Fintel reports that on May 17, 2023, HC Wainwright & Co. reiterated coverage of Aadi Bioscience (NASDAQ:AADI) with a Buy recommendation.

Analyst Price Forecast Suggests 467.86% Upside

As of May 11, 2023, the average one-year price target for Aadi Bioscience is 40.54. The forecasts range from a low of 30.30 to a high of $49.35. The average price target represents an increase of 467.86% from its latest reported closing price of 7.14.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Aadi Bioscience is 23MM, an increase of 21.77%. The projected annual non-GAAP EPS is -2.58.

What is the Fund Sentiment?

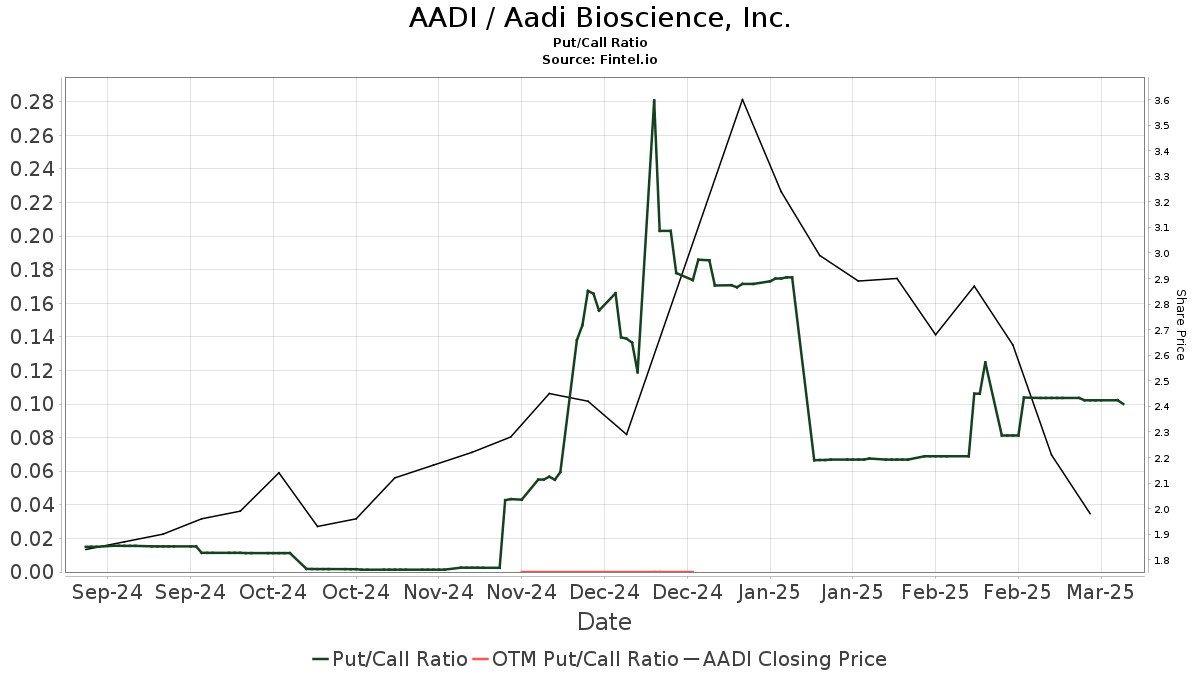

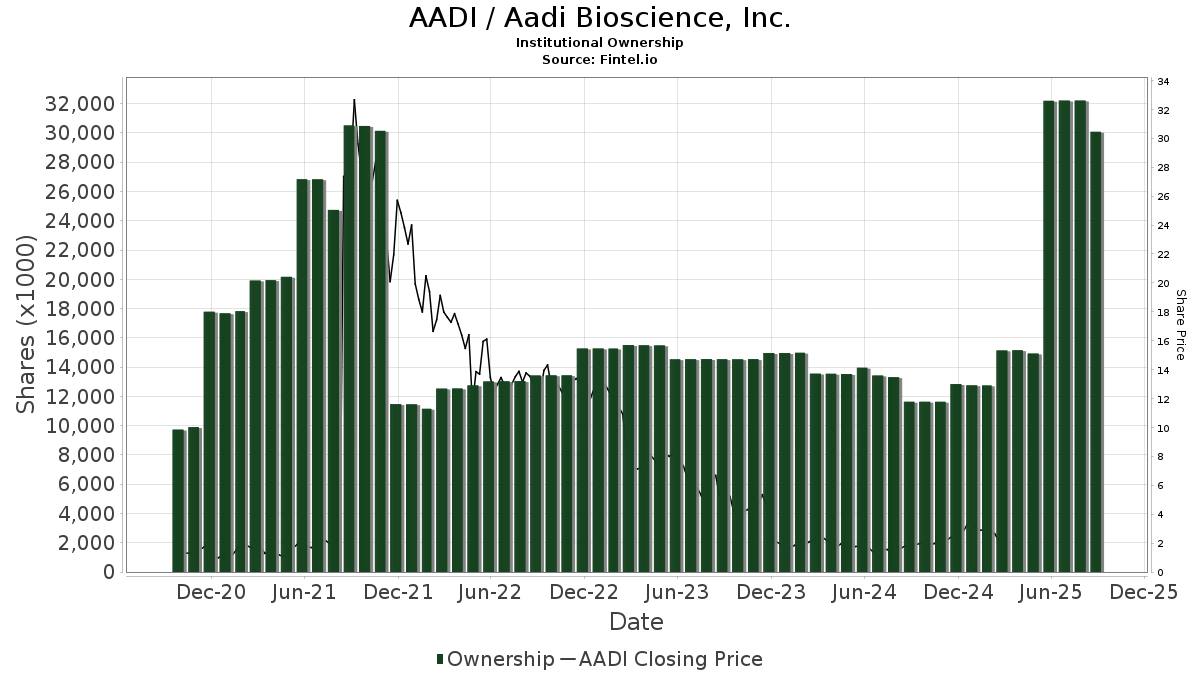

There are 163 funds or institutions reporting positions in Aadi Bioscience. This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to AADI is 0.29%, a decrease of 40.77%. Total shares owned by institutions decreased in the last three months by 6.43% to 14,501K shares.  The put/call ratio of AADI is 0.04, indicating a bullish outlook.

The put/call ratio of AADI is 0.04, indicating a bullish outlook.

What are Other Shareholders Doing?

Avoro Capital Advisors holds 2,849K shares representing 11.66% ownership of the company. No change in the last quarter.

Acuta Capital Partners holds 1,849K shares representing 7.57% ownership of the company. No change in the last quarter.

Satter Management Co. holds 1,631K shares representing 6.67% ownership of the company. No change in the last quarter.

Baker Bros. Advisors holds 990K shares representing 4.05% ownership of the company. No change in the last quarter.

