Fintel reports that on May 12, 2023, EF Hutton reiterated coverage of BioAtla (NASDAQ:BCAB) with a Buy recommendation.

Analyst Price Forecast Suggests 316.89% Upside

As of May 11, 2023, the average one-year price target for BioAtla is 15.30. The forecasts range from a low of 8.08 to a high of $26.25. The average price target represents an increase of 316.89% from its latest reported closing price of 3.67.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for BioAtla is 4MM, an increase of ∞%. The projected annual non-GAAP EPS is -2.84.

What is the Fund Sentiment?

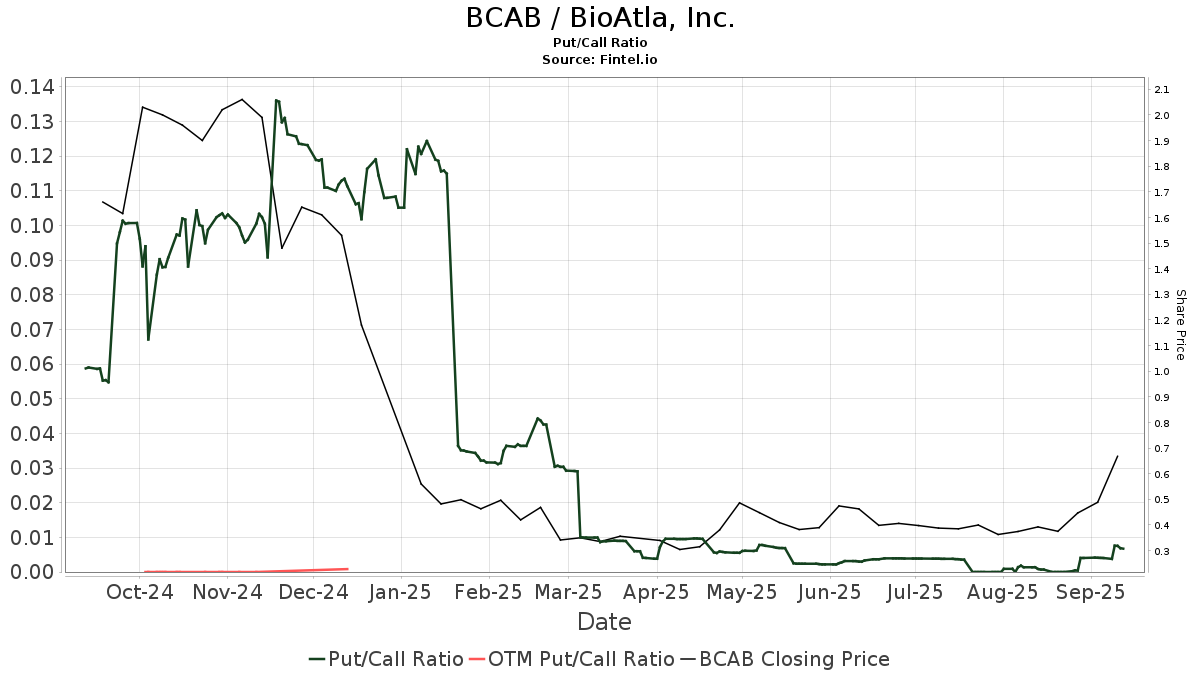

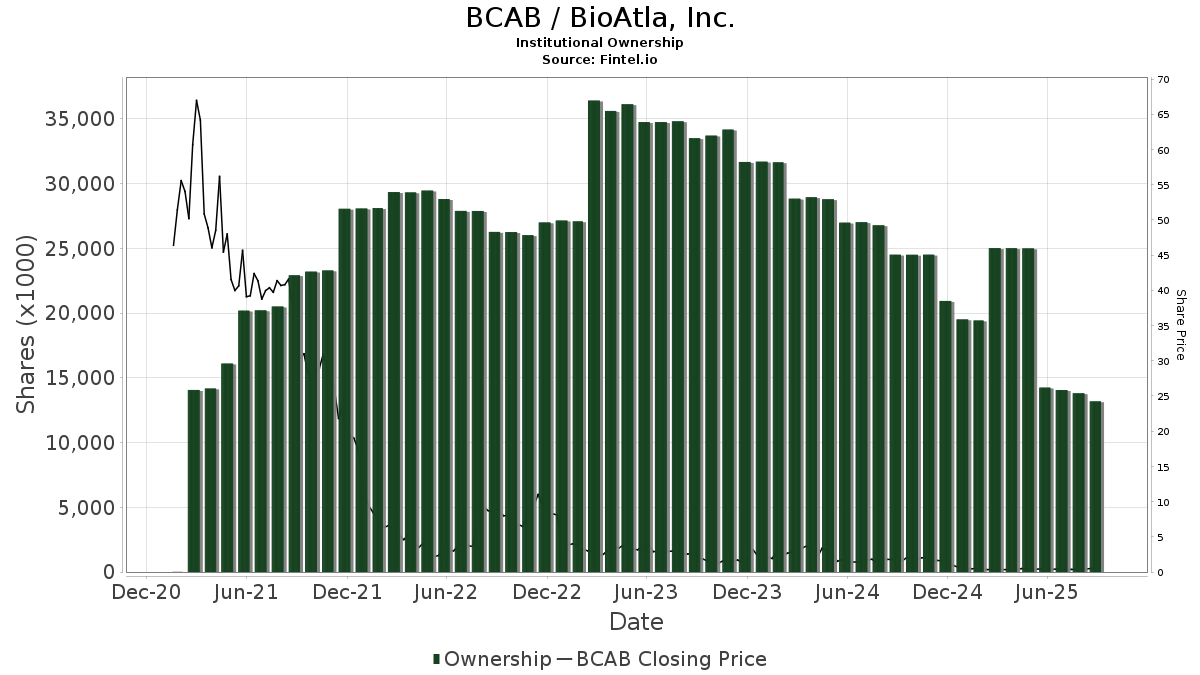

There are 153 funds or institutions reporting positions in BioAtla. This is an increase of 21 owner(s) or 15.91% in the last quarter. Average portfolio weight of all funds dedicated to BCAB is 0.15%, an increase of 20.55%. Total shares owned by institutions increased in the last three months by 30.15% to 36,582K shares.  The put/call ratio of BCAB is 0.19, indicating a bullish outlook.

The put/call ratio of BCAB is 0.19, indicating a bullish outlook.

What are Other Shareholders Doing?

Soleus Capital Management holds 4,220K shares representing 8.86% ownership of the company. In it's prior filing, the firm reported owning 3,401K shares, representing an increase of 19.43%. The firm increased its portfolio allocation in BCAB by 40.40% over the last quarter.

Cormorant Asset Management holds 3,680K shares representing 7.73% ownership of the company. In it's prior filing, the firm reported owning 2,181K shares, representing an increase of 40.74%. The firm increased its portfolio allocation in BCAB by 73.07% over the last quarter.

