Exponent said on April 27, 2023 that its board of directors declared a regular quarterly dividend of $0.26 per share ($1.04 annualized). Previously, the company paid $0.26 per share.

Shares must be purchased before the ex-div date of June 8, 2023 to qualify for the dividend. Shareholders of record as of June 9, 2023 will receive the payment on June 23, 2023.

At the current share price of $96.27 / share, the stock's dividend yield is 1.08%.

Looking back five years and taking a sample every week, the average dividend yield has been 0.97%, the lowest has been 0.64%, and the highest has been 1.26%. The standard deviation of yields is 0.13 (n=235).

The current dividend yield is 0.87 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.52. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.37%, demonstrating that it has increased its dividend over time.

Learn to Harvest Dividends

Buy Stock. Capture Dividend. Sell Stock. Repeat. This is the essence of dividend harvesting and you can do it easily with Fintel's Dividend Capture Calendar.

What is the Fund Sentiment?

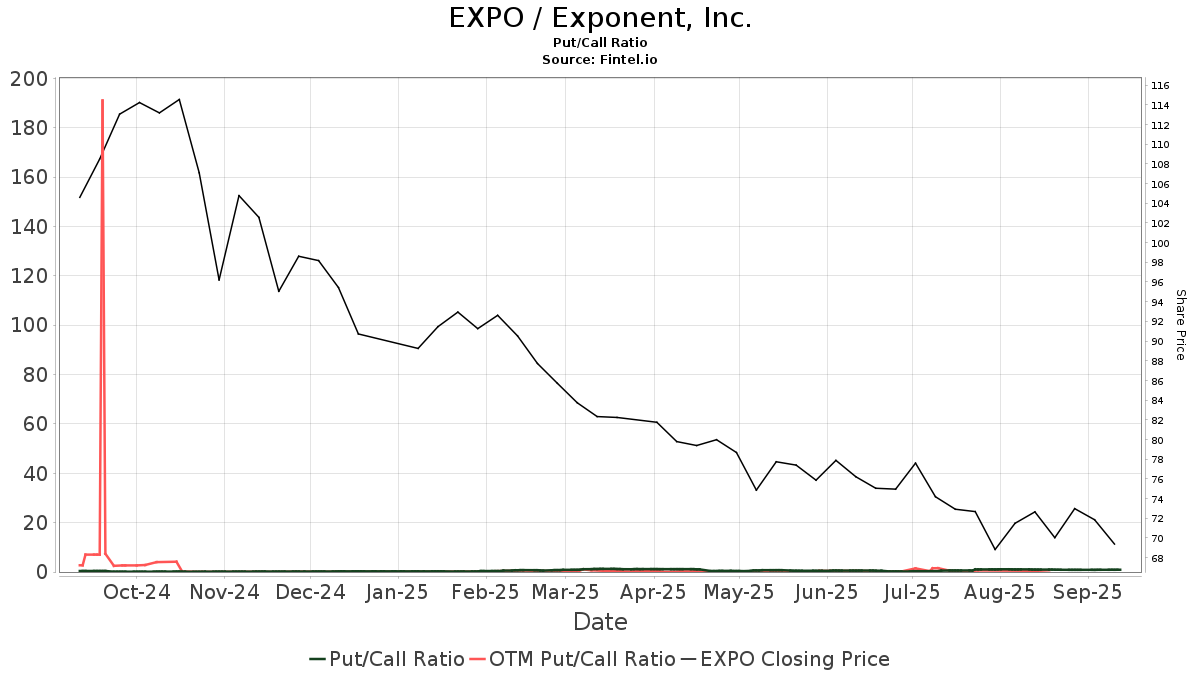

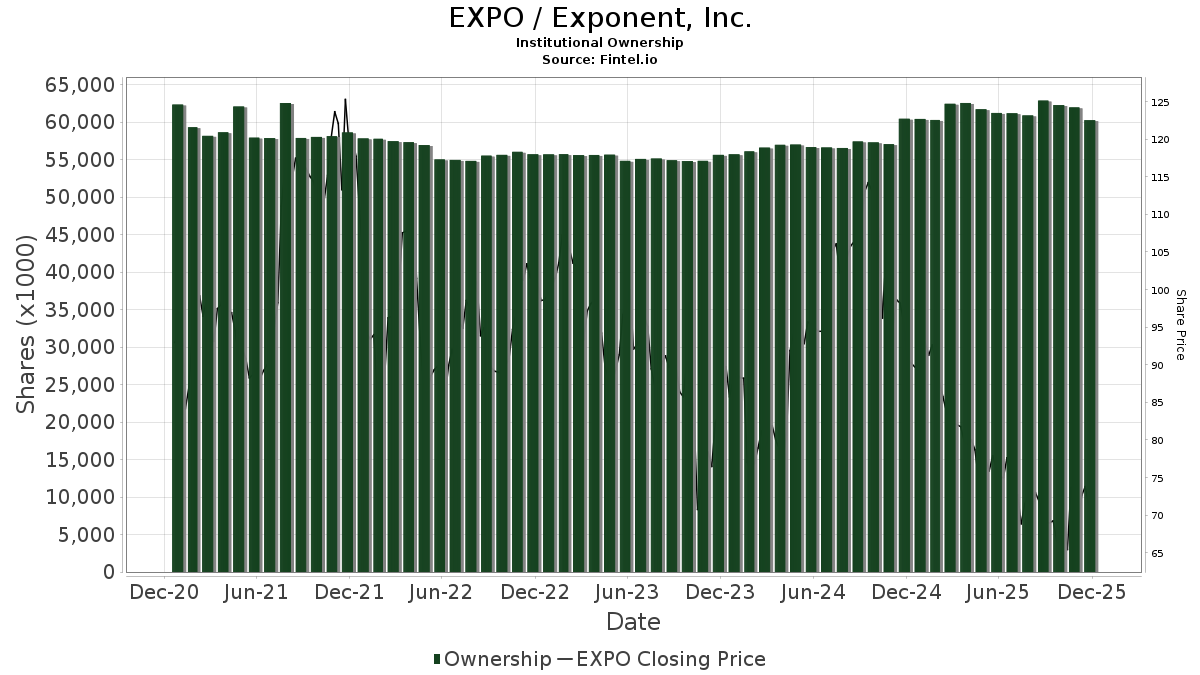

There are 683 funds or institutions reporting positions in Exponent. This is an increase of 6 owner(s) or 0.89% in the last quarter. Average portfolio weight of all funds dedicated to EXPO is 0.24%, a decrease of 3.87%. Total shares owned by institutions decreased in the last three months by 0.24% to 55,580K shares.  The put/call ratio of EXPO is 0.27, indicating a bullish outlook.

The put/call ratio of EXPO is 0.27, indicating a bullish outlook.

Analyst Price Forecast Suggests 27.14% Upside

As of March 31, 2023, the average one-year price target for Exponent is 122.40. The forecasts range from a low of 121.20 to a high of $126.00. The average price target represents an increase of 27.14% from its latest reported closing price of 96.27.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Exponent is 507MM, an increase of 6.88%. The projected annual non-GAAP EPS is 2.10.

What are Other Shareholders Doing?

