As Amazon (NASDAQ: AMZN) shares topped $3,600 in recent times, investors have had one question on their minds: Will the retail giant announce a stock split? Such a move is interesting because it lowers the price of a single share. And that opens the door to a broader range of investors. Some investors don't want to invest thousands of dollars in just one stock, for example. (There is the option of fractional shares -- but certain brokerages don't offer them.)

Amazon satisfied investors' curiosity last week. The company announced a 20-for-1 stock split. If shareholders approve, it will take place in early June. So, will the stock take off then? Let's look at Amazon's last stock split for a few clues.

Image source: Getty Images.

Three stock splits

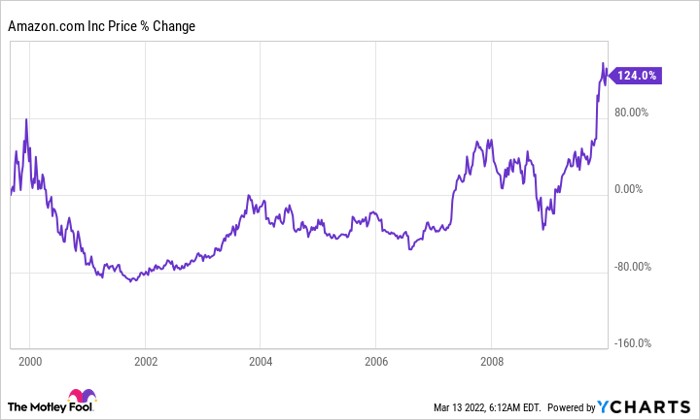

Amazon is no stranger to stock splits. It's carried out three in its history. But they haven't been in the company's most recent history. They all happened in the period of 1998 through 1999. The last took place on Sept. 2, 1999. The stock climbed as much as 75% in the months after the operation. But a look at the stock's performance in the few years following that split isn't inspiring. Amazon shares fell from their high. And investors had to wait about 10 years for the shares to truly take off.

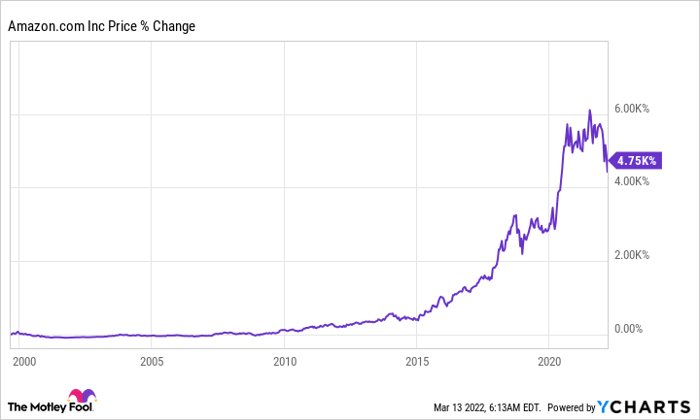

The good news is from there, the stock made its way pretty steadily higher. In fact, Amazon shares have soared more than 4,700% since their last split.

So, does this mean we'll see a huge increase in the weeks after Amazon's upcoming stock split -- and then have to wait many years for more gains? It's impossible to predict exactly what might happen. But I'm optimistic Amazon's performance after this new split won't take as long to pay off. Why? The company looks a lot different today than it did in 1999 -- and the outlook for e-commerce has grown brighter and brighter. U.S. e-commerce will reach $1 trillion this year, Insider Intelligence predicts. Prior to the pandemic -- which offered e-commerce a boost -- the firm expected online shopping to reach that level in 2024.

Several major revenue and profit drivers didn't even exist at the time of Amazon's last stock split. Amazon launched its Prime subscription service in 2005, for example. In 2020, that service topped 200 million members worldwide. And the company launched Amazon Web Services (AWS), its cloud computing business, in 2006. Today, AWS is the global industry leader -- and accounts for 74% of Amazon's operating income.

Growth prospects

Of course, Prime and AWS have been around for a while now. So, investors may wonder if they can continue growing. The elements we have so far make me confident. In the most recent earnings report, Amazon said it added "millions" of Prime members worldwide. The company also continues to invest in the program, adding new features such as prescription deals through Amazon Pharmacy. At the same time, Amazon Prime is increasing its membership fee in the U.S. As for AWS, the service has maintained its 32% to 33% market share over the past several years, according to Synergy Research. It remains considerably ahead of its closest competitor -- Microsoft, with 21% market share.

All of this means Amazon has two significant growth motors to power revenue and profit ahead in the coming years.

Now, let's get back to the upcoming stock split. It's reasonable to expect an initial boost after the split -- even if the gain isn't as big as the one back in 1999. As I mentioned above, a lower price may attract more investors to buy shares of this dynamic retail stock. But even better, Amazon's growth in the coming quarters and years -- thanks to all it's built so far -- should make the stock a winner well into the future.

10 stocks we like better than Amazon

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Amazon wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of March 3, 2022

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adria Cimino owns Amazon. The Motley Fool owns and recommends Amazon and Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.