Lazard LAZ is intensifying its focus on the Financial Advisory segment, which represented nearly 58% of total operating revenues as of Sept. 30, 2025. The firm is expanding its advisory capabilities through targeted senior hiring, new specialized services, including geopolitical advisory, and a greater emphasis on high-growth verticals such as Private Capital Advisory. These strategic priorities position Lazard to scale its platform and capture accelerating global deal activity.

Lazard plans to add 10-15 net new managing directors (MDs) to its Financial Advisory division each year, while maintaining its high standards of excellence and further improving productivity. On the productivity front, Lazard reached average revenues per MD of $8.6 million in 2024, reaching this milestone a full year ahead of schedule. Since then, productivity has climbed to nearly $9 million per MD. The company remains confident in its ability to continue raising this figure, including surpassing its 2028 target of $10 million per MD.

Lazard is also deepening its connectivity to private capital markets, a key driver of its accelerated revenue growth in recent years. The firm’s Private Capital Advisory platform, spanning primary fundraising and secondary advisory, enhances client coverage across the private-markets ecosystem. Looking ahead, Lazard aims for private-capital-related activity to account for 50% of the total advisory revenues.

LAZ is also broadening its global footprint, adding new offices and expanding its presence across key growth regions, including Europe and the Middle East. This enhanced geographic reach enables the firm to access a wider and more diversified client base, strengthening sector coverage and making its advisory business more resilient to regional economic fluctuations. In parallel, Lazard is investing in proprietary AI tools, including LazardGPT, to deepen client insights, streamline internal processes and further elevate productivity across its advisory platform.

By scaling its MD base, deepening private-capital integration, broadening its geographic platform and deploying advanced AI tools, Lazard is positioning itself for sustained growth and improved profitability into 2030. The company expects to double firmwide revenues by 2030 and targets delivering 10-15% annual shareholder returns per year over this period.

How LAZ Competes With Its Peers in Terms of Advisory Business

Lazard peers, T. Rowe Price TROW and Federated Hermes FHI are also strengthening their advisory businesses.

T. Rowe Price is expanding its investment advisory revenues through higher average asset under management (AUM) from market gains, diversification into alternatives and multi-asset strategies, product innovations like ETFs and target-date funds, and fee rate stabilization. T. Rowe Price’s Investment advisory revenue constitutes 77% of net revenues as of Sept. 30, 2025. The segment revenues rose nearly 3% in the first nine months of 2025.

Federated Hermes’ net investment advisory fees contribute a substantial portion to the total revenues. As of Sept. 30, 2025, it comprised 67.2% of the total revenues. Given its large AUM base, diversified investment strategies, and broad client reach, Federated Hermes seems well-positioned to sustain and grow its advisory-fee business. The mix of liquidity/money-market, fixed income, equity, and alternative strategies gives it resilience across market cycles.

LAZ Price Performance & Zacks Rank

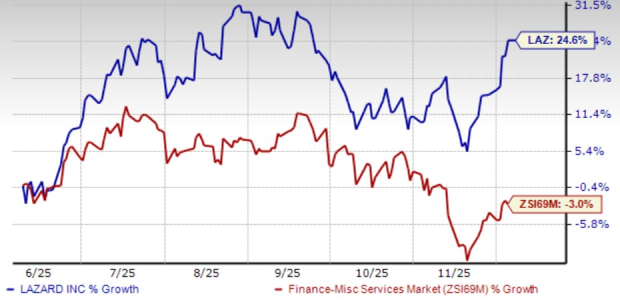

In the past six months, LAZ shares have gained 24.6% against the industry’s decline of 3%.

Price Performance

Image Source: Zacks Investment Research

Currently, Lazard carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Lazard, Inc. (LAZ) : Free Stock Analysis Report

Federated Hermes, Inc. (FHI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.