Four Corners Property Trust FCPT recently announced multiple acquisitions aggregating $11.6 million. The move underscores the company’s efforts to expand and diversify its portfolio.

The company bought out a Tires Plus property in the strong retail corridor in Georgia for $2.3 million. Priced at a cap rate in line with the previous transactions, the property is corporate-operated under a long-term triple-net lease.

FCPT also acquired four Mission Pet Health properties for $9.3 million, three located in strong retail corridors in Illinois and one in Wisconsin. Priced at a 6.9% cap rate on rent as of the closing date and excluding the transaction costs, the properties are corporate-operated under long-term net leases with a weighted average of 11 years of term remaining.

More on FCPT

This real estate investment trust (REIT), mainly engaged in the ownership and acquisition of high-quality, net-leased restaurant and retail properties, has a track record of acquisitions.

In December, FCPT acquired a newly constructed Jiffy Lube automotive property for $2.7 million. The property is located in a strong retail corridor in Colorado and is corporate-operated under a long-term triple-net lease with approximately 12 years of term remaining.

In the third quarter of 2025, FCPT acquired 28 properties totaling $82 million, with a weighted-average remaining lease term of 11.6 years. The acquired properties belonged to diverse industries, boosting stability in revenue generation. 39% were medical, 36% auto service, 16% quick service restaurants and 9% casual dining restaurants by purchase price.

The above purchases fall in line with Four Corners’ strategy of structuring a resilient portfolio that will withstand varied economic cycles. However, the company’s growth plans could encounter challenges due to its sizable $1.21 billion debt load, which may continue to keep borrowing costs high.

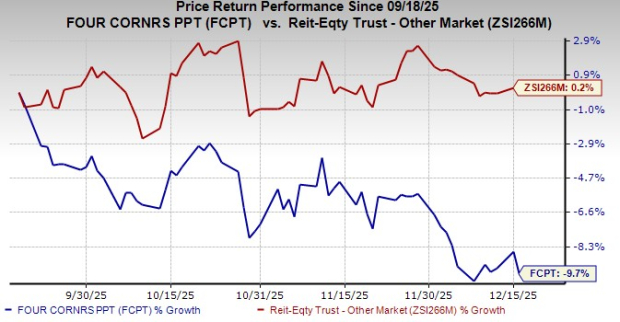

In the past three months, shares of this Zacks Rank #4 (Sell) company have declined 9.7% compared with the industry's fall of 0.2%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Cousins Properties CUZ and Digital Realty Trust DLR, each carrying a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Cousins Properties’ 2025 FFO per share is pegged at $2.84, which indicates year-over-year growth of 5.6%.

The Zacks Consensus Estimate for DLR’s full-year FFO per share stands at $7.35, which calls for an increase of 9.5% from the year-ago period.

Note: Anything related to earnings presented in this write-up represents FFO, a widely used metric to gauge the performance of REITs.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Cousins Properties Incorporated (CUZ) : Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Four Corners Property Trust, Inc. (FCPT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.