Fintel reports that on July 17, 2023, Goldman Sachs maintained coverage of Summit Materials Inc - (NYSE:SUM) with a Neutral recommendation.

Analyst Price Forecast Suggests 5.03% Upside

As of July 6, 2023, the average one-year price target for Summit Materials Inc - is 38.86. The forecasts range from a low of 31.31 to a high of $52.50. The average price target represents an increase of 5.03% from its latest reported closing price of 37.00.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Summit Materials Inc - is 2,540MM, an increase of 4.66%. The projected annual non-GAAP EPS is 1.50.

What is the Fund Sentiment?

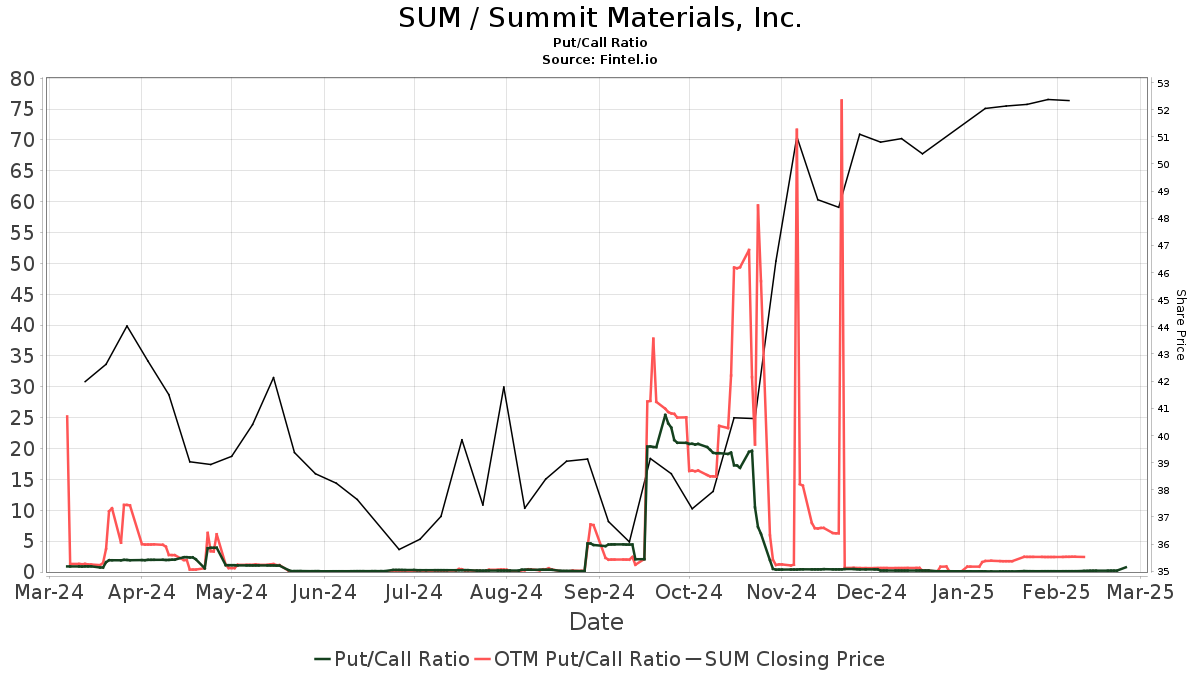

There are 587 funds or institutions reporting positions in Summit Materials Inc -. This is a decrease of 1 owner(s) or 0.17% in the last quarter. Average portfolio weight of all funds dedicated to SUM is 0.31%, an increase of 3.67%. Total shares owned by institutions decreased in the last three months by 1.42% to 164,613K shares.  The put/call ratio of SUM is 0.46, indicating a bullish outlook.

The put/call ratio of SUM is 0.46, indicating a bullish outlook.

What are Other Shareholders Doing?

Price T Rowe Associates holds 8,301K shares representing 6.99% ownership of the company. In it's prior filing, the firm reported owning 9,029K shares, representing a decrease of 8.76%. The firm decreased its portfolio allocation in SUM by 14.13% over the last quarter.

Capital International Investors holds 7,452K shares representing 6.27% ownership of the company. In it's prior filing, the firm reported owning 7,422K shares, representing an increase of 0.40%. The firm decreased its portfolio allocation in SUM by 3.44% over the last quarter.

Macquarie Group holds 5,234K shares representing 4.40% ownership of the company. In it's prior filing, the firm reported owning 5,151K shares, representing an increase of 1.58%. The firm decreased its portfolio allocation in SUM by 15.29% over the last quarter.

Principal Financial Group holds 5,110K shares representing 4.30% ownership of the company. In it's prior filing, the firm reported owning 5,551K shares, representing a decrease of 8.62%. The firm decreased its portfolio allocation in SUM by 50.24% over the last quarter.

TRMCX - T. Rowe Price Mid-Cap Value Fund holds 4,996K shares representing 4.20% ownership of the company. In it's prior filing, the firm reported owning 5,465K shares, representing a decrease of 9.40%. The firm decreased its portfolio allocation in SUM by 10.32% over the last quarter.

Summit Materials Background Information

(This description is provided by the company.)

Summit Materials is a leading vertically integrated materials-based company that supplies aggregates, cement, ready-mix concrete and asphalt in the United States and British Columbia, Canada. Summit is a geographically diverse, materials-based business of scale that offers customers a single-source provider of construction materials and related downstream products in the public infrastructure, residential and non-residential end markets. Summit has a strong track record of successful acquisitions since its founding and continues to pursue growth opportunities in new and existing markets.

Additional reading:

- Participation Notice and Agreement under Summit Materials, Inc. Executive Severance Plan by and between Summit Materials, Inc. and Scott Anderson.

- Amendment to Participation Notice and Agreement under Summit Materials, Inc. Executive Severance Plan, dated as of March 1, 2023, by and between Summit Materials, Inc. and Anne P. Noonan.

- Mine Safety Disclosures

- Summit Materials, LLC’s Unaudited Consolidated Financial Statements and Notes to Unaudited Consolidated Financial Statements.

- Summit Materials, Inc. Reports First Quarter 2023 Results Record First Quarter Net Revenue Record Quarterly Aggregates Pricing Growth Raises 2023 Adjusted EBITDA Guidance

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.