Enterprise Products Partners L.P. EPD secures stable, fee-based income through long-term contracts with shippers who book its diverse midstream assets capacity, ensuring predictable cash flow. The midstream assets comprise above 50,000 miles of pipeline network and more than 300 million barrels of liquids storage properties. Space in these facilities is booked for storing and transporting oil, natural gas and energy products between producers and consumers.

These long-term contracts are inflation-protected, allowing the midstream player to raise fees to offset inflation-led higher costs and bring stability in its business model while generating predictable cash flow.

EPD expects to increase its predictable cash flow from key growth projects worth billions. Athena and Mentone West 2 are among the projects expected to be operational by the end of 2026.

With an inflation-resilient business model and additional cash flows expected from its project pipeline, EPD stands out as an attractive option for income investors.

KMI & WMB Have Stable Business Models Like EPD

Two other midstream players are Kinder Morgan Inc. KMI and The Williams Companies, Inc. WMB. KMI and WMB also generate stable, fee-based revenues by utilizing their assets under long-term contracts with shippers. KMI and WMB expect to increase their predictable cash flows through expansion projects, thereby bringing stability to their business models.

EPD’s Price Performance, Valuation & Estimates

Shares of Enterprise Products have gained 0.7% over the past year against the 1.1% decline registered by the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

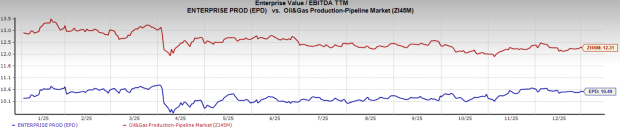

From a valuation standpoint, EPD trades at a trailing 12-month enterprise-value-to-EBITDA (EV/EBITDA) of 10. 49X, below the broader industry average of 12.31X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for EPD’s 2025 earnings has been unchanged over the past seven days.

Image Source: Zacks Investment Research

Enterprise Products currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWilliams Companies, Inc. (The) (WMB) : Free Stock Analysis Report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.