Financial Literacy Basics: Concepts, Strategies and Challenges

Definition of Financial Literacy

Financial literacy refers to the understanding and capability to make informed and efficient decisions about personal financial resources. It encompasses the knowledge of how money works in the world: how it is earned, managed, and invested to meet people’s needs and goals.

Being financially literate is essential in today’s complex financial landscape. It arms individuals with the knowledge required to make sound decisions about their money, ensuring their present and future economic well-being.

Without this knowledge, people can make ill-informed choices, leading to financial hardships and insecurity.

Financial Literacy Concepts

Budgeting and Cash Flow Management

Essential to financial literacy is the ability to organize and manage one's finances through budgeting. It allows individuals to set spending limits, allocate funds to different needs, and prioritize essentials.

Understanding cash flow is equally significant, involving the regular monitoring of income versus expenses. By mastering this, one can ensure they live within their means, save efficiently, and plan for financial uncertainties.

Proper cash flow management also aids in preventing unmanageable debts and promotes proactive financial behavior.

Saving and Investing

While most people understand the rudimentary concept of saving, financial literacy delves deeper into the significance and strategies of saving effectively. This means not just setting aside money but also optimizing the growth of these savings.

Investing complements saving; it is about allocating resources to instruments or assets like stocks, bonds, or real estate that can potentially yield returns over time. Understanding the principles of risk, return, and diversification in investing can pave the way for long-term financial growth and security.

Credit and Debt

Being financially literate means comprehending the mechanics of credit—how interest rates work, the implications of different loan terms, and the impact of one's credit score on borrowing abilities. It also means knowing how to manage and reduce debt judiciously.

Uncontrolled debt can spiral into financial distress, so it is essential to have strategies to handle it.

Insurance and Risk Management

Life is unpredictable, and financial literacy encompasses preparing for these uncertainties. Insurance products offer protection against unforeseen financial blows, be it from health issues, accidents, or natural disasters.

Understanding the types of insurance available, their terms, and benefits can make the difference between financial stability and upheaval during challenging times.

Risk management, in a broader sense, also includes recognizing potential financial pitfalls and taking steps to mitigate them.

Financial Products and Services

The financial world is abundant with tools designed to help individuals grow, save, and manage their wealth. From basic savings accounts to intricate financial instruments like derivatives, knowing how to navigate this landscape is crucial.

Financial literacy empowers individuals to discern which products align with their goals and how to avoid pitfalls and fees associated with some services.

Tax Planning

Taxes, while inevitable, can be optimized with proper knowledge. Financial literacy includes understanding the tax code to some extent, especially areas relevant to one's financial situation.

It could mean leveraging tax deductions, credits, and benefits to minimize liabilities or knowing when to seek advice from tax professionals to ensure compliance and optimization.

Retirement Planning

Retirement may seem distant to many, but the foundations for a comfortable retirement begin early. Financial literacy equips individuals with the knowledge to devise retirement strategies and understand the value of pensions, 401(k)s, IRAs, and other retirement savings tools.

It also emphasizes the need for regular contributions and the benefits of compound interest over time.

Building Wealth and Asset Management

Financial literacy also includes strategies for growing one's net worth over time. It involves understanding the principles of asset allocation, diversification, and the value of reinvesting returns.

Adequate wealth and asset management can lead to financial freedom, allowing individuals to achieve their long-term goals and leave a legacy.

