Sprouts Farmers Market, Inc. SFM reported an 11.8% adjusted EBITDA margin in the first quarter of 2025, reflecting a 210-basis-point expansion year over year. The strong improvement prompts a key question: Has SFM established a new baseline for profitability?

The main reason behind this improvement is Sprouts Farmers’ evolving business model. The company continues to optimize its store footprint by focusing on smaller, more efficient boxes while expanding private-label offerings and high-margin products. Sprouts Brand products contributed 24% of total sales in the first quarter, pointing to a profitable product mix.

Operational efficiency is another reason behind the elevated margin. The ongoing transition to self-distribution for fresh meat and seafood has enhanced product control while reducing supply-chain costs. Nearly 80% of stores now operate within 250 miles of a distribution center, supporting tighter inventory management and vendor coordination. These efforts helped push the gross margin up 129 basis points to 39.6% in the first quarter.

SFM achieved these gains without resorting to aggressive pricing, maintaining both margin discipline and top-line momentum. The plan to open at least 35 stores in 2025 — each expected to generate $13 million in first-year sales and cash-on-cash returns in the low to mid-thirties by year five — shows that SFM can grow its business without hurting profits.

Management’s outlook for EBIT margin expansion supports Sprouts Farmers' EBITDA performance. Undoubtedly, SFM has elevated its financial playbook, and its first-quarter EBITDA margin reflects strategic execution, not a one-off gain.

How Grocery Outlet & Target EBITDA Margins Compare to SFM

When comparing EBITDA margins, Sprouts Farmers leads the way with 11.8%. Grocery Outlet Holding Corp. GO posted an adjusted EBITDA margin of 4.6%, up 80 basis points in the first quarter of 2025. Grocery Outlet’s adjusted EBITDA rose 31.7% to $51.9 million, and it expects full-year adjusted EBITDA between $260 million and $270 million.

Target Corporation TGT also saw solid gains, with first-quarter fiscal 2025 EBITDA increasing 11.9% to $2,285 million. Target’s EBITDA margin expanded 130 basis points year over year to 9.6%, reflecting improved profitability. Though Target trails Sprouts Farmers on EBITDA margin, it remains ahead of Grocery Outlet.

SFM’s Price Performance, Valuation and Estimates

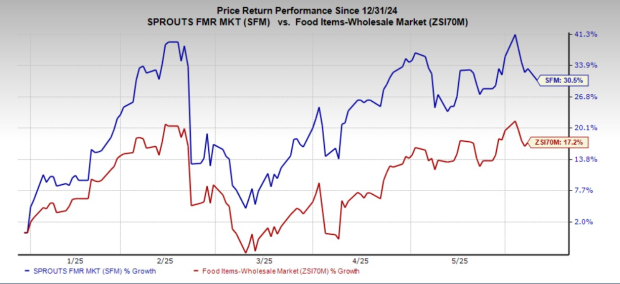

Sprouts Farmers stock has been a standout performer, with shares rallying 30.5% year to date, outpacing the industry’s growth of 17.2%.

Image Source: Zacks Investment Research

From a valuation standpoint, SFM's forward 12-month price-to-sales ratio stands at 1.76, higher than the industry’s ratio of 0.27. SFM carries a Value Score of D.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and earnings per share implies year-over-year growth of 13.7% and 35.5%, respectively.

Image Source: Zacks Investment Research

Sprouts Farmers Market currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Target Corporation (TGT) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.