EMCOR Group, Inc. EME continues to deliver standout operating performance, and its record remaining performance obligations (RPOs) underscore the visibility supporting future growth. As of Sept. 30, 2025, EMCOR’s RPOs hit an all-time high of $12.61 billion, up nearly 29% year over year, reflecting sustained demand across data centers, healthcare, manufacturing and infrastructure-related markets.

The diversity in the company’s RPOs stretches across various market segments, with the networking and communications sector contributing about $4.3 billion (as of Sept. 30), and the healthcare sector contributing $1.3 billion. Owing to the Miller Electric acquisition, the healthcare sector’s RPOs witnessed nearly 7% growth year over year, with the manufacturing and industrial sector contributing about $1.1 billion to the RPOs. EME’s ability to win share through its multi-trade capabilities, prefabrication expertise and disciplined bidding approach is aiding in expanding the order book.

From a growth perspective, the record backlog provides meaningful revenue visibility into 2026 and beyond, supporting management’s confidence in sustaining above-industry margins. During the first nine months of 2025, the company posted 9.1% of operating margin, with 9.4% reported in the third quarter. For 2025, EME now expects operating margin in the range of 9.2% to 9.4% compared with the previous expectation of 9% to 9.4%.

That said, execution risks remain as rapid expansion into new geographies and large-scale data center projects can pressure labor productivity, as evidenced by some margin variability in newer markets. Nonetheless, EMCOR’s record RPO position appears more catalyst than concern. The combination of diversified demand, proven operational controls and strong financial flexibility positions the company well to convert backlog into profitable growth.

EMCOR’s Competitive Position

EMCOR stands out against Sterling Infrastructure, Inc. STRL and MYR Group Inc. MYRG through its broader multi-trade capabilities and deeper exposure to complex data center projects.

Sterling is heavily oriented toward civil and site-development work for data center campuses, benefiting early in project lifecycles when hyperscale customers are rapidly expanding footprints. However, this concentration makes Sterling more sensitive to project timing and lumpier backlog conversion. Conversely, MYR Group’s strength is electrical construction and transmission work tied to utilities and mission-critical facilities, including data centers. This narrower focus can drive strong performance during peak power and interconnection buildouts but exposes MYR Group to utility spending cycles and labor productivity risks.

Overall, EMCOR’s diversified, multi-trade model supports steadier execution and higher visibility compared with Sterling Infrastructure’s timing-driven growth and MYR Group’s electrical concentration.

EME Stock’s Price Performance & Valuation Trend

Shares of this Connecticut-based infrastructure service provider have gained 41.2% in the past year, underperforming the Zacks Building Products - Heavy Construction industry, but outperforming the broader Construction sector and the S&P 500 Index.

Image Source: Zacks Investment Research

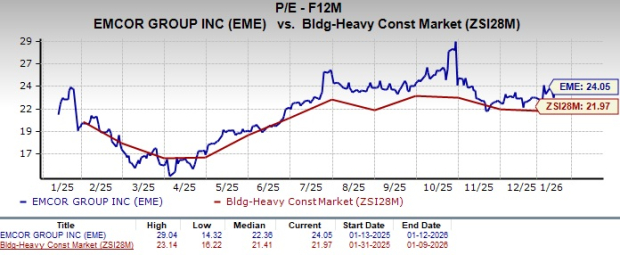

EME stock is currently trading at a premium compared with the industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 24.05, as evidenced by the chart below.

Image Source: Zacks Investment Research

Earnings Estimate Revision of EME

EME’s earnings estimates for 2025 and 2026 have remained unchanged in the past 60 days at $25.24 and $27.41 per share, respectively. However, the estimates for 2025 and 2026 imply year-over-year growth of 17.3% and 8.6%, respectively.

Image Source: Zacks Investment Research

EMCOR currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpEMCOR Group, Inc. (EME) : Free Stock Analysis Report

MYR Group, Inc. (MYRG) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.