Figma FIG is benefiting from an expanding clientele, which has been a major growth driver for its success. Its focus on AI-native workflows and product innovation has been a key catalyst in attracting new customers and expanding its reach within existing accounts.

The launch of Figma Make, an AI-powered tool that allows users to create prototypes and web apps using text prompts, has been noteworthy. Approximately 30% of customers spending $100,000 or more in ARR were using Figma Make weekly by the end of September.

In the third quarter of 2025, FIG’s customer base grew significantly, with the company adding more than 90,000 paid teams in just two quarters, bringing the total to 540,000 paid customers. This growth was driven by the adoption of new products like Figma Make and AI features, which attracted new users and expanded usage within existing teams.

As of Sept. 30, 2025, the company had 12,910 paid customers with more than $10,000 in annual recurring revenues (ARR) and 1,262 paid customers with more than $100,000 in ARR. In the third quarter of 2025, Figma’s net dollar retention for paid customers with more than $10,000 in ARR increased to 131%, up 2 percentage points sequentially. This growth was driven by faster customer adoption of new products and platform features.

Figma Suffers From Stiff Competition

Figma is facing stiff competition from companies like Adobe ADBE and Atlassian TEAM, both of which are expanding their clientele and AI-driven revenue base.

Adobe’s strategy of infusing AI into its portfolio is driving growth. In October 2025, Adobe expanded its partnership with Google Cloud to integrate Google’s latest AI models into Adobe’s creative ecosystem. This will allow for richer creative outputs and customizable, brand-specific AI solutions for businesses.

Atlassian’s focus on adding generative AI features to some of its collaboration software is likely to drive the top line. In August 2025, Atlassian announced a multi-year partnership with Google Cloud. The company’s collaboration with Google Cloud aims to bring its AI-powered teamwork platform, including Jira, Confluence, and Loom, onto Google’s AI-optimized infrastructure. This will allow for deeper Gemini integrations and smoother collaboration across platforms.

Figma’s Share Price Performance, Valuation, and Estimates

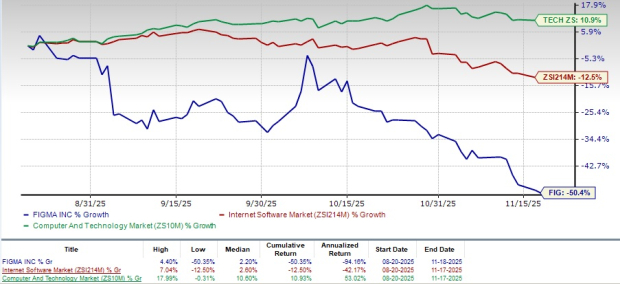

Figma’s shares have lost 50.4% in the past three months. The broader Zacks Computer & Technology sector has appreciated 10.9% while the Zacks Internet - Software industry has decreased 12.5% in the same period.

FIG Stock's Performance

Image Source: Zacks Investment Research

Figma’s stock is trading at a premium, with a forward 12-month Price/Sales of 12.17X compared with the Computer and Technology sector’s 6.63X. FIG has a Value Score of F.

Price/Sales (F12M)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2025 earnings is pegged at 41 cents per share, which has increased 37% over the past 30 days. This indicates a 110.96% increase from the reported figure of 2024.

Figma, Inc. Price and Consensus

Figma, Inc. price-consensus-chart | Figma, Inc. Quote

Figma currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Figma, Inc. (FIG) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Atlassian Corporation PLC (TEAM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.