Fintel reports that on July 19, 2023, Exane BNP Paribas upgraded their outlook for Snowflake Inc - (NYSE:SNOW) from Underperform to Neutral .

Analyst Price Forecast Suggests 4.48% Upside

As of July 6, 2023, the average one-year price target for Snowflake Inc - is 196.63. The forecasts range from a low of 106.05 to a high of $525.00. The average price target represents an increase of 4.48% from its latest reported closing price of 188.20.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Snowflake Inc - is 3,066MM, an increase of 48.43%. The projected annual non-GAAP EPS is 0.49.

What is the Fund Sentiment?

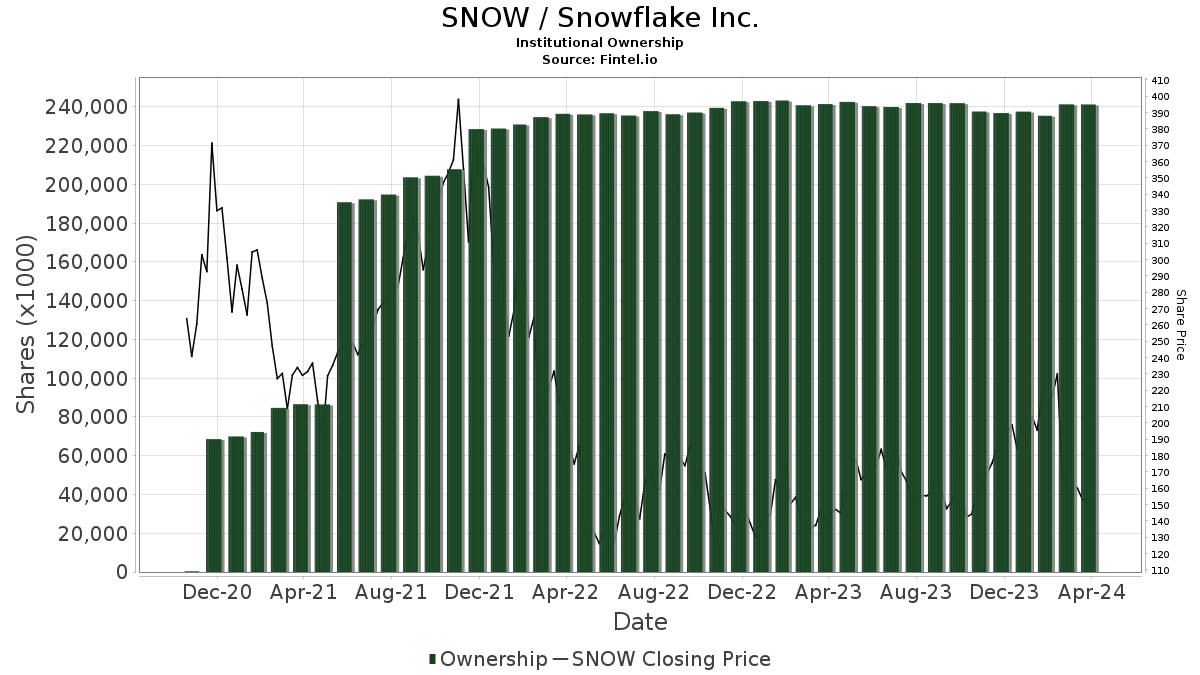

There are 1510 funds or institutions reporting positions in Snowflake Inc -. This is an increase of 4 owner(s) or 0.27% in the last quarter. Average portfolio weight of all funds dedicated to SNOW is 0.70%, a decrease of 0.56%. Total shares owned by institutions decreased in the last three months by 0.24% to 240,104K shares.  The put/call ratio of SNOW is 0.89, indicating a bullish outlook.

The put/call ratio of SNOW is 0.89, indicating a bullish outlook.

What are Other Shareholders Doing?

Altimeter Capital Management holds 15,369K shares representing 4.73% ownership of the company. No change in the last quarter.

Sc Us holds 13,634K shares representing 4.20% ownership of the company. No change in the last quarter.

Capital Research Global Investors holds 12,559K shares representing 3.86% ownership of the company. In it's prior filing, the firm reported owning 8,528K shares, representing an increase of 32.10%. The firm increased its portfolio allocation in SNOW by 49.47% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 8,460K shares representing 2.60% ownership of the company. In it's prior filing, the firm reported owning 8,271K shares, representing an increase of 2.23%. The firm increased its portfolio allocation in SNOW by 1.51% over the last quarter.

ICONIQ Capital holds 6,576K shares representing 2.02% ownership of the company. In it's prior filing, the firm reported owning 11,422K shares, representing a decrease of 73.70%. The firm decreased its portfolio allocation in SNOW by 36.24% over the last quarter.

Snowflake Background Information

(This description is provided by the company.)

Snowflake Inc. is a cloud computing-based data warehousing company based in San Mateo, California. It was founded in July 2012 and was publicly launched in October 2014 after two years in stealth mode. The company's name was chosen as a tribute to the founders' love of winter sports.

Additional reading:

- Steve B. Burke Joins Snowflake Board of Directors

- Snowflake Reports Financial Results for the First Quarter of Fiscal 2024

- Mark D. McLaughlin Joins Snowflake Board of Directors

- SNOWFLAKE INC. ADVISOR AGREEMENT

- Amended and Restated Non-Employee Director Compensation Policy

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.