The Estee Lauder Companies Inc. EL has experienced prolonged softness in its skin care business over recent quarters, making the category a key area of focus. First-quarter fiscal 2026 results provide updated insight, with skin care sales increasing 3% to $1,575 million. This marked an improvement from prior declines and supported the company’s overall sales growth during the quarter. Growth was fueled by core brands La Mer and Estee Lauder, which benefited from a low prior-year base and recovery in Asia travel retail.

Performance improved largely due to share gains in the United States and Mainland China. In the U.S. prestige beauty market, Estee Lauder reported 8% retail growth in skin care compared with 6% growth for the broader category. Momentum was driven by The Ordinary, which continues to attract consumers and the Estee Lauder brand, which posted its third consecutive quarter of overall share gains.

Initiatives under the company’s “Beauty Reimagined” strategy also supported results. New launches in faster-growing areas such as longevity-focused products and acne treatments, along with expanded distribution through Amazon in Mexico and TikTok Shop in select markets, helped broaden consumer reach.

Profitability within the segment also showed resilience. Skin care operating income rose 60% year over year during the quarter, supported by higher sales and operational efficiencies from the Profit Recovery and Growth Plan.

Despite these gains, the path forward is not without obstacles. Global travel retail remains a volatile channel, with persistent challenges in Eastern markets. Management noted that while consumer sentiment in Mainland China is improving, it remains subdued relative to historical peaks. While the first-quarter results are encouraging, the company must continue to navigate a dynamic macroeconomic environment to prove that skin care’s recent growth is sustainable rather than a temporary rebound from a low base.

Skin Care Strategies Among EL’s Competitors

Coty Inc.’s COTY continues to face pressure in skin care, which weighed on its Prestige segment in the first-quarter fiscal 2026. Even as overall prestige sell-out remained positive, Coty reported declines in prestige makeup and skincare sales during the quarter. Management highlighted ongoing efforts to adjust retailer inventories and improve execution, while continuing initiatives to strengthen the Consumer Beauty business, reflecting that skin care remains a less consistent contributor than Coty’s fragrance portfolio.

e.l.f. Beauty, Inc. ELF continues to expand its skin care presence, positioning the segment as an increasingly important growth driver. As a top-ranked teen skin care brand, e.l.f. Beauty SKIN has reached a new high, reflecting strong consumer engagement. The acquisition of Naturium adds a fast-growing, ingredient-focused platform, while the addition of rhode further strengthens the portfolio. Together, these brands highlight e.l.f. Beauty’s focus on accessible, high-performance skin care innovation.

EL’s Price Performance, Valuation & Estimates

Shares of Estee Lauder have gained 6.5% in the past month compared with the industry growth of 6%.

Image Source: Zacks Investment Research

From a valuation standpoint, Estee Lauder trades at a forward price-to-earnings ratio of 44.45X, up from the industry average of 30.35X.

Image Source: Zacks Investment Research

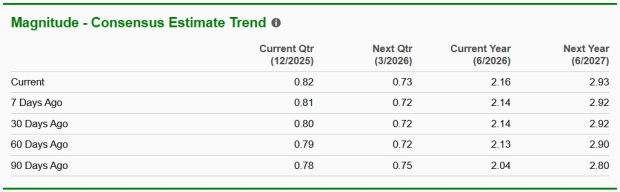

The Zacks Consensus Estimate for Estee Lauder’s fiscal 2026 and 2027 earnings has moved up 2 cents and 1 cent to $2.16 and $2.93, respectively, over the past seven days.

Image Source: Zacks Investment Research

Estee Lauder currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpThe Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.