Edwards Lifesciences Corporation EW announced its decision to acquire Innovalve Bio Medical Ltd., an early-stage transcatheter mitral valve replacement (TMVR) company. This follows Edwards Lifescience's initial investment in Innovalve in 2017, following which Innovalve has shown progress and early clinical success. The acquisition is set to bolster Edwards Lifesciences’ existing mitral innovations, providing advanced TMVR solutions to address significant unmet needs in structural heart disease.

Significance of the Acquisition

Per Edwards Lifesciences, the acquisition of Innovalve Bio Medical Ltd is a strategic move to enhance the company’s TMVR technologies. By integrating Innovalve's promising technologies with EW’s existing expertise in mitral valve disease, the company aims to develop a differentiated range of therapies for patients with complex mitral conditions. The acquisition underscores EW's commitment to transforming the treatment landscape for mitral and tricuspid valve diseases, backed by robust clinical evidence and innovation.

This merger will also support Edwards Lifesciences’ long-term growth and expand the treatable population, particularly as the SAPIEN M3 system, an investigational device for treating mitral valve disease, is likely to gain regulatory approval in Europe by the end of 2025. The company has completed enrollment in the pivotal trial for the SAPIEN M3 system. This system, limited to investigational use by U.S. law, promises advancements in mitral valve treatment.

Edward Lifesciences plans to spend approximately $300 million in cash to complete the acquisition, which is expected to be closed by the end of 2024.

Industry Prospects

Per a report by Zion Market Research, the global transcatheter heart valve replacement market is expected to be worth $5.65 billion in 2022. It is anticipated to reach $10.48 billion by the end of 2030 at a CAGR of 7.97%

The growth will likely be aided by an increase in the number of patients suffering from several cardiovascular diseases, growing investments in the healthcare sector and technological advancements in the transcatheter aortic valve replacement procedure. Furthermore, the growing adoption of minimally invasive surgery to reduce the duration of hospital stay and healthcare expenditure is projected to fuel the growth of theglobal market The constantly growing geriatric population, coupled with the increasing incidences of heart valve diseases, will drive market growth during the forecast period.

Recent Developments

In a separate deal announced on Friday, Edwards Lifesciences will pay 15 million euros (about $16.3 million) for a stake in France’s Affluent Medical and access to its technologies. This agreement includes an exclusive option to buy Affluent's mitral ring subsidiary and a global license for its biomimetic mitral valve replacement technology. With 5 million euros of the total payment, Edwards Lifesciences will gain a 9.21% equity position in Affluent.

In May, Edwards Lifesciences announced the European launch of the SAPIEN 3 Ultra RESILIA valve, marking it as the only transcatheter aortic heart valve to incorporate the innovative RESILIA tissue technology. This breakthrough technology is designed to extend the valve's durability, enhancing the treatment of heart valve disease. The SAPIEN 3 Ultra RESILIA valve recently received CE Mark approval for use in patients with native calcific aortic stenosis at all levels of surgical risk and for those at high or greater risk for open surgical therapy due to the failure of either a transcatheter or surgical bioprosthetic valve.

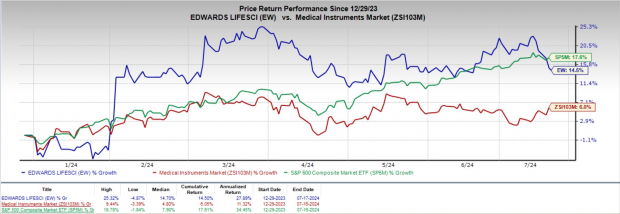

Price