Ra Capital Management holds 590K shares representing 2.42% ownership of the company. No change in the last quarter.

Aadi Bioscience Background Information

(This description is provided by the company.)

Aadi is a clinical stage biopharmaceutical company developing precision therapies for genomically defined cancers. Aadi’s primary goal is to bring transformational outcomes to cancer patients with mTOR pathway driver alterations where other mTOR inhibitors have not or cannot be effectively exploited due to problems of pharmacology, effective drug delivery, safety or effective targeting to the disease site. Aadi’s initial focus is on treating patients with aberrant TSC1 or TSC2 genes, tumor suppressors that when mutated are the source of many different cancer types. Aadi’s AMPECT pivotal trial of ABI-009 demonstrated meaningful clinical efficacy in Malignant PEComa, a type of cancer with the highest known mutation rate of TSC1 or TSC2 genes. Based on the AMPECT trial, emerging data for ABI-009 in other solid tumors with TSC1 or TSC2 mutations, and following discussions with the FDA, Aadi is proceeding with a tumor-agnostic registrational trial in cancers harboring TSC1 or TSC2 pathogenic, inactivating mutations with a planned initiation in 2021. Aadi also has ongoing studies across multiple high unmet need, advanced cancers including colorectal cancer, sarcoma, and glioblastoma to identify activity of ABI-009 in additional mTOR pathway driver alterations and combination regimens.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.