The Goldman Sachs Group, Inc.’s GS Asset & Wealth Management (AWM) division is increasingly becoming a core pillar of the firm’s growth strategy, with 2025 results underscoring a steady shift toward more durable, fee-based revenues and lower balance-sheet intensity.

Goldman’s AWM division has become a central pillar of the firm’s strategy, with 2025 results highlighting a continued shift toward more durable, fee-based revenues and lower balance sheet intensity. AWM business generated $14.89 billion in net revenues in 2025, supported by record management and other fees of $11.54 billion. Since 2021, AWM division revenues witnessed a compounded annual growth rate of 12%.

AWM Net Revenues

Image Source: The Goldman Sachs Group, Inc.

Image Source: The Goldman Sachs Group, Inc.

Lending to wealthy individuals and entrepreneurs has been a key growth driver for the bank. Private banking and lending net revenues reached a record $3.3 billion in 2025, rising 16% from the prior year, as higher net interest margin and improved loan performance boosted the results. Management continues to emphasize lending penetration as a way to deepen client relationships and enhance returns.

Alternative investments remain a defining feature of the platform. Goldman oversees more than $625 billion in alternative assets, including $420 billion in alternative investments AUS, while gross third-party fundraising hit a record $115 billion in 2025. Since 2019, the firm has raised $438 billion in alternatives and expects $75-$100 billion in annual fundraising going forward.

AWM division’s scale continues to expand. Total assets under supervision rose to a record $3.61 trillion in 2025, up $469 billion year over year, driven by market appreciation and net inflows across all client channels. The firm also recorded its 32nd consecutive quarter of long-term fee-based net inflows, underscoring the strength and stickiness of its client base.

Profitability has improved alongside growth. AWM delivered a 25% pre-tax margin and a 12.5% return on equity in 2025. Goldman is targeting high-teens returns for the AWM division and roughly 5% annual growth in long-term fee-based net inflows over the medium term.

As Goldman rebalances away from more capital-intensive businesses, wealth management has emerged as a stabilizing earnings engine. The December 2025 agreement to acquire Innovator Capital Management further expands its ETF capabilities and reinforces the firm’s focus on building diversified, durable revenue streams for its next phase of growth.

Where Do Goldman’s Peers Stand?

Two close peers of GS are JPMorgan JPM and Morgan Stanley MS.

JPMorgan’s Asset & Wealth Management segment is a steadier, fee-led profit engine inside the bank, spanning asset management and the private bank. In the fourth quarter of 2025, AWM net revenues were $6.5 billion (up 13% year over year), resulting in net income of $1.8 billion. As of Dec. 31, 2025, JPMorgan’s assets under management (AUM) hit $4.8 trillion and client assets touched $7.1 trillion.

Morgan Stanley’s wealth and asset management push is more than a diversification story. The wealth and asset management businesses’ aggregate contribution to total net revenues jumped to 54% in 2025 from 26% in 2010. By the end of 2025, total client assets across Wealth and Investment Management reached $9.3 trillion, supported by $356 billion of net new assets, keeping Morgan Stanley within sight of its long-stated $10 trillion ambition.

Goldman’s Price Performance, Valuation, & Estimates

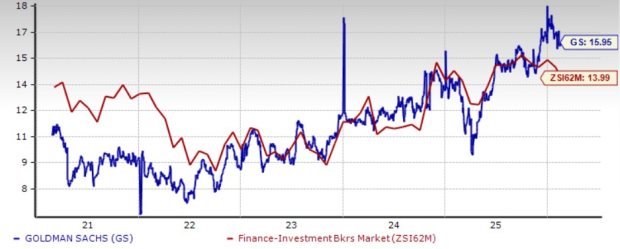

GS shares have surged 37.1% in the past year compared with the industry’s growth of 15.6%.

Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, Goldman trades at a forward price-to-earnings (P/E) ratio of 15.95X, above the industry’s average of 13.99X.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for GS’s 2026 and 2027 earnings implies year-over-year rallies of 10.3% and 10.6%, respectively. Estimates for both years have been revised upward over the past month.

Estimate Revision Trend

Image Source: Zacks Investment Research

Goldman currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.