Gilead Sciences, Inc., GILD announced that it has entered into settlement agreements to resolve the patent litigations with a few generic manufacturers who were looking to market generic versions of its flagship HIV treatment, Biktarvy.

Biktarvy is one of the top revenue generators for GILD. Biktarvy sales totaled $6.7 billion in the first half of 2025.

Hence, the latest news relieved investors, and shares of GILD gained accordingly.

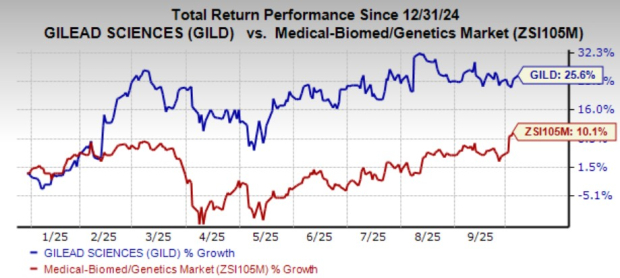

Shares of the company have surged 25.6% year to date compared with the industry’s growth of 10.1%.

Image Source: Zacks Investment Research

More on GILD’s Agreements With Generic Manufacturers

GILD has entered into agreements with Lupin Ltd., Cipla Ltd., and Laurus Labs Ltd., which have filed abbreviated new drug applications with the FDA to market generic versions of Biktarvy.

Per the agreements, no generic entry is expected prior to April 1, 2036, in the United States for Biktarvy tablets containing bictegravir (50 mg), emtricitabine (200 mg) and tenofovir alafenamide (25 mg).

These agreements are subject to standard acceleration provisions.

Gilead has a market-leading portfolio of HIV treatments. Flagship drug Biktarvy accounts for over 51% of the treatment market in the United States. Biktarvy continues to lead in share in major markets around the world.

The latest agreements provide patent protection to Biktarvy for almost a decade.

GILD’s Strong HIV Franchise

GILD’s HIV portfolio received a boost with the FDA approval for its twice-yearly injectable HIV-1 capsid inhibitor, lenacapavir, for the prevention of HIV. This groundbreaking injectable therapy marks the first and only twice-yearly pre-exposure prophylaxis (PrEP) option available in the United States.

The FDA approval of lenacapavir under the brand name Yeztugo solidifies GILD’s HIV portfolio as its other prevention drug, Truvada, faces generic competition.

Descovy for PrEP has also performed well. GILD is optimistic about growth in the HIV prevention market as it prepares to launch its recently approved PrEP treatment, Yeztugo. The company now expects HIV sales to grow approximately 3% in 2025 from its prior assumption of flat revenue growth, driven by the strong performance of Biktarvy and Descovy so far this year.

Yeztugo has a competitive advantage as it needs to be taken only twice a year, unlike daily oral pills, and addresses a broad population.

The European Commission also recently granted marketing authorization to HIV prevention drug lenacapavir, under the brand name Yeytuo.

Gilead’s efforts to constantly innovate its HIV portfolio should enable it to maintain growth amid competition from GSK plc GSK.

GSK’s HIV portfolio sales are being driven by strong patient demand for Cabenuva, Apretude and Dovato.

GILD has also collaborated with Merck MRK to evaluate the investigational combination of islatravir and lenacapavir for the treatment of HIV, with a phase III update expected in 2026.

The FDA has accepted Merck’s new drug application (NDA) for doravirine/islatravir, an investigational, once-daily, oral, two-drug regimen for the treatment of adults with virologically suppressed HIV-1 based on the phase III MK-8591A-051 and MK-8591A-052 studies. The agency set a target action date of April 28, 2026. Merck also announced the initiation of the late-stage EXPrESSIVE studies for MK-8527, its investigational once-monthly oral candidate for PrEP.

GILD’s Zacks Rank and Stock to Consider

Gilead presently carries a Zacks Rank #3 (Hold). A better-ranked stock in the pharma/biotech sector is Bayer BAYRY, which sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

BAYRY’s EPS estimate has increased from $1.28 to $1.33 for 2025 over the past 90 days and the same for 2026 has risen from $1.36 to $1.38. Year to date, shares of Bayer have surged 69.6%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.