Fintel reports that on May 19, 2023, Exane BNP Paribas upgraded their outlook for MaxLinear (NYSE:MXL) from Underperform to Neutral .

Analyst Price Forecast Suggests 31.49% Upside

As of May 11, 2023, the average one-year price target for MaxLinear is 37.55. The forecasts range from a low of 22.22 to a high of $52.50. The average price target represents an increase of 31.49% from its latest reported closing price of 28.56.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for MaxLinear is 1,162MM, an increase of 5.18%. The projected annual non-GAAP EPS is 3.96.

What is the Fund Sentiment?

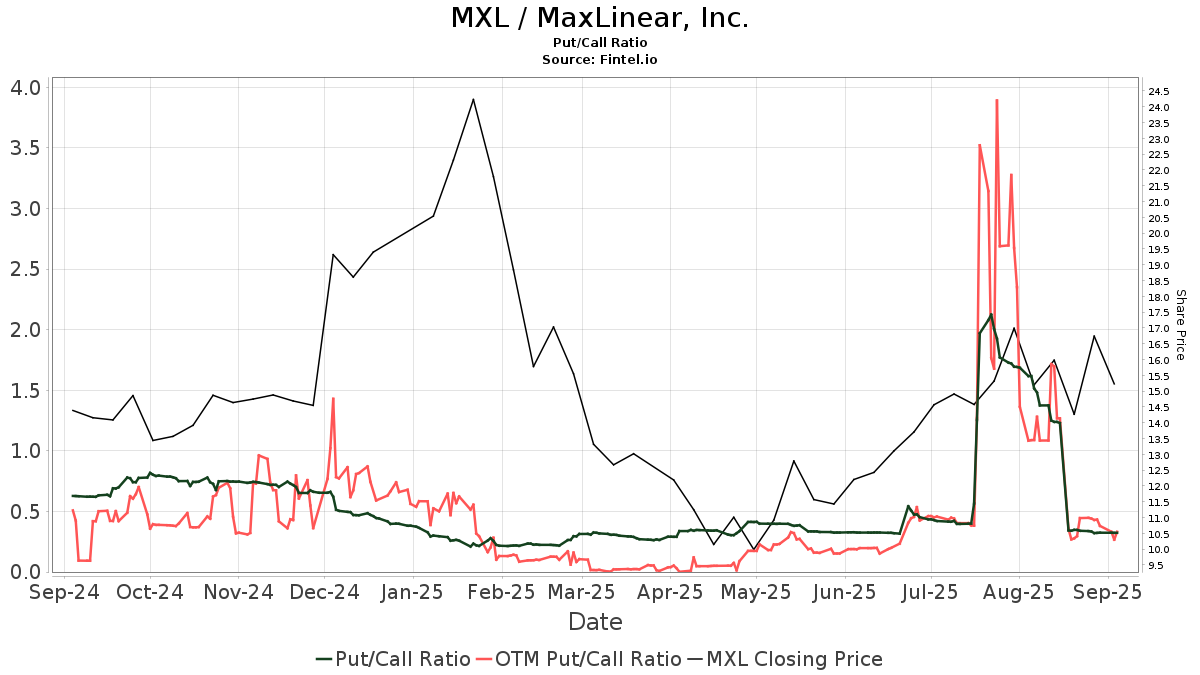

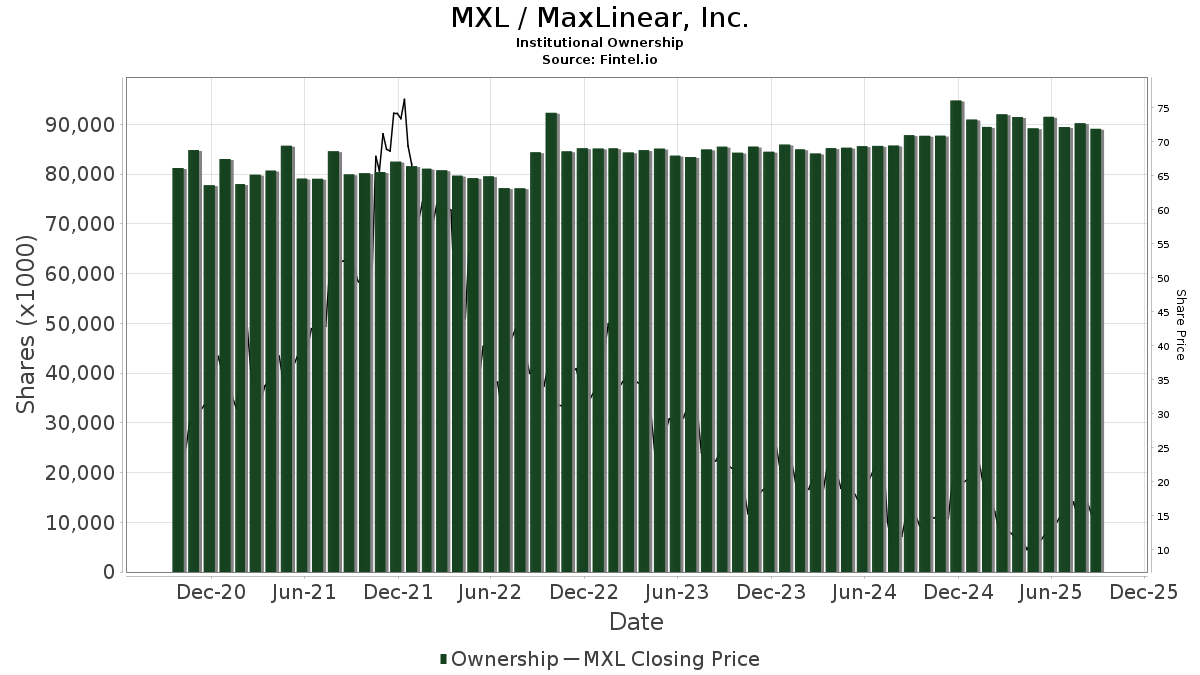

There are 681 funds or institutions reporting positions in MaxLinear. This is a decrease of 3 owner(s) or 0.44% in the last quarter. Average portfolio weight of all funds dedicated to MXL is 0.18%, an increase of 7.17%. Total shares owned by institutions decreased in the last three months by 0.83% to 83,510K shares.  The put/call ratio of MXL is 0.22, indicating a bullish outlook.

The put/call ratio of MXL is 0.22, indicating a bullish outlook.

What are Other Shareholders Doing?

IJR - iShares Core S&P Small-Cap ETF holds 5,356K shares representing 6.70% ownership of the company. In it's prior filing, the firm reported owning 5,274K shares, representing an increase of 1.52%. The firm decreased its portfolio allocation in MXL by 3.85% over the last quarter.

Primecap Management holds 2,967K shares representing 3.71% ownership of the company. In it's prior filing, the firm reported owning 3,019K shares, representing a decrease of 1.76%. The firm decreased its portfolio allocation in MXL by 2.93% over the last quarter.

Millennium Management holds 2,651K shares representing 3.31% ownership of the company. In it's prior filing, the firm reported owning 2,960K shares, representing a decrease of 11.67%. The firm decreased its portfolio allocation in MXL by 3.74% over the last quarter.

Macquarie Group holds 2,370K shares representing 2.96% ownership of the company. In it's prior filing, the firm reported owning 2,319K shares, representing an increase of 2.17%. The firm decreased its portfolio allocation in MXL by 17.59% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 2,149K shares representing 2.69% ownership of the company. In it's prior filing, the firm reported owning 2,090K shares, representing an increase of 2.76%. The firm decreased its portfolio allocation in MXL by 1.15% over the last quarter.

MaxLinear Background Information

(This description is provided by the company.)

MaxLinear, Inc. is a leading provider of radio frequency (RF), analog, digital and mixed-signal integrated circuits for the connectivity and access, wired and wireless infrastructure, and industrial and multi-market applications. MaxLinear is headquartered in Carlsbad, California.

Key filings for this company:

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.