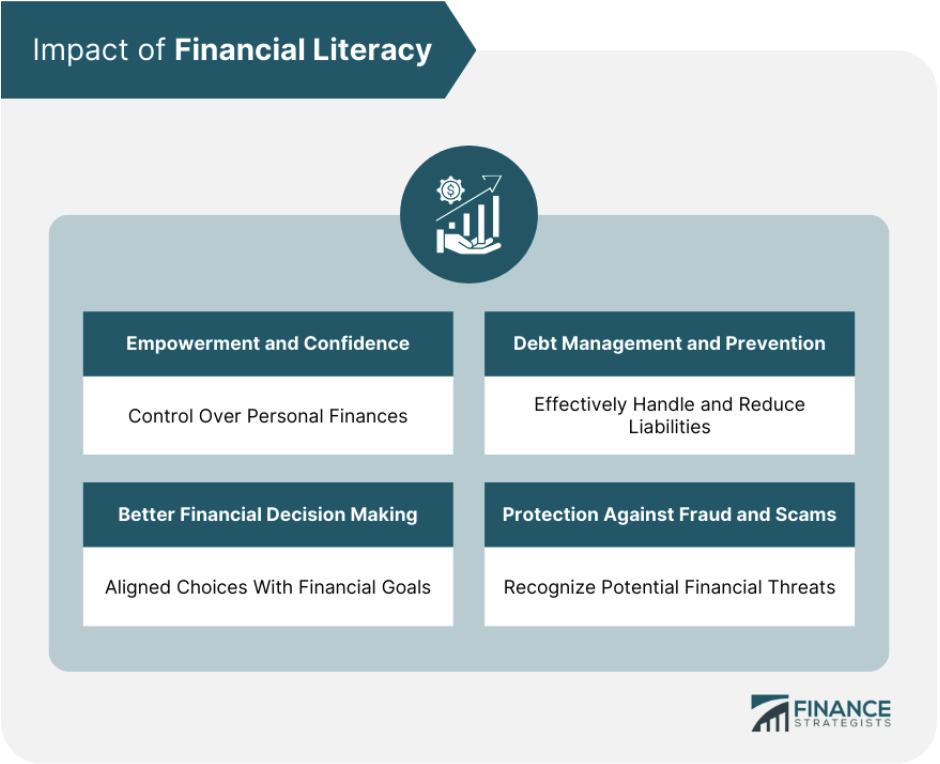

Impact of Financial Literacy

Empowerment and Confidence

As individuals gain knowledge about financial concepts and strategies, they inevitably gain the confidence to make informed decisions. This empowerment is not just psychological but tangible.

With a solid understanding of their financial position and potential strategies, people can take charge of their monetary destiny, making proactive choices rather than reactive ones.

This newfound confidence can significantly reduce financial stress, allowing individuals to approach money matters with a clear, focused mindset.

Better Financial Decision-Making

Knowledge invariably leads to better decision-making. Whether deciding on investment opportunities, purchasing a home, or even everyday spending decisions, a well-informed perspective can make all the difference.

Understanding the potential risks and rewards and critically evaluating options ensure that individuals can navigate the intricate financial landscape more adeptly, avoiding common pitfalls.

Debt Management and Prevention

Financial literacy provides the tools and knowledge to approach debt systematically. It encompasses knowing interest rates, recognizing the dangers of excessive debt, and crafting effective strategies to manage and reduce liabilities.

With the knowledge of how credit works, individuals can negotiate better terms, prioritize high-interest debt, and avoid the snares of crippling debt altogether. Moreover, a preventive approach can keep individuals from accumulating unmanageable debt in the first place.

Protection Against Fraud and Scams

Financial scams and frauds are rife in an increasingly digital world. Financial literacy serves as a shield against such threats.

Individuals can protect their assets by understanding the mechanics of financial transactions, the importance of safeguarding personal financial information, and recognizing the red flags indicative of scams.

Furthermore, informed individuals are less likely to fall prey to "too good to be true" investment schemes or other deceptive financial products.

How to Enhance Financial Literacy

Start Early

Beginning one's financial education journey early in life lays the foundation for sound financial habits that persist throughout adulthood. For young individuals, this can begin with basic lessons on saving, understanding the value of money, and basic budgeting.

Schools and parents play a pivotal role in introducing these fundamental concepts. The earlier one is exposed to these principles, the more time they have to internalize them, make informed decisions, and benefit from long-term financial practices like compound interest.

Continue Learning

The financial world is not static; it continuously evolves with emerging products, changing regulations, and global economic shifts. As such, one's financial education should not be a one-time event but a lifelong commitment.

Regularly updating one's knowledge by attending seminars, reading books, or subscribing to platforms ensures that individuals remain equipped to navigate the complexities of the financial world.

This ongoing education also provides adaptability, allowing individuals to adjust their strategies in response to the changing economic landscape.

Use Technology

With the digital age in full swing, technology offers a plethora of tools to boost financial literacy. Numerous apps and online platforms provide tutorials, real-time budget tracking, investment simulators, and more.

These tools not only make financial planning more accessible but also offer interactive ways to grasp complex financial concepts.

For instance, robo-advisors can provide insights into investment strategies, while budgeting apps can give real-time feedback on spending habits, aiding individuals in making more informed decisions.

Build a Network

Surrounding oneself with financially literate individuals or joining financial communities can significantly enhance one's understanding. Engaging in discussions, sharing experiences, and learning from others' successes and failures offers a wealth of practical knowledge.

It can take joining financial literacy workshops, attending investment clubs, or simply engaging in online financial forums. By building a network, individuals learn and stay motivated, with a community supporting and sharing their financial literacy journey.

Seek Professional Guidance

Sometimes, the world of finance can be overwhelmingly complex. In such scenarios, seeking the expertise of financial advisors or counselors can be invaluable.

These professionals can offer personalized advice tailored to an individual's unique financial situation, helping craft effective strategies for wealth management, tax planning, and retirement, among others.

Moreover, they can act as a sounding board, offering a second opinion on major financial decisions and ensuring that individuals avoid common financial missteps.

