Fed Easing: What Does It Mean For The Dollar?

Marshall Gittler, Investment Strategy Consultant, BDSwiss.group

Now that the Fed has cut rates – and the market is putting a 100% probability on another rate cut in September – what does this mean for the dollar?

In theory, there are (at least) three possible implications:

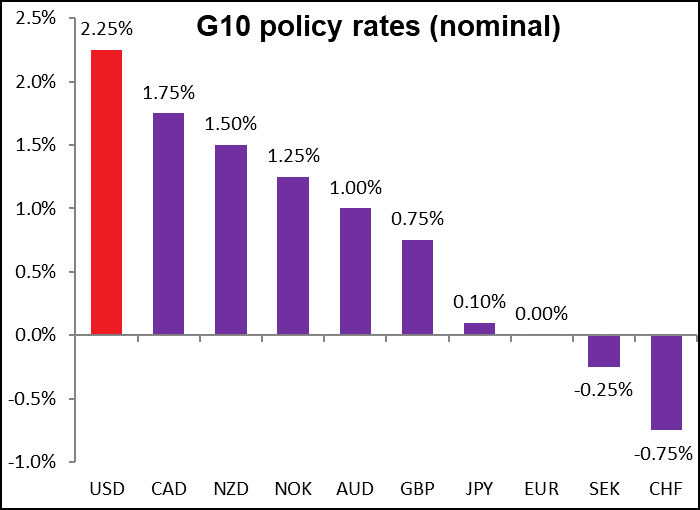

- Since the dollar’s interest rates are higher than everyone else’s, even if other countries cut their rates, they can’t cut as far as the US can. That means the spread between US rates and foreign rates is bound to narrow. The narrowing spread should make the dollar less

- Since the dollar’s interest rates are higher than everyone else’s, even if other countries cut their rates, US rates will still be higher. That means the US will retain a relatively wide yield spread, which should make the dollar more

- Since the dollar’s interest rates are higher than everyone else’s, the US has more room to cut than other countries, which should mean more monetary stimulus. That, combined with the fact that the US economy is already in relatively good shape, should make the US an attractive place to invest and keep the dollar strong.

OK, those are various theoretical possibilities. But how does it work in practice? What has happened to the dollar in the past when the Fed eased rates?

As you might expect, the dollar has generally fallen during Fed rate cutting cycles.

(I’ve skipped the pre-1984 periods, because the Fed cycles were quite erratic then – frequently shifting from cutting to hiking and back to cutting.)

However, as the graph shows, the behavior is not consistent. It isn’t just a one-way street. Looking at the major Fed loosening cycles:

- In 1984/86, it rose 10% during the first seven months of the cycle, then plunged 27% in the remaining 17 months. This was an odd cycle however as there were several months when the Fed funds rate was raised during this period.

- In 1989/1992, the dollar fell 12% in the first 18 months, then largely moved sideways for the remaining 23 months.

- In 2000/03, it rose 7% over the first 14 months of the cycle, then fell 19% over the next 16 months.

- In 2007/08, it had the opposite pattern: it fell around 9% in the first seven months, then rebounded 15% in the next nine months.

So although it generally weakens overall during the easing cycle, sometimes it gains in the first several months, sometimes it doesn’t.

This time it’s even more complicated, because the ECB is going to be cutting rates at the same time. That muddies the water.

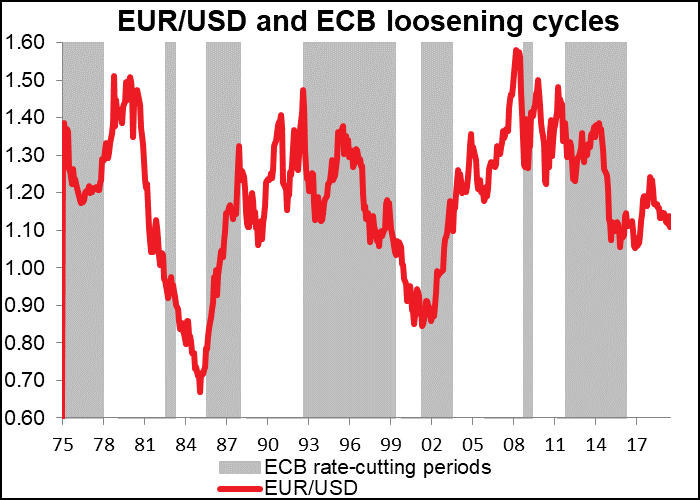

First let’s look at how EUR/USD has performed during periods when the ECB (or the Bundesbank before it) was easing. In this case, EUR/USD has generally declined – i.e., the euro (or similar basket before Jan. 1999) has weakened. The big exception to that was of course the period immediately following the Plaza Accord, but that was a special period when central banks were intervening in the FX market. We can discard that period from our analysis.

