The 2025 Q4 earnings season continues to chug along, with a wide selection of notable companies on the reporting docket, including several consumer-facing names like e.l.f. Beauty ELF and Estee Lauder EL.

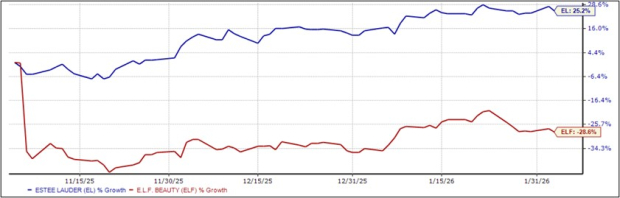

There has been quite a performance disparity between the pair over the past three months, as shown below.

Image Source: Zacks Investment Research

The performance disparity largely remains the same when zooming out to include the past year, with ELF shares down 4.4% compared to EL’s nearly 70% gain.

Will the gap widen even further post-earnings?

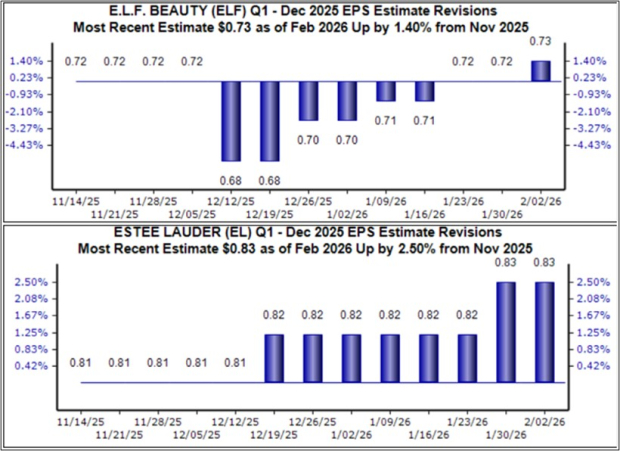

Quarterly Estimates

EPS revisions for both companies have been largely positive over recent months, as shown below. The Zacks Consensus EPS estimate of $0.83 for Estee Lauder suggests 33% year-over-year growth, whereas the $0.73 per share estimate for EL reflects a 1.2% decline from the year-ago period.

Image Source: Zacks Investment Research

Sales revisions for both companies have also been positive, though ELF has seen a tad more positivity. ELF’s sales are forecasted to grow 30% YoY, whereas EL is expected to see its top-line expand 5% from the year-ago period.

Image Source: Zacks Investment Research

While the profitability picture for Estee Lauder remains much more constructive, e.l.f. Beauty is expected to see stronger sales growth, though the lack of negative revisions on both fronts for both companies remains a positive heading into both releases.

Keep in mind that Estee Lauder is a current Zacks Rank #2 (Buy), whereas e.l.f. Beauty currently ranks as a Zacks Rank #3 (Hold).

Factors Driving Recent Performance

Quarterly results haven’t been enough to perk ELF shares up over recent periods, with a growth cooldown driving the negative sentiment.

The growth cooldown can be seen in the chart below, where the values tracked reflect the YoY % change in sales. Please note that these are not actual sales numbers.

Image Source: Zacks Investment Research

While sales growth has remained broadly strong for ELF, the cooldown has been the bigger story here, helping explain the weak performance relative to Estee Lauder.

In addition, the margins picture for Estee Lauder has remained more constructive relative to ELF over recent periods, as shown in the chart below, which tracks gross margins on a trailing twelve-month basis. This supports the stronger profitability picture for EL, owing to management’s execution.

Image Source: Zacks Investment Research

Which is Better?

In addition to its current favorable Zacks Rank and stronger margin performance, Estee Lauder has greater exposure across a wider range of beauty categories than ELF, providing a more ‘defensive’ and balanced business overall. ELF has largely been a high-growth play in primarily the makeup category, which also helps explain its more volatile nature.

Both upcoming earnings releases will nonetheless give us a much stronger feel for the state of the consumer, with both companies’ products carrying a ‘staply’ nature. The diversification and more balanced product portfolio of Estee Lauder EL gives it a decent edge over e.l.f. Beauty ELF, with a more favorable Zacks Rank also a notable positive. EL shares also pay a dividend, currently yielding 1.2% annually vs. the S&P 500’s current 1.1% annual yield.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.