58, beating expectations by 11.5%. Robust international pharmaceutical sales, up 10.9% year-over-year to $429 million, were fueled by successful new product launches and continued growth in Drug Compounding.

Analysts' consensus rating on BAX stock is cautiously upbeat, with a "Moderate Buy" rating overall. Out of 15 analysts covering the stock, five suggest a "Strong Buy," nine have a "Hold," and one advises a "Moderate Sell." The average analyst price target for BAX is $37.75, suggesting a potential upside of 35.7% from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Elon Musk Admits ‘My Companies Are Suffering’ From Work at DOGE, Says ‘It’s Disadvantageous’

- Nvidia Stock Plunged Nearly 7% on New Export Restrictions. Is NVDA a Buy, Sell, or Hold Now?

- If Netflix Stock Drops After Q1 Earnings, Here’s Why You Should Consider Buying the Dip

- Analysts Love These 2 Stocks to Buy for Q2

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.