By Sara Rodriguez, Sage ESG Research Analyst

About The Walt Disney Company

The Walt Disney Company is an American multinational media and entertainment conglomerate operating in multiple segments including media networks, studio entertainment, and theme parks and experiences. With a long, rich history of producing entertainment content since 1923, Disney owns some of the world’s most recognizable brands—in 2021 Disney’s brand was valued at $51.2 billion and was number 22 on BrandFinance’s list of the top 500 companies globally.

Environmental

According to the Sustainability Accounting Standards Board (SASB), there are no identified environmental key performance indicators for companies in the media industry. However, Disney’s business model is far from that of a traditional media company, and encompasses multiple industries including leisure facilities, hotels, restaurants, cruise lines, apparel and footwear, and toys that make up its Parks, Experiences, and Products segment. This piece of Disney accounted for 25% of total revenue in the third quarter of 2021, and as much as 37% pre-COVID. As such, environmental concerns are of material importance to Disney’s business model, as this segment faces both climate change risks and opportunities.

Disney is a leader from an emissions perspective. While many companies focus on a reduction in greenhouse gas (GHG) emission intensity, Disney has been able to decrease its absolute Scope 1 and 2 emissions and total energy usage from 2018 to 2020. In 2020, Disney met its target to reduce GHG emissions by 50% from 2012 levels. Disney’s parks and experiences offer customers a variety of restaurants, which generate food waste. The company recognized a desire to send less total waste to landfill and implemented extensive programs focused on food waste capture, material sorting, and the reduction of plastics and unnecessary waste. In 2020 Disney diverted 60% of waste from landfills and incineration, sending less total waste to landfill than in 2015. Additionally, Disney reduced its potable water usage from 6.46 billion gallons in 2018 to 4.99 billion in 2020.

Disney’s 2020 annual investor report mentions that the demand for travel and tourism can be significantly adversely affected as a result of severe weather conditions or natural disasters such as hurricanes, earthquakes, and excessive heat. Additionally, the company may incur additional costs if it must obtain insurance coverage with respect to these events. Disney’s corporate sustainability report (CSR) does not yet cover climate change risk and it seems that the company does not have a proposed mitigation strategy, which is something we will continue monitoring.

Social

Disney encounters most of its financially relevant sustainability issues in the social category. The company’s CSR features links to a multitude of company policies including: a code of conduct for manufacturers, conflict minerals policy, diversity and inclusion commitment, human rights policy, nutrition guidelines, and smoking in movies policy. While this is commendable, it is difficult to gauge the effectiveness of a policy merely on its existence. This is a problem that reigns true for ESG analysis across the board, and we hope to continue to see sustainability standards and frameworks work to solidify the decision-usefulness and transparency of disclosures related to policies.

Despite the difficulty in determining if policies strengthen a company’s social performance, it is simple to gauge past performance based on controversy. Disney is the world’s leading licensing business and has a global network of suppliers. As such, Disney is exposed to a variety of supply chain risks, especially labor rights. Over the past decade, Disney has been subject to numerous controversies involving labor rights and has been accused of multiple violations including unsafe working conditions, severe overtime, inadequate safety training and protective equipment, and paying wages below the legal minimum. These accusations have ranged in location across the globe. Although it is unclear whether Disney adopted it supply chain policies due to its bad behavior or if they were previously in place, Disney has programs to conduct due diligence of its supply chain operations and prevent labor rights violations. Disney’s Code of Conduct for Manufacturers is consistent with the International Labor Organization (ILO) and is enforced through the company’s International Labor Standards (ILS) program. This program requires licensees and vendors to conduct on-site compliance audits in higher risk countries and report to Disney for review and approval. Notably, Disney terminated its manufacturing contracts in Bangladesh following the 2013 Rana Plaza Building collapse due to noncompliance with its policy.