Tang Capital Management holds 3,124K shares representing 6.56% ownership of the company. In it's prior filing, the firm reported owning 1,967K shares, representing an increase of 37.04%. The firm increased its portfolio allocation in BCAB by 101.59% over the last quarter.

Janus Henderson Group holds 1,983K shares representing 4.16% ownership of the company. In it's prior filing, the firm reported owning 2,175K shares, representing a decrease of 9.68%. The firm decreased its portfolio allocation in BCAB by 67.37% over the last quarter.

Adage Capital Partners Gp, L.l.c. holds 1,750K shares representing 3.67% ownership of the company.

BioAtla Background Information

(This description is provided by the company.)

BioAtla® is a San Diego biotech company that develops novel monoclonal antibody and cell based therapeutics using our proprietary Conditionally Active Biologics™ (CAB) and Comprehensive Integrated Antibody Optimization (CIAO!™) platforms. These and other proprietary technologies (protected by more than 150 issued patents and patent applications) allow it to develop novel biologics (CABs) that are better drugs in multiple ways including more selective targeting of cancer tissue and improved manufacturability. Improved selectivity for the tumor microenvironment (TME), even when the target is also found in normal tissue, not only improves safety and thus therapeutic index but also expands the universe of potential drug targets, enabling the treatment of previously untreatable cancers.

See all BioAtla regulatory filings.This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.