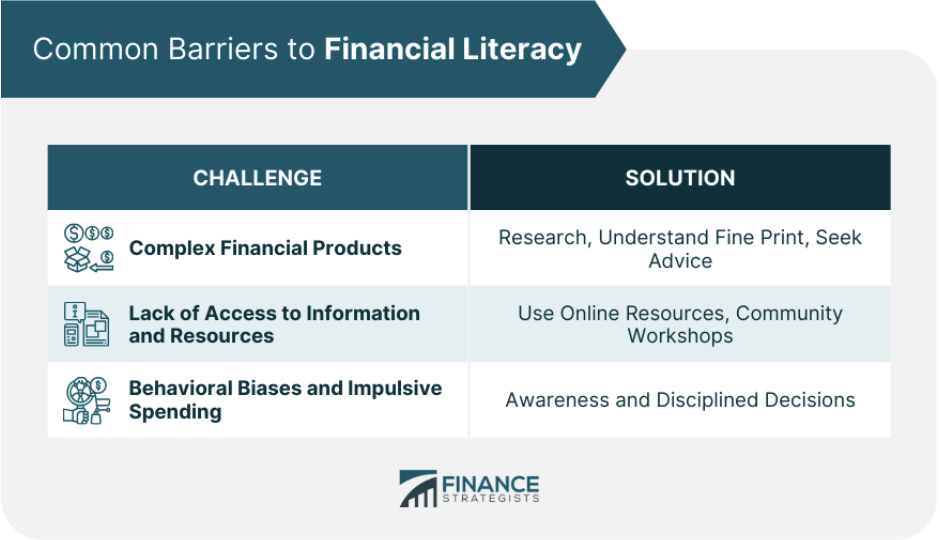

Common Barriers to Financial Literacy

Complex Financial Products and Services

The financial market is teeming with products and services, each with its intricacies. For a novice, this can be overwhelming.

To navigate this maze, start by understanding fundamental financial products relevant to one's current life stage, such as savings accounts or insurance policies. As one's knowledge grows, they can delve into more complex instruments.

Moreover, leveraging tools like comparison websites or even seeking advice from financial advisors can simplify decision-making.

The key is not to rush. Take the time to understand each product, its risks, benefits, and relevance to one's financial goals.

Lack of Access to Information and Resources

Another barrier is the absence of readily available and reliable resources. This challenge is particularly pronounced in underserved communities or regions with limited educational infrastructure.

However, online platforms have started bridging this gap in this digital age. Numerous websites, courses, and applications offer free or affordable financial education.

For those with limited internet access, community centers, local libraries, and non-profit organizations often host workshops or provide resources on financial literacy.

The Financial Literacy Coalition is one such organization. It is a collective of financial advisors, educators, firms, and corporations sharing their expertise and resources to spark a change in how Americans view and handle their finances.

It is vital to seek out these resources actively and spread this knowledge within the community, creating a ripple effect of financial empowerment.

Behavioral Biases and Impulsive Spending

Human nature is inherently influenced by emotions and biases, sometimes leading to impulsive financial decisions or mismanagement. It is essential to recognize and address these behavioral patterns.

One effective strategy is the "30-day rule", where individuals wait a month before making any significant non-essential purchase, giving them time to evaluate its necessity.

Additionally, educating oneself about common behavioral finance biases, like confirmation bias or loss aversion, can help make more rational, informed decisions.

Maintaining a written budget, setting clear financial goals, and periodically reviewing spending habits can also mitigate impulsive behaviors.

