Walt Disney (NYSE: DIS) stock has taken a huge hit over the past few years as the company deals with one problem after another. It's lost nearly half of its value over the past three years, a huge blow to shareholders of the world's premier entertainment company.

Could the tide finally be turning? All eyes are on this one number.

The more it changes, the more Disney stays the same

Disney hasn't changed much from its core as a global entertainment powerhouse. It produces excellent content and distributes it in various forms of media, and it translates its creative work into products, parks, and experiences. It's a model that has worked for decades.

The mediums it uses to get its content out have changed over the years, though, and it's expanded its repertoire through acquisitions and new franchises. Notably, it launched Disney+ to great fanfare in 2019. It was well positioned to benefit from skyrocketing streaming subscriptions when the pandemic started.

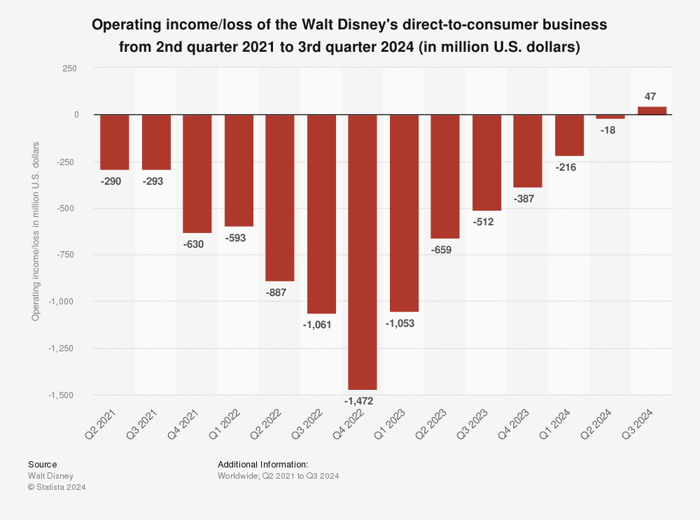

But things might have moved a bit faster than it was expecting. The launch of Disney+ came with large and costly marketing campaigns to roll out the network as well as expenses to drive constant fresh content on the site. This is how it's looked over the past three years.

Image source: Statista.

Nearly five years in, the streaming business is finally in the black. However, what's not included here is ESPN+, which is reported as part of Disney's sports segment instead of its entertainment segment. With ESPN+, direct-to-consumer, or the streaming business, still posted an operating loss in the 2024 fiscal third quarter (ended June 29).

Management has said that Disney is on track to deliver its first complete streaming operating profit in the fourth quarter, which will be reported in early November. If it comes through, expect Disney stock to get a boost.

Should you invest $1,000 in Walt Disney right now?

Before you buy stock in Walt Disney, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walt Disney wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Jennifer Saibil has positions in Walt Disney. The Motley Fool has positions in and recommends Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.