Fintel reports that on May 1, 2023, HC Wainwright & Co. maintained coverage of Embarq (NASDAQ:EQ) with a Buy recommendation.

Analyst Price Forecast Suggests 1,397.74% Upside

As of April 24, 2023, the average one-year price target for Embarq is 9.32. The forecasts range from a low of 2.83 to a high of $21.00. The average price target represents an increase of 1,397.74% from its latest reported closing price of 0.62.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Embarq is 0MM, a decrease of 100.00%. The projected annual non-GAAP EPS is -1.28.

What is the Fund Sentiment?

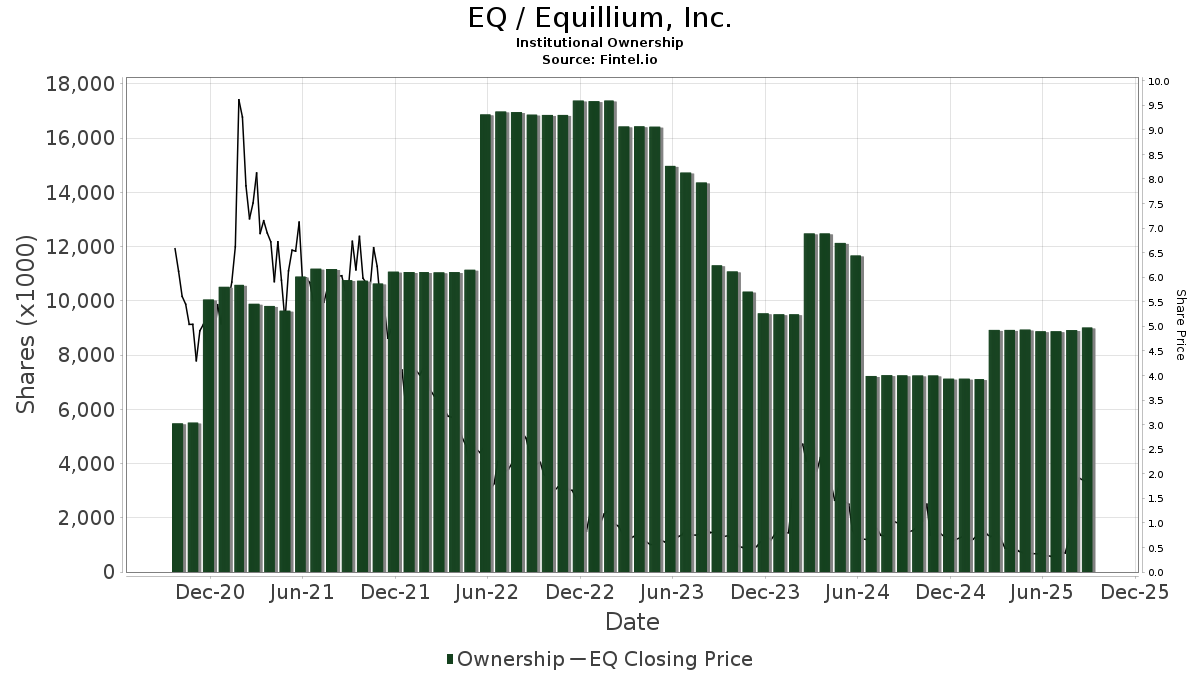

There are 61 funds or institutions reporting positions in Embarq. This is a decrease of 2 owner(s) or 3.17% in the last quarter. Average portfolio weight of all funds dedicated to EQ is 0.05%, a decrease of 47.17%. Total shares owned by institutions decreased in the last three months by 5.50% to 16,429K shares.  The put/call ratio of EQ is 0.02, indicating a bullish outlook.

The put/call ratio of EQ is 0.02, indicating a bullish outlook.

What are Other Shareholders Doing?

Decheng Capital Management III holds 4,447K shares representing 12.92% ownership of the company. No change in the last quarter.

Victory Capital Management holds 3,199K shares representing 9.29% ownership of the company. In it's prior filing, the firm reported owning 3,651K shares, representing a decrease of 14.14%. The firm decreased its portfolio allocation in EQ by 73.31% over the last quarter.

RSEGX - Victory RS Small Cap Growth Fund holds 1,465K shares representing 4.26% ownership of the company. In it's prior filing, the firm reported owning 1,632K shares, representing a decrease of 11.39%. The firm decreased its portfolio allocation in EQ by 44.24% over the last quarter.

USSCX - Science & Technology Fund Shares holds 992K shares representing 2.88% ownership of the company. In it's prior filing, the firm reported owning 971K shares, representing an increase of 2.15%. The firm decreased its portfolio allocation in EQ by 45.53% over the last quarter.

Franklin Resources holds 895K shares representing 2.60% ownership of the company. No change in the last quarter.

Equillium Background Information

(This description is provided by the company.)

Equillium is a clinical-stage biotechnology company leveraging deep understanding of immunobiology to develop novel products to treat severe autoimmune and inflammatory disorders with high unmet medical need. Equillium is developing itolizumab for multiple severe immuno-inflammatory diseases, including acute graft-versus-host-disease (aGVHD), lupus/lupus nephritis and uncontrolled asthma.

See all Embarq regulatory filings.This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.