Fintel reports that on August 14, 2023, Goldman Sachs maintained coverage of Maxeon Solar Technologies (NASDAQ:MAXN) with a Buy recommendation.

Analyst Price Forecast Suggests 159.52% Upside

As of August 2, 2023, the average one-year price target for Maxeon Solar Technologies is 39.34. The forecasts range from a low of 30.30 to a high of $47.25. The average price target represents an increase of 159.52% from its latest reported closing price of 15.16.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Maxeon Solar Technologies is 1,588MM, an increase of 25.47%. The projected annual non-GAAP EPS is -2.56.

What is the Fund Sentiment?

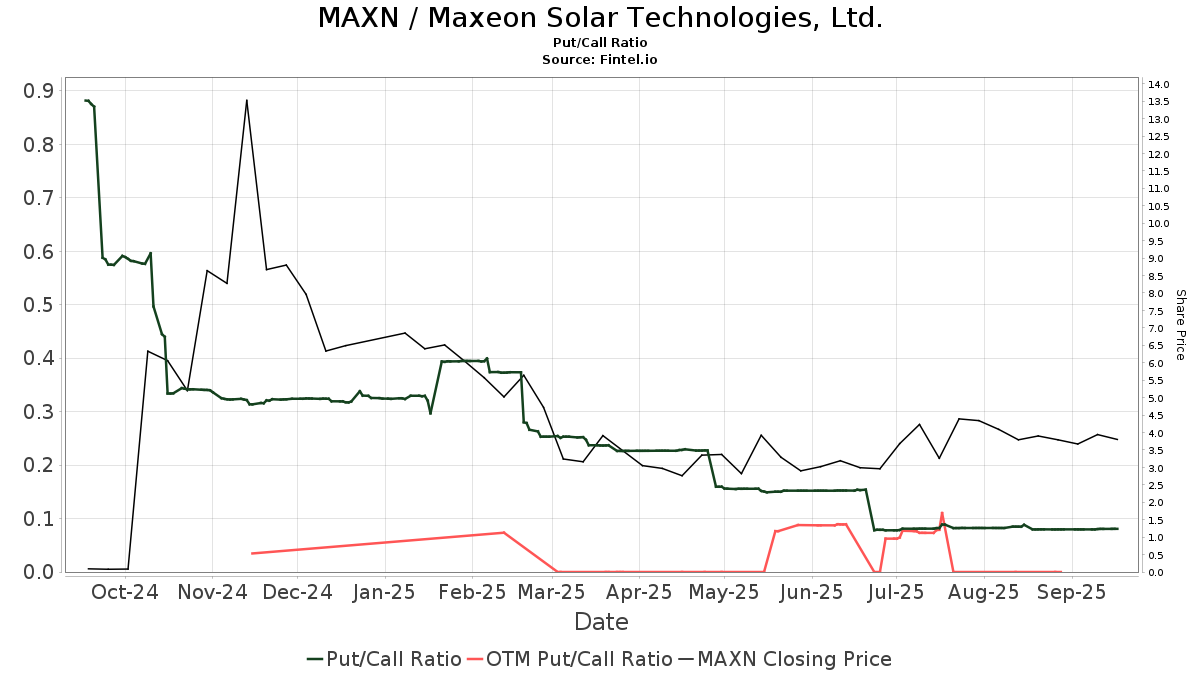

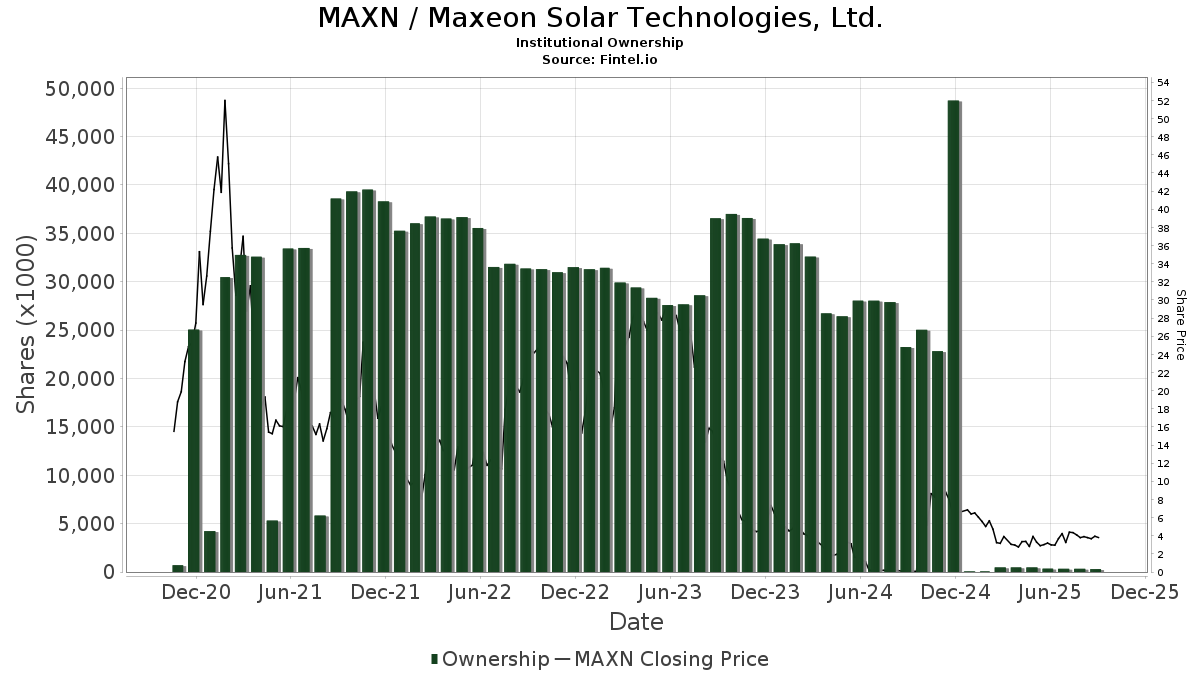

There are 233 funds or institutions reporting positions in Maxeon Solar Technologies. This is an increase of 24 owner(s) or 11.48% in the last quarter. Average portfolio weight of all funds dedicated to MAXN is 0.36%, an increase of 110.59%. Total shares owned by institutions increased in the last three months by 1.79% to 29,195K shares.  The put/call ratio of MAXN is 0.33, indicating a bullish outlook.

The put/call ratio of MAXN is 0.33, indicating a bullish outlook.

What are Other Shareholders Doing?

VISAX - Virtus KAR International Small-Cap Fund holds 6,878K shares representing 12.73% ownership of the company. No change in the last quarter.

Wellington Management Group Llp holds 1,922K shares representing 3.56% ownership of the company. In it's prior filing, the firm reported owning 1,955K shares, representing a decrease of 1.70%. The firm decreased its portfolio allocation in MAXN by 85.95% over the last quarter.

LMR Partners LLP holds 1,864K shares representing 3.45% ownership of the company. In it's prior filing, the firm reported owning 160K shares, representing an increase of 91.42%. The firm increased its portfolio allocation in MAXN by 785.43% over the last quarter.