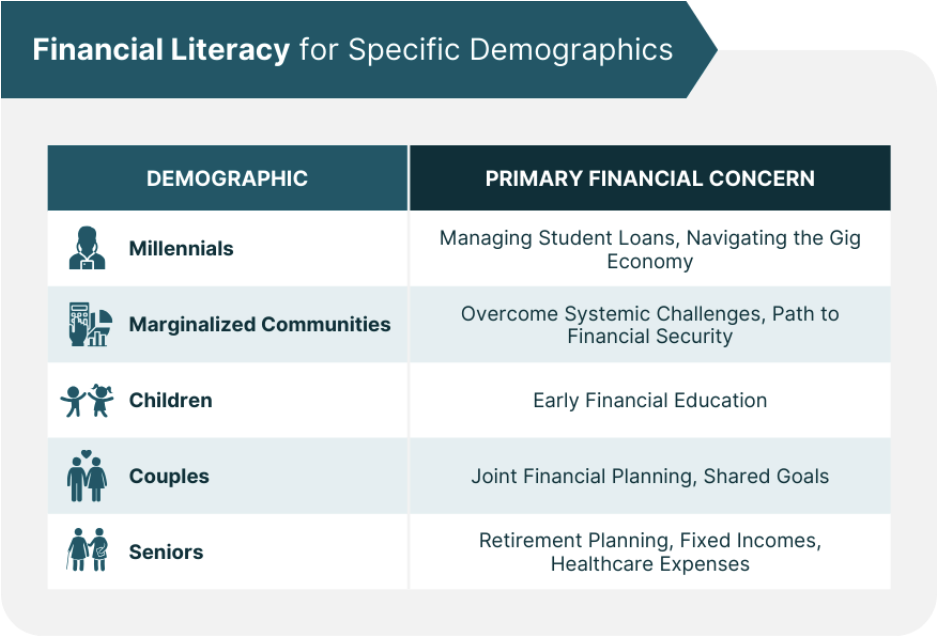

Financial Literacy for Specific Demographics

Millennials

Often labeled as the "digital generation," millennials have grown up amidst rapid technological advancements and significant economic shifts. They face unique financial challenges, such as grappling with student loan debt or navigating the gig economy.

Understanding the intricacies of digital currencies, online investments, and robo-advisors becomes crucial for this demographic. It is also imperative for millennials to grasp the importance of early retirement planning, considering the uncertainties surrounding social security's future.

Financial literacy education tailored to millennials should address these concerns, equipping them to maximize their earnings and investments in a digital age.

Marginalized Communities

For marginalized or underserved communities, financial literacy is about empowerment and bridging socio-economic gaps. These communities often face barriers like limited access to traditional banking or higher susceptibility to predatory lending.

Tailored financial education for these groups should focus on essential banking services, understanding credit, and building wealth through savings and investments.

Grassroots organizations, community centers, and financial inclusion initiatives are crucial in delivering this tailored education, ensuring these communities have the tools to break financial barriers and build a secure future.

Children

Instilling financial literacy in children sets the foundation for responsible financial behavior in adulthood. Simple lessons like grasping the value of money, basic saving practices using piggy banks, and the concept of delayed gratification can be introduced at a young age.

As they grow, it can be beneficial to introduce concepts like budgeting through allowances, understanding the rudiments of interest, and even basic investment principles through games or apps.

Couples

For couples, financial literacy takes on a collaborative dimension. Merging finances or even just coordinating financial goals requires clear communication and shared understanding.

Couples must be well-versed in joint financial products like shared bank accounts, mortgages, or insurance policies. They should also be equipped to navigate financial challenges together, whether it's planning for a family, buying a home, or saving for vacations.

Financial literacy for couples emphasizes the importance of regular financial check-ins, aligning financial goals, and ensuring transparency in financial dealings.

Seniors

As individuals approach or enter retirement, their financial concerns shift towards preserving wealth, generating sustainable post-retirement income, and estate planning. Seniors also become potential targets for financial scams or frauds.

Thus, financial literacy for this demographic should focus on understanding retirement accounts, managing withdrawal strategies, and being alert to potential financial threats. Information about healthcare costs, long-term care insurance, and legacy planning becomes paramount.

Conclusion

Financial literacy is an essential life skill that empowers individuals to navigate the intricate world of personal finance with confidence and competence. It encompasses a range of concepts, from budgeting and investing to debt management and retirement planning.

Financial literacy equips individuals with the knowledge to make informed decisions and helps protect against financial pitfalls, fraud, and impulsive spending.

Starting early and continuing to learn throughout life, utilizing technology, seeking professional guidance, and building a network of financially literate individuals are strategies to enhance one's financial knowledge.

Overcoming common challenges such as limited access to resources, behavioral biases, and the complexity of financial products requires diligence and education.

Financial literacy is not one-size-fits-all; it must be tailored to specific demographics, including millennials, children, couples, seniors, and marginalized communities.

Ultimately, financial literacy is not just about managing money but about achieving financial freedom and securing a brighter future.

FAQs

1. What is financial literacy?

Financial literacy refers to the understanding and application of various financial skills, including personal financial management, budgeting, and investing. It is about making informed choices regarding financial resources and understanding the implications of those decisions.

2. Why is financial literacy important?

Financial literacy is crucial because it equips individuals to navigate the complex financial landscape, make informed decisions, and achieve financial security. Without it, individuals are more prone to making poor financial choices, accumulating debt, and facing financial hardships.

3. How can one improve their financial literacy?

Improving financial literacy involves continuous learning. This can be achieved by reading books on finance, attending workshops, taking online courses, using financial planning tools and apps, and seeking advice from financial professionals. Regularly reviewing and updating one's financial knowledge is key.

4. At what age should financial literacy education begin?

It is never too early to start financial literacy education. Simple concepts like saving and the value of money can be introduced to children. As they grow, more complex topics like budgeting, investing, and credit can be discussed. Instilling these principles early sets the foundation for responsible financial behavior in adulthood.

5. Can financial literacy help with retirement planning?

Absolutely. Financial literacy enables you to understand retirement options, such as 401(k) plans and IRAs, make informed investment choices, and create a retirement savings strategy to secure your financial future.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.