Kayne Anderson Rudnick Investment Management holds 4,169K shares representing 8.20% ownership of the company. In it's prior filing, the firm reported owning 4,160K shares, representing an increase of 0.22%. The firm increased its portfolio allocation in EXPO by 6.51% over the last quarter.

IJR - iShares Core S&P Small-Cap ETF holds 3,752K shares representing 7.38% ownership of the company. In it's prior filing, the firm reported owning 3,736K shares, representing an increase of 0.44%. The firm increased its portfolio allocation in EXPO by 3.27% over the last quarter.

Neuberger Berman Group holds 2,898K shares representing 5.70% ownership of the company. In it's prior filing, the firm reported owning 2,936K shares, representing a decrease of 1.32%. The firm increased its portfolio allocation in EXPO by 4.74% over the last quarter.

Conestoga Capital Advisors holds 2,408K shares representing 4.74% ownership of the company. In it's prior filing, the firm reported owning 2,381K shares, representing an increase of 1.10%. The firm increased its portfolio allocation in EXPO by 90,941.35% over the last quarter.

NBGNX - Neuberger Berman Genesis Fund Investor Class holds 1,798K shares representing 3.54% ownership of the company. In it's prior filing, the firm reported owning 1,826K shares, representing a decrease of 1.53%. The firm decreased its portfolio allocation in EXPO by 1.17% over the last quarter.

Exponent Background Information

(This description is provided by the company.)

Exponent is an engineering and scientific consulting firm providing solutions to complex problems. Exponent's interdisciplinary organization of scientists, physicians, engineers, and business consultants draws from more than 90 technical disciplines to solve the most pressing and complicated challenges facing stakeholders today. The firm leverages over 50 years of experience in analyzing accidents and failures to advise clients as they innovate their technologically complex products and processes, ensure the safety and health of their users, and address the challenges of sustainability.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.