BigBear.ai Holdings, Inc. BBAI sits at the nexus of national security, logistics, and artificial intelligence just as governments and global partners commit to record-scale AI spending. The recently passed “One Big Beautiful Bill” (OB3) directs $170 billion to the Department of Homeland Security and $150 billion to the Department of Defense, with targeted allocations for border technology, biometrics, drone swarms and shipbuilding. These align directly with BigBear.ai’s product suite, including veriScan for biometric screening, ConductorOS for autonomous command-and-control and Shipyard AI for logistics.

Financially, the company’s second-quarter 2025 results reflected short-term turbulence: revenue declined to $32.5 million, pressured by Army contract disruptions, and adjusted EBITDA widened to a loss. However, BigBear.ai’s cash reserves tell a different story. With $391 million on hand—the strongest balance sheet in its history—the company now holds the financial flexibility to scale aggressively and pursue acquisitions.

Global partnerships bolster the long-term outlook. A $1.4 trillion AI investment framework with the United Arab Emirates, plus initiatives in Panama and other international markets, positions BigBear.ai to capture demand beyond U.S. borders.

Execution risks remain, particularly around federal contracting cycles and integration of new markets. Yet, with sector tailwinds, expanding global partnerships, and ample liquidity, BigBear.ai is positioned to compete for a meaningful share of generational AI investments reshaping defense and critical infrastructure worldwide.

Competitors in the Generational AI Race

As BigBear.ai looks to capture its share of the generational AI investment wave, it faces stiff competition from Palantir Technologies PLTR and C3.ai AI. Palantir has built a strong foothold with U.S. defense and intelligence agencies, offering advanced decision-making platforms that directly overlap with BigBear.ai’s federal ambitions. Palantir continues to benefit from long-standing contracts and its ability to integrate data at scale, making it a consistent benchmark for investors tracking AI-driven government services.

C3.ai has carved its identity as a versatile enterprise AI provider, with applications spanning defense, energy, and manufacturing. Unlike BigBear.ai’s specialized defense-first focus, C3.ai markets a broader suite of AI solutions, giving it an edge in diversification. As global governments and corporations increase AI spending, Palantir and C3.ai represent formidable competitors. BigBear.ai must leverage its expertise in biometrics, autonomy, and logistics to carve out a distinct niche in this rapidly expanding landscape.

BBAI’s Price Performance, Valuation and Estimates

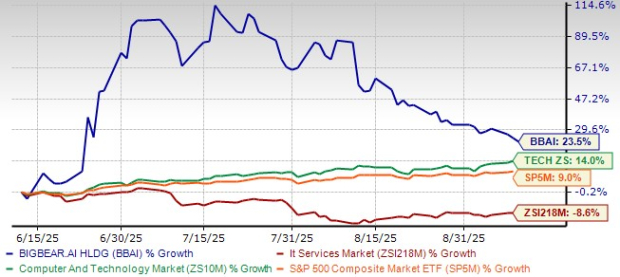

Shares of the company have gained 23.5% in the past three months, outperforming the Zacks Computers - IT Services industry, the Zacks Computer and Technology sector and the S&P 500 Index. A key driver of the rally is BigBear.ai’s expanding footprint in U.S. defense and homeland security.

BBAI Price Performance

Image Source: Zacks Investment Research

In terms of its forward 12-month price-to-sales ratio, BBAI stock is trading at 11.05, down from the industry’s 17.23.

BBAI’s P/S Ratio (Forward 12-Month) vs. Industry

Image Source: Zacks Investment Research

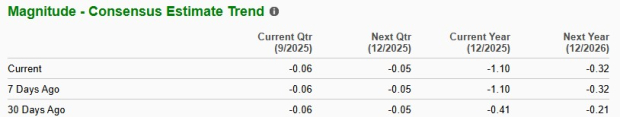

Over the past 30 days, the Zacks Consensus Estimate for BBAI’s 2025 loss per share has widened to $1.10 from 41 cents. The company had reported the same in the year-ago period.

Image Source: Zacks Investment Research

BBAI stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>C3.ai, Inc. (AI) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

BigBear.ai Holdings, Inc. (BBAI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.