EnPro Industries, Inc. NPO yesterday completed the divestment of its business unit, Compressor Products International, Inc., for $195 million. The other party to the transaction was Glasgow, UK-based Howden Group.

The divestment deal was signed between the parties on Oct 12, 2021.

Yesterday, EnPro’s shares gained 2.63%, ending the trading session at $109.15.

Howden Group provides products for handling air and gas as well as related services. Product offerings include fans, heaters, compressors, blowers and steam turbines. It serves multiple industries, including cement, gas processing, marine, chemical, oil & gas, food and beverage, power generation, transportation, and specialty gases.

Inside the Headlines

The divested Compressor Products business provides products and related services for reciprocating compressors. The business serves customers in the oil & gas, and petrochemical industries. Before divestment, the business was part of EnPro’s Engineered Materials segment. The segment’s revenues totaled $234.2 million in the first nine months of 2021, marking an increase of 16.3% from the year-ago quarter.

Presently, EnPro’s Engineered Materials segment comprises Garlock Pipeline Technologies and GGB. While the former provides pipeline customers with mechanic solutions, the latter provides polymer-bearing solutions.

For EnPro, the divestment price of $195 million represents 10.4x adjusted LTM earnings before interest, tax, depreciation and amortization (EBITDA). It intends to utilize the net proceeds of $170 million from the divestment to lower debts and funding the buyout of NxEdge. The acquisition was completed this November for $850 million. (For more information on the buyout, please read: EnPro Industries’ NxEdge Buyout to Boost Its Prospects)

The divestment is in sync with EnPro’s initiatives to concentrate on businesses related to industrial technology. Its focus is mainly on improving operations in photonics, food and pharma, semiconductor, and aerospace industries.

In addition to the above-mentioned divestment, EnPro completed the divestment of its polymer components business to Edgewater Capital Partners in September 2021 and the bushing block business to Melma Group in December 2020. EnPro also sold STEMCO’s Air Springs business to an associate of Turnspire Capital Partners in November 2020.

EnPro divested Crewson brake adjuster and Motor Wheel brake drum businesses of the STEMCO division in September. The other party to the transaction was Hendrickson USA, LLC. In January, EnPro sold its Fairbanks Morse to private equity firm Arcline Investment Management.

Zacks Rank, Estimate Trend and Price Performance

EnPro presently has a market capitalization of $2.3 billion and a Zacks Rank #3 (Hold). It is poised to gain from buyouts and divestments, solid product offerings, and pricing actions. Cost inflation and supply-chain woes are concerning.

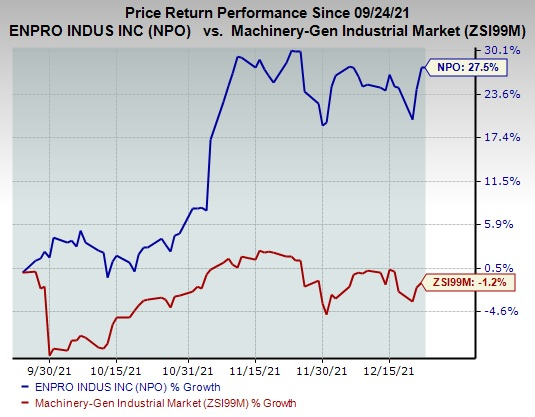

In the past three months, EnPro’s shares have gained 27.5% against the industry’s decline of 1.2%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for EnPro’s earnings is pegged at $5.48 for 2021 and $6.80 for 2022, reflecting growth of 0.2% and 12.8% from the respective 60-day-ago figures. The consensus estimate for the fourth quarter has decreased 5.7% to $1.15 during the same timeframe.

EnPro Industries Price and Consensus

EnPro Industries price-consensus-chart | EnPro Industries Quote

Stocks to Consider

Some better-ranked stocks in the Zacks Industrial Products sector are discussed below.

Helios Technologies, Inc. HLIO presently sports a Zacks Rank #1 (Strong Buy). Its earnings beat in the last reported quarter was 30.49%. The earnings beat in the last four quarters was 37.54%, on average.

You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, Helios’ earnings estimates have risen 7.9% for 2021 and 9.6% for 2022. HLIO’s shares have gained 13.9% in the past three months.

Ingersoll Rand Inc. IR reported better-than-expected results in the last reported quarter, with earnings surpassing estimates by 23.91%. Its earnings surprise in the last four quarters was 19.78%, on average. The company presently carries a Zacks Rank #2 (Buy).

Ingersoll’s earnings estimates have risen 11.7% for 2021 and 7.9% for 2022 in the past 60 days. IR’s shares have gained 15.7% in the past three months.

Applied Industrial Technologies, Inc.’s AIT results in the last reported quarter were impressive, with earnings surpassing estimates by 14.29%. Its last four-quarter average earnings surprise was 26.71%. The company presently carries a Zacks Rank #2.

Applied Industrial’s earnings estimates have been increased by 1.9% for fiscal 2022 (ending June 2022) and 2.2% for fiscal 2023 (ending June 2023) in the past 60 days. AIT’s shares have gained 13.6% in the past three months.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Ingersoll Rand Inc. (IR): Free Stock Analysis Report

EnPro Industries (NPO): Free Stock Analysis Report

Helios Technologies, Inc (HLIO): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.