So far, the results are consistent with what we found for the dollar: in both cases, the currency tends to weaken over time when its interest rates are coming down, albeit not in a straight line.

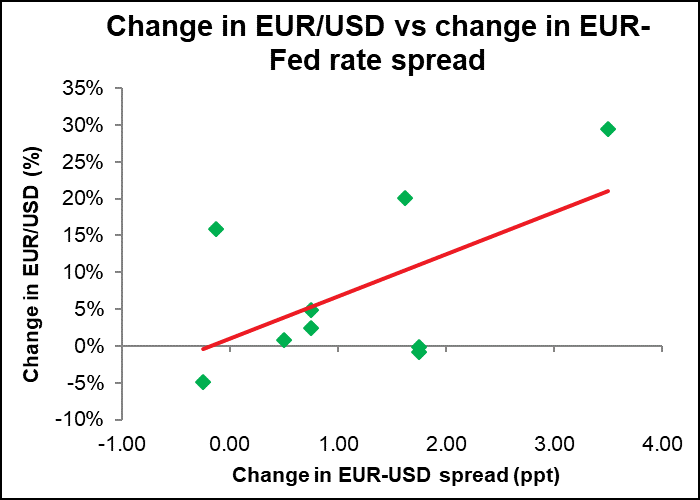

The time we’re in now is a bit more complicated. What happens when both economies are cutting rates? How will EUR/USD react in that case?

As you can see, it’s pretty much as you imagine. EUR/USD tends to gain during periods when the yield gap is moving in favor of the euro. Of course, it’s also noticeable that almost all of these periods are periods when the yield gap is moving in favor of the euro.

What does that suggest for our current situation? It suggests that Theory #1 – the narrowing rate spread – is likely to dominate the FX market’s movement over time, weakening the dollar and pushing EUR/USD higher.

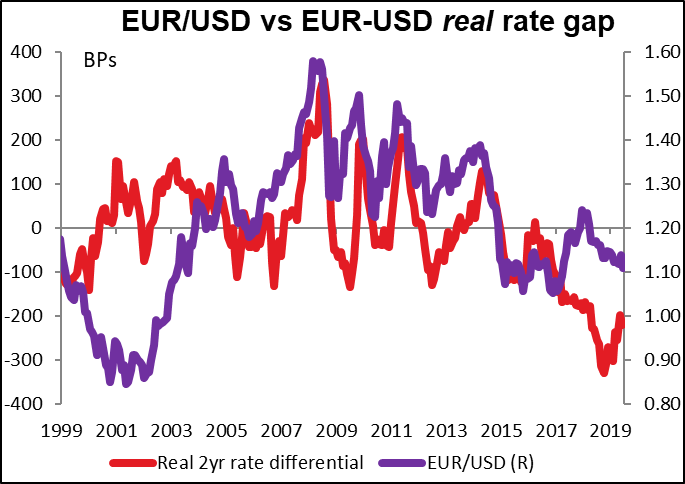

Having said all that…there’s one point I should mention: it looks like the rate gap isn’t such a big influence on EUR/USD nowadays. If it were, then EUR/USD would be substantially lower already. (These graphs use the two-year notes; 10yr show basically the same pattern.) It looks to me like for the last several years, the interest rate gap has not been a major

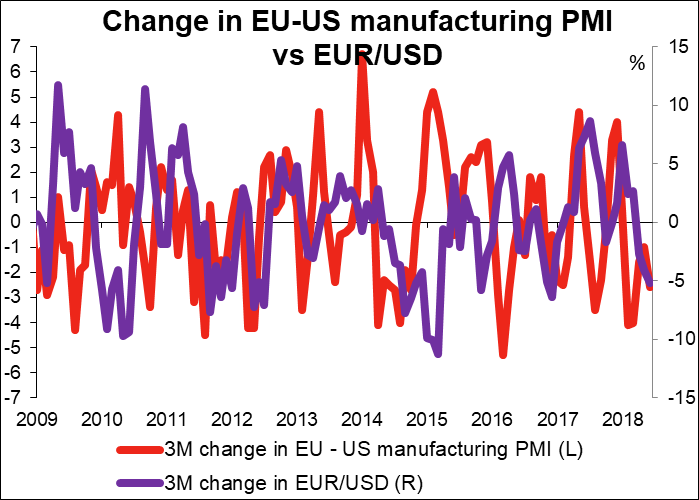

There is some evidence that with interest rates at such low levels, it may be growth, or the business cycle, that’s the dominant influence on EUR/USD nowadays. Although even that wouldn’t explain why EUR/USD is so much higher than what the yield differential suggests it should be, since of course the US economy is in demonstrably better shape than the EU is. It does however suggest some evidence for Theory #3: that since the US has room for more monetary stimulus, it should make the US an attractive place to invest and keep the dollar strong. But we’ll have to examine that in another note.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.