Haynes International, Inc. HAYN recorded earnings $1.02 per share in fourth-quarter fiscal 2023 (ended Sep 30, 2023), down from $1.30 per share in the year-ago quarter. It lagged the Zacks Consensus Estimate of $1.06.

Sales rose around 12% year over year to $160.6 million in the quarter. The figure, however, missed the Zacks Consensus Estimate of $163.8 million. The top line was driven by a roughly 11% increase in product average selling price per pound aided by price increases and a favorable product mix.

Haynes International, Inc. Price, Consensus and EPS Surprise

Haynes International, Inc. price-consensus-eps-surprise-chart | Haynes International, Inc. Quote

Volumes and Prices

The company witnessed strong increases in volume and average selling price per pound in aerospace and industrial gas turbines in fiscal 2023. Aerospace volumes rose roughly 11% year over year while aerospace average selling prices increased around 14%. Industrial gas turbine volumes (IGT) increased roughly 20% year over year with IGT average selling prices rising around 10% in fiscal 2023. Volumes in the chemical processing industry (CPI) fell around 21% year over year while CPI average selling price per pound increased roughly 27% in fiscal 2023.

In fiscal 2023, the product average selling price per pound was $30.43, up roughly 15% year over year. For the fiscal fourth quarter, the product average selling price per pound was $31.56, up around 11% year over year.

FY23 Results

Earnings for fiscal 2023 was $3.26 per share, compared with earnings of $3.57 a year ago. Revenues were around $590 million for the full year, up around 20% year over year.

Financials

At the end of fiscal 2023, the company had cash and cash equivalents of $10.7 million, up around 27% year over year. Long-term debt was around $7.4 million, down roughly 5% year over year.

Net cash used in operating activities was $16.7 million in fiscal 2023 compared with net cash used in operating activities of $79.5 million in fiscal 2022.

Outlook

For fiscal 2024, the company sees continued volume and revenue growth along with incremental improvements in gross margin and positive cash flow from operations. Revenue and earnings for the first quarter of fiscal 2024 are projected to be higher compared with the year-ago quarter, but lower than the fourth quarter of fiscal 2023.

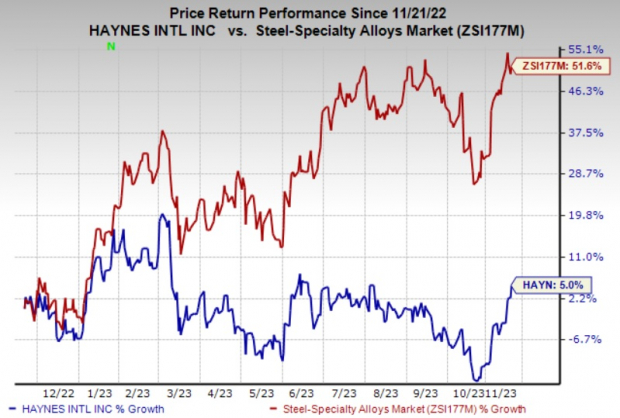

Price Performance

Shares of Haynes International are up 5% in the past year compared with the 51.6% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

HAYN currently has a Zacks Rank #4 (Sell).

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Denison Mines has a projected earnings growth rate of 100% for the current year. DNN has a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 54.8% in a year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Axalta Coating Systems’ current year has been revised upward by 8.2%. AXTA, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 6.7%. The company’s shares have gained 3% in the past year. The company’s shares have gained 21% in the past year.

Andersons currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 8.6% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 32.8%, on average. ANDE shares have rallied around 36% in a year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners UpThe Andersons, Inc. (ANDE) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Haynes International, Inc. (HAYN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.