Emerson Electric Co. EMR recently partnered with Prevalon Energy LLC to provide smarter and optimized energy systems for data centers worldwide. The partnership aims to improve energy solutions for data centers using both companies’ technologies.

Based in Heathrow, FL, Prevalon is a joint venture between Mitsubishi Power Americas and Energy Storage Solutions (“EES”). It is engaged in providing flexible, utility-scale battery energy storage products to companies seeking reliable and sustainable energy systems.

Inside the Headlines

Per the deal, Emerson will combine its Ovation Automation Platform with Prevalon’s HD5 Energy Storage Platform and insightOS Energy Management System. Through this collaboration, two companies will provide support to the colocation, hyperscale and enterprise data centers. The companies will also collaborate on providing marketing and customer support services to promote the use of advanced energy technologies for data centers.

The Emerson-Prevalon partnership will create an integrated system that improves grid stability and overall control for the data centers. With the combined automation and storage technologies, data centers can reduce energy waste, lower operating costs and react faster to changes like equipment issues or shifts in electricity prices. The collaboration aims to make energy systems more reliable, easier to manage and better suited for the increasing demands of modern data center operations.

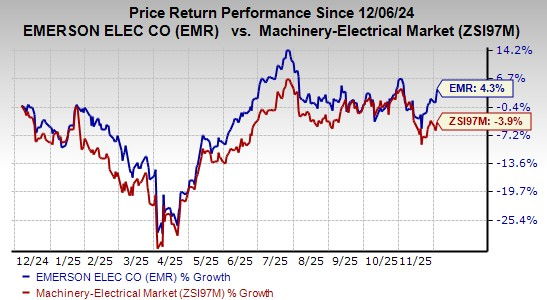

EMR’s Zacks Rank & Price Performance

EMR is benefiting from solid momentum in the Intelligent Devices and Software and Control segments. Strength in the power end markets is aiding the Final Control business. Robust growth across the Americas and Asia, Middle East & Africa regions bodes well for the Measurement & Analytical business.

The company currently carries a Zacks Rank #3 (Hold). In the past year, EMR’s shares have gained 4.3% against the industry’s 3.9% decline.

Image Source: Zacks Investment Research

However, softness across all geographies within the Safety & Productivity business is concerning for the company. Weakness across the Europe and China regions is hurting EMR’s Test & Measurement business.

Stocks to Consider

Some better-ranked companies are discussed below:

Crane Company CR currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CR delivered a trailing four-quarter average earnings surprise of 9.3%. In the past 60 days, the Zacks Consensus Estimate for Crane’s 2025 earnings has increased 2.9%.

Helios Technologies, Inc. HLIO presently sports a Zacks Rank of 1. HLIO delivered a trailing four-quarter average earnings surprise of 16.8%.

In the past 60 days, the consensus estimate for Helios’ 2025 earnings has increased 2.5%.

Dover Corporation DOV presently carries a Zacks Rank of 2. DOV delivered a trailing four-quarter average earnings surprise of 3.9%.

In the past 60 days, the consensus estimate for Dover’s 2025 earnings has increased 1.4%.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpEmerson Electric Co. (EMR) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Helios Technologies, Inc (HLIO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.