In the near term, financial markets will likely continue to swing sharply back and forth between gains and losses as the economy tries to right itself and get past the disruptions caused by the coronavirus pandemic. While this can cause investors to get caught up in a short-term trading mindset if they're not careful, it can also present great opportunities for the long run.

After a difficult 2022, the S&P 500 index has gained 4% so far to start off this year. But not all stocks have enjoyed these gains. Shares of the world's largest asset manager, BlackRock (NYSE: BLK), have shed 4% of their value year to date. This recent volatility arguably makes the stock a smart pick for long-term dividend growth investors. Let's assess BlackRock's fundamentals and valuation to elaborate further.

It's only a matter of time before BlackRock recovers

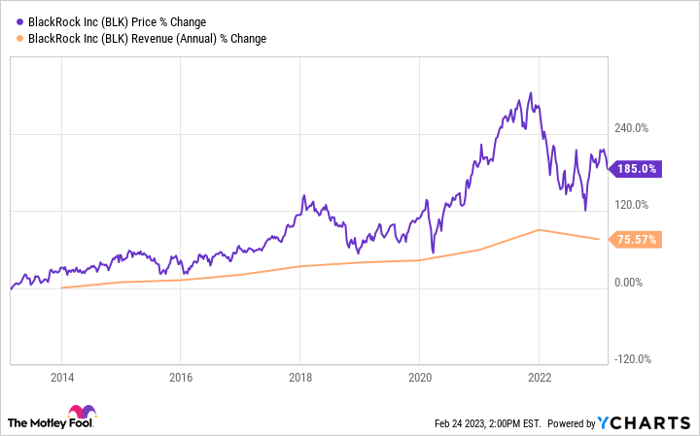

As you'd expect from an asset manager, BlackRock does exceptionally well in terms of both fundamentals (i.e., revenue growth) and stock performance during bull markets. This is because bull markets are characterized by business growth, which makes stocks more profitable and valuable over time. Asset managers earn revenue based on a percentage of the assets they manage, which is why BlackRock generates more in revenue and profits in a bull market than in a bear market.

Due to the 2022 bear market, BlackRock saw its average assets under management (AUM) decrease by more than 4% to $8.9 trillion. This, along with decreased performance fees stemming from the market downturn, further pressured revenue to dip nearly 8% to $17.9 billion during the year.

All things considered, this performance was still quite impressive. BlackRock's saving grace was its status as the leading asset manager, which helped it attract more than $300 billion in long-term net inflows in 2022, offsetting part of the market sell-off-related decline in AUM.

The good news for BlackRock is that every bear market in history has (so far) been followed by a bull market. (Whether that bull market begins next week, next month, or next year remains to be seen, however.) This is why analysts believe that BlackRock's non-GAAP (adjusted) diluted earnings per share (EPS) will grow by 6.3% each year for the next five years.

The dividend can continue to grow

Income investors will notice and appreciate that BlackRock's 2.9% dividend yield is substantially above the S&P 500 index's average 1.7% yield. This doesn't appear to be a yield trap, either.

That's because BlackRock's dividend payout ratio is expected to come in around 57% in 2023, on the high end of the spectrum for an asset manager. But it's worth noting that this payout ratio will come down moderately as soon as 2024 when adjusted diluted EPS is expected to climb by nearly 14%. This should allow BlackRock to resume making strong dividend hikes by 2025.

An enticing valuation for a blue-chip stock

Given the current circumstances of a beaten-down equities market, BlackRock remains a fundamentally solid business. And its valuation seems to be attractive enough to warrant a buy for dividend growth investors.

The Shiller price-to-earnings (P/E) ratio, which averages out the last 10 years of a company's inflation-adjusted earnings, demonstrates shares of BlackRock to be undervalued. BlackRock's Shiller P/E ratio of 22.7 is meaningfully below its 10-year median Shiller P/E ratio of 28.7. Because 10 years is generally thought to represent a full economic cycle, this could be a more accurate valuation metric than its P/E ratio counterpart (which only goes back a year).

10 stocks we like better than BlackRock

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and BlackRock wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of February 8, 2023

Kody Kester has positions in BlackRock. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.