AnglePoint Asset Management holds 1,607K shares representing 2.97% ownership of the company. In it's prior filing, the firm reported owning 1,280K shares, representing an increase of 20.31%. The firm increased its portfolio allocation in MAXN by 25.54% over the last quarter.

Millennium Management holds 1,258K shares representing 2.33% ownership of the company. In it's prior filing, the firm reported owning 196K shares, representing an increase of 84.42%. The firm increased its portfolio allocation in MAXN by 999.12% over the last quarter.

Maxeon Solar Technologies Background Information

(This description is provided by the company.)

Maxeon Solar Technologies, Ltd. is Powering Positive Change™. Headquartered in Singapore, Maxeon designs, manufactures and sells SunPower® brand solar panels in more than 100 countries, operating the SunPower brand worldwide except the United States and Canada. Maxeon is a leader in solar innovation with access to over 1,000 patents and two best-in-class solar panel product lines. With operations in Africa, Asia, Oceania, Europe and Mexico, Maxeon's products span the global rooftop and solar power plant markets through a network of more than 1,100 trusted partners and distributors. A pioneer in sustainable solar manufacturing, Maxeon leverages a 35-year history in the solar industry and numerous awards for its technology.

Additional reading:

- Maxeon Solar Technologies Selects Albuquerque, New Mexico As Site for New 3-Gigawatt Solar Cell and Panel Manufacturing Facility

- Maxeon Solar Technologies Announces Second Quarter 2023 Financial Results --$56 Million GAAP Gross Profit, $30 Million Adjusted EBITDA-- --New Mexico site selected for US cell and module facility--

- Financial Results for the Second Quarter Ended July 2, 2023

- INDEX TO FINANCIAL STATEMENTS

- MAXEON SOLAR TECHNOLOGIES, LTD. (Incorporated in the Republic of Singapore) (Company Registration Number: 201934268H) (the "Company")

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.