Freedom of association is another pertinent labor rights issue present in Disney’s operations. 54% of Disney’s U.S. employees are covered by collective bargaining agreements – however, the company operates in countries where collective bargaining is prohibited. Recently, Disney committed to paying all U.S. Disney Parks and Resorts hourly employees a minimum of $15/hour by the end of 2021. However, this development may have been the result of increasing scrutiny of Disney by both the public and elected officials. In 2018, 23 congress members signed a letter to Disney’s former CEO Robert Iger, urging him to use the company’s profits to pay Disneyland employees a living wage.

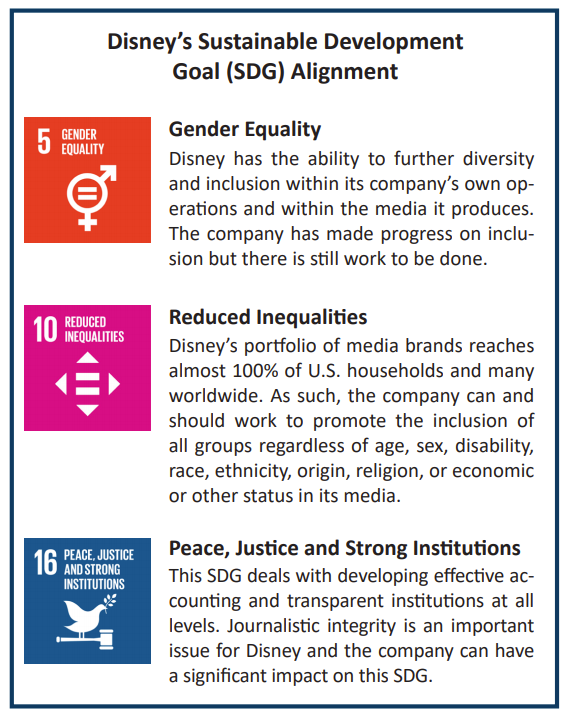

Media pluralism is a social topic material to media companies, and refers to the social, racial/ethnic, and political diversity represented in the company itself and in the media content it produces. Disney tracks and discloses company demographic data including its global breakdown of female and minority employees. From 2018 to 2020, Disney’s percentage of female employees and female management decreased. During that same time, the percentage of minority employees increased, as did minority employees in management positions. Overall, the company offers transparent and in-depth demographic reporting that exceeds that done by most other companies regardless of industry.

To bolster diversity within its content, Disney recently unveiled the Onyx Collective, a production entity designed to feature work by underrepresented creators. Disney’s long history also means it must grapple with how to approach past content depicting offensive racial stereotypes and culturally insensitive material. Movies such as Peter Pan, Dumbo, and Pocahontas have been a point of contention for modern audiences. Rather than remove the content, Disney’s launch of streaming service Disney+ featured a warning for some movies, informing audiences of “outdated cultural depictions.” This decision has been praised as a way to spark conversation and acknowledge the harmful impact of these films without eliminating them from view.

Journalistic integrity is one of the main ESG facets related to companies operating in the media industry. SASB describes journalistic integrity in three pillars:

- Truthfulness, accuracy, objectiveness, fairness, and accountability

- Independence of content and/or transparency of potential bias

- Protection of privacy and limitation of harm

While it is difficult to gauge company performance on these pillars, the second pillar of journalistic integrity is one where Disney struggles. Acquisitions have been a major vehicle of growth for Disney. In 1995, Disney merged with Capital Cities/ABC Inc., which was the second largest corporate takeover at the time. The merger included a minority stake in A&E Television Networks and a majority stake in ESPN. In the 2000s under CEO Robert Iger, the company acquired Pixar Animation Studios, Marvel, and Lucasfilm. In 2019, Disney completed the purchase of the majority of 20th Century Fox’s entertainment assets. That same year, the company launched its own streaming service, Disney+. Even with Disney’s pre-established dominance, these mergers and acquisitions have allowed Disney to own some of the world’s best known, highest-grossing entertainment franchises. From 2015 to 2019, Disney’s market share almost doubled from 20% to about 40%, and in 2019, almost 40% of all U.S. box office sales came from a Disney-owned movie. The company’s news segment also has an incredibly far reach. According to Disney’s annual investors report, ABC Television networks has affiliation agreements with 240 local television stations reaching almost 100% of U.S. television households.

