General Motors Company GM has spent several years strengthening its supply chain to withstand issues like the semiconductor shortage. The company has focused on securing battery raw materials and rare earths from North America wherever possible. Whether sourced onshore or offshore, these investments are beginning to show results. GM is making progress in areas such as magnet materials sourcing and considers its stake in Lithium Americas another valuable move.

Regarding the situation with Novelis, General Motors reports minimal impact and has already secured alternative suppliers, so it does not anticipate any significant disruption.

General Motors is also cautiously optimistic about the chip issues in China. The company is aware that government-level discussions are underway and hopes for a positive resolution. In parallel, GM’s teams are proactively assessing potential risks, identifying backup suppliers, and working continuously to mitigate disruptions.

Although there is no definitive timeline, General Motors remains optimistic. It is actively engaged in both monitoring developments and ensuring substitute sources are in place to keep operations running smoothly. GM sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The State of Supply Chain Resilience Among Major Automakers

Ford Motor Company F is grappling with supply disruptions following the fire at Novelis’ aluminium plant, a key supplier. The incident is expected to result in a fourth-quarter EBIT headwind of $1.5-$2 billion and a free cash flow hit of $2-$3 billion for Ford. This reflects Ford’s vulnerability to supply chain disruptions and near-term production challenges.

Honda Motor Co., Ltd. HMC aims for EVs and FCEVs to constitute 100% of its global vehicle sales by 2040. To achieve this, Honda plans to establish a comprehensive, vertically-integrated EV supply chain, focusing on reducing battery costs by more than 20% in North America by 2030. Honda's strategy includes partnerships for lithium-ion batteries and joint ventures. The company will also begin in-house production of batteries in collaboration with GS Yuasa.

GM’s Price Performance, Valuation and Estimates

General Motors has outperformed the Zacks Automotive-Domestic industry in the past six months. GM’s shares have gained 68.4% compared with the industry’s growth of 45.6%.

Image Source: Zacks Investment Research

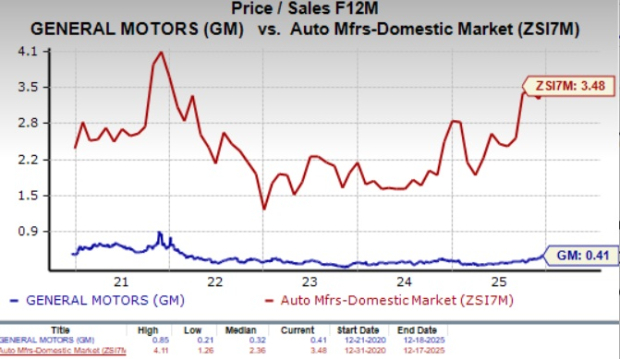

From a valuation perspective, GM appears undervalued compared to the industry. Going by its price/sales ratio, the company is trading at a forward sales multiple of 0.41, lower than the industry’s 3.48.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for GM’s 2025 and 2026 EPS has moved up a penny and 6 cents, respectively, in the past seven days.

Image Source: Zacks Investment Research

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpFord Motor Company (F) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.