Hasbro, Inc. HAS reached an agreement to acquire D&D Beyond, a role-playing game (RPG) digital toolset from the fan platform Fandom. The value of the deal stands at $146.3 million. Following the news, the company’s shares moved up 1.4% in the after-hour trading session.

This acquisition will help the company solidify its competencies in the fast-growing digital tabletop category. Hasbro CEO Chris Cocks, stated, “The acquisition of D&D Beyond will accelerate our progress in both gaming and direct to consumer, two priority areas of growth for Hasbro, providing immediate access to a loyal, growing player base.”

The deal, which is expected to be sealed during the second or the third quarter of 2022, will be immaterial to revenues and earnings per share (EPS) in 2022. The company anticipates the deal to be accretive in fiscal 2023 and beyond.

Since 2017, D&D Beyond has managed to power DUNGEONS & DRAGONS tabletop play. The game delivered the brand's eighth successive year of growth in 2021.

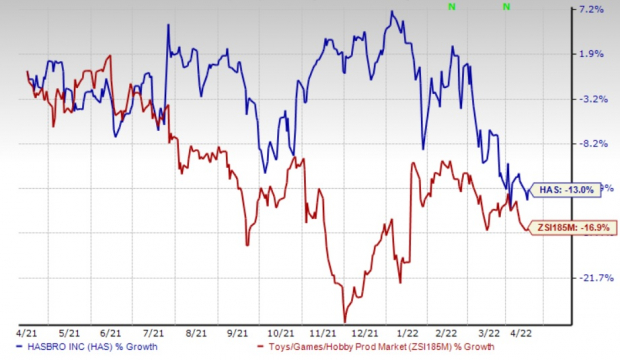

Shares of the company have declined 13%, compared with the industry’s decrease of 16.9%.

Image Source: Zacks Investment Research

Gaming Category to Drive Growth

The Zacks Rank #3 (Hold) company is witnessing strong gaming demand during the coronavirus crisis. The company boasts a supreme gaming portfolio and is refining gaming experiences across many platforms like face-to-face gaming, tabletop gaming and digital mobile gaming experiences. Hasbro’s Entertainment and Licensing segment is poised for growth, given a strong product lineup and a greater focus on entertainment-backed products. The company stated that it is currently investing in longer-term larger gameplay.

Wizards generated solid performance on the back of Magic: The Gathering and Dungeons & Dragons. The heightened engagement was witnessed in desktop and mobile versions, thereby attracting new arena players. In the digital space, the company reported solid performance with respect to Magic: The Gathering Arena's launch on mobile. It stated that monthly active users had doubled from pre-launch days and has settled into a 50% increase in average monthly users.

Going forward, the company intends to emphasize digital avenues by improving the gameplay in downloadable content. During the fiscal fourth quarter, Wizards of the Coast and digital gaming segment revenues increased 18% year over year. In 2021, digital gaming revenues (including the high-margin licensed digital gaming business) rallied 36% year over year. Meanwhile, Tabletop gaming revenue increased 44% year over year.

Key Picks

Some better-ranked stocks in the Consumer Discretionary sector are Funko, Inc. FNKO, SeaWorld Entertainment, Inc. SEAS and Bluegreen Vacations Holding Corporation BVH.

Funko sports a Zacks Rank #1 (Strong Buy) at present. FNKO has a trailing four-quarter earnings surprise of 96.2%, on average. Shares of the company have declined 18.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Funko’s current financial year sales and EPS (earnings per share) suggests growth of 22.6% and 26.8%, respectively, from the year-ago period’s reported levels.

SeaWorld Entertainment presently carries a Zacks Rank #1. SEAS has a trailing four-quarter earnings surprise of 137.2%, on average. Shares of the company have gained appreciated 44.3% in the past year.

The Zacks Consensus Estimate for SEAS current financial year sales and EPS indicates growth of 14% and 27.3%, respectively, from the year-ago period’s reported levels.

Bluegreen Vacations presently flaunts carries a Zacks Rank #1. BVH has a trailing four-quarter earnings surprise of 425.1%, on average. The stock has increased 37.3% in the past year.

The Zacks Consensus Estimate for BVH’s current financial year sales and EPS indicates growth of 8.3% and 20.8%, respectively, from the year-ago period’s reported levels.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS): Free Stock Analysis Report

SeaWorld Entertainment, Inc. (SEAS): Free Stock Analysis Report

Funko, Inc. (FNKO): Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.