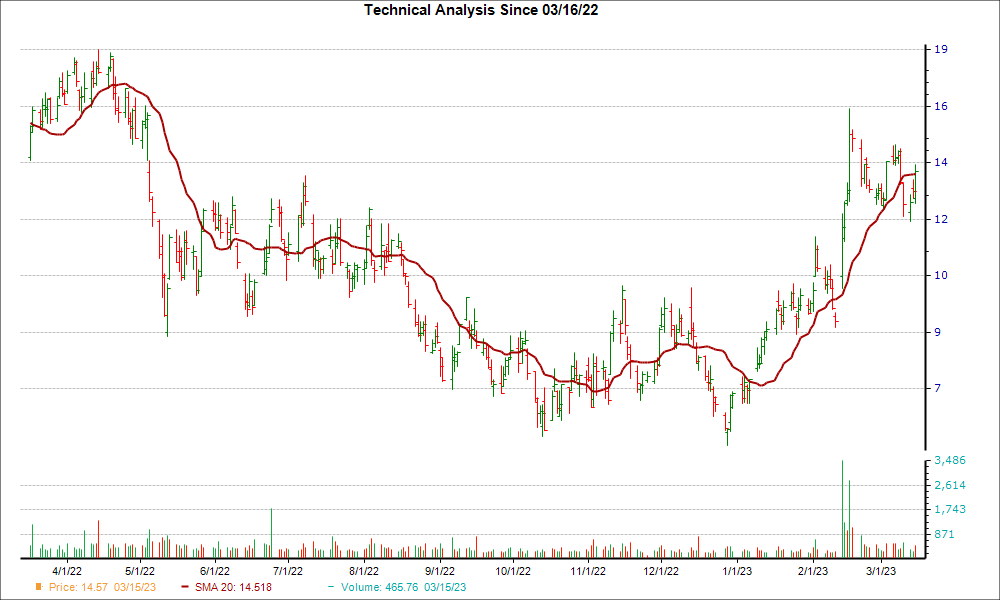

From a technical perspective, Fastly (FSLY) is looking like an interesting pick, as it just reached a key level of support. FSLY recently overtook the 20-day moving average, and this suggests a short-term bullish trend.

A well-liked tool among traders, the 20-day simple moving average offers a look back at a stock's price over a 20-day period. This is very beneficial to short-term traders, as it smooths out short-term price trends and gives more trend reversal signals than longer-term moving averages.

Like other SMAs, if a stock's price is moving above the 20-day, the trend is considered positive. When the price falls below the moving average, it can signal a downward trend.

Shares of FSLY have been moving higher over the past four weeks, up 5.1%. Plus, the company is currently a Zacks Rank #2 (Buy) stock, suggesting that FSLY could be poised for a continued surge.

The bullish case solidifies once investors consider FSLY's positive earnings estimate revisions. No estimate has gone lower in the past two months for the current fiscal year, compared to 7 higher, while the consensus estimate has increased too.

With a winning combination of earnings estimate revisions and hitting a key technical level, investors should keep their eye on FSLY for more gains in the near future.

Is THIS the Ultimate New Clean Energy Source? (4 Ways to Profit)

The world is increasingly focused on eliminating fossil fuels and ramping up use of renewable, clean energy sources. Hydrogen fuel cells, powered by the most abundant substance in the universe, could provide an unlimited amount of ultra-clean energy for multiple industries.

Our urgent special report reveals 4 hydrogen stocks primed for big gains - plus our other top clean energy stocks.

See Stocks NowFastly, Inc. (FSLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.