[caption id="attachment_445071" align="aligncenter" width="1435"] Source: 2020 Corporate Social Responsibility Report, Disney.[/caption]

Source: 2020 Corporate Social Responsibility Report, Disney.[/caption]

This consolidation was allowed by the Telecommunications Act of 1996, which reduced the Federal Communications Commission’s (FCC) regulations on cross-ownership of media and eliminated the 40-station ownership cap. The effect of this legislation is often cited using a popular statistic – today, only six media conglomerates control 90% of the media we read, watch, or listen to. For comparison, 90% of American media was owned by about 50 companies in 1983. This consolidation is inherently at odds with the principle of media companies to supply access to accurate and unbiased information, and while Disney is hardly the only media vertically integrating, it is consistently ranked in the top three largest media companies by revenue.

Disney-owned ABC saw an uptick in viewers in 2020, making it the network with the third-highest market share among adults aged 18-49. As such, Disney’s potential to heavily influence ABC coverage may have a negative effect on viewers’ access to unbiased information. When news breaks of unsavory events related to accusations of labor rights violations in Disney’s supply chain or low wages at its theme parks, can ABC present an unbiased view of its parent company? Will it choose to cover the topics at all?

On top of affecting free and unbiased information, consolidation can negatively affect wages, innovation, and the viability of independent films. As a corporation concerned with reporting its revenues, Disney is more inclined to seek content that can move fluidly across its different media channels, making it more likely to ignore creative talent and content in favor of commercial viability.

We can see Disney contradict its journalistic integrity in its relationship with China. China’s box office is considered the largest market in the world, however, the Chinese Communist Party exerts strict control over the content it allows played in China and often censors films that do not meet the criteria of “telling China’s story well.” According to a report published by PEN America, “as U.S. film studios compete for the opportunity to access Chinese audiences, many are making difficult and troubling compromises on free expression.” In 2020, the release of the remake of Disney’s Mulan faced intense backlash and calls for a boycott after the leading actress expressed her support for Hong Kong police during protests. Additionally, audiences noticed that the movie’s credits thanked eight government entities in Xinjiang, the region in China where Uighur Muslims have been detained in mass internment camps. As Disney expands its Chinese business interests (such as its 47% stake in the new Shanghai Disneyland Park), it is possible that increased censorship in line with the wishes of the government in Beijing may further align with the company’s business goals. Additionally, while Disney’s ownership of cross-media entities is in line with regulation by the Federal Communications Commission (FCC), the company may face future regulatory risk, especially if it partakes in further consolidation.

Governance

Governance is the pillar of ESG that must be solid for a company to succeed in its sustainability goals, and we find that Disney presents governance risks despite having some strengths. The company’s board of directors is generally diverse, with four out of ten directors being women and three out of ten considered racially/ethnically diverse. Disney’s executive team is 42% female and 22% racially/ethnically diverse, the latter of which can use improvement. Disney’s sustainability report discloses to multiple frameworks including the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), CDP, and Task Force on Climate-related Financial Disclosure (TCFD). The company is generally considered to be highly transparent in its disclosure by ESG rating providers, however, the report offers no level of third-party assurance of the data.

Political lobbying, an important issue often left out of the governance section of ESG analysis, has been found to correlate with more than 3,600 corporate risk incidents worldwide over the past 13 years. Lobbying is connected to numerous ESG issues pertinent to investors’ financial decision-making, including corruption and bribery. We know that Disney has previously used its political clout and campaign contributions to secure tax incentives in Florida and California, the home of its expansive theme parks and studio entertainment hub, respectively. The company disclosed that it spent almost $39 million on federal lobbying from 2010 to 2019 but does not disclose state lobbying expenditures. A March 2021 shareholder proposal called for Disney to improve its disclosure of lobbying activity, however, the proposal was rejected by shareholders. It is notable that over two-thirds of Disney stock is owned by large institutional investors who take responsibility for proxy voting when clients purchase shares in a fund. Calls for Disney to disclose lobbying activity have been brought forward by activist shareholders before, and we expect to see it happen again.

Risk & Outlook

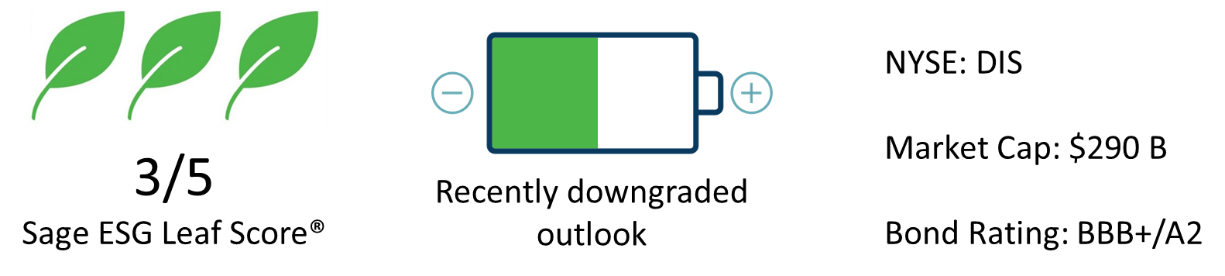

While Disney’s environmental progress is commendable, the company faces material ESG risk present in its social and governance activities due to past controversies and current behavior. Furthermore, we are not fully convinced that Disney’s net positive effects on society significantly outweigh its net negative effects. Corporate citizenship is important for building mutually beneficial relationships between organizations and the public, and as a company largely dependent on the intangible asset of brand value, it is crucial for Disney to prioritize its reputation as a corporate citizen. Overall, we’d like to see progress on the social and governance issues that really matter when it comes to Disney and will be watching for developments. We have decided to downgrade Disney from its previous Leaf Score of a 4 to a 3. We still consider Disney to be suitable for our ESG strategies, but no longer consider it an above average ESG performer.

Sage ESG Leaf Score Methodology

No two companies are alike. This is exceptionally apparent from an ESG perspective, where the challenge lies not only in assessing the differences between companies, but also in the differences across industries. Although a company may be a leader among its peer group, the industry in which it operates may expose it to risks that cannot be mitigated through company management. By combining an ESG macro industry risk analysis with a company-level sustainability evaluation, the Sage Leaf Score bridges this gap, enabling investors to quickly assess companies across industries. Our Sage Leaf Score, which is based on a 1 to 5 scale (with 5 leaves representing ESG leaders), makes it easy for investors to compare a company in, for example, the energy industry to a company in the technology industry, and to understand that all 5-leaf companies are leaders based on their individual company management and the level of industry risk that they face.

For more information on Sage’s Leaf Score, click here.

Sources

- 2020 Corporate Social Responsibility Report. The Walt Disney Company.

- Institutional Shareholder Services (ISS) ESG Corporate Rating Report for The Walt Disney Company.

- Fiscal Year 2020 Annual Financial Report. The Walt Disney Company.

- 2021 Notice of Annual Meeting of Shareholders and Proxy Statement. The Walt Disney Company.

- Media & Entertainment: Sustainability Accounting Standard. Sustainability Accounting Standards Board. 2018.

- BrandFinance Global 500 (100) 2021. Brand Finance. 2021.

- Dreier, Peter. Disney Is Not the Greatest Place on Earth to Work. The Nation. March 2020.

- Lobbying—the forgotten ESG risk? RepRisk. September 2020.

- Sanders, Bernie. How Corporate Media Threatens Our Democracy. In These Times. January 2017.

Disclosures

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. The information included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. This report is for informational purposes only and is not intended asinvestment adviceor an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sustainable investing limits the types and number of investment opportunities available, this may result in the Fund investing in securities or industry sectors that underperform the market as a whole or underperform other strategies screened for sustainable investing standards. No part of this Material may be produced in any form, or referred to in any other publication, without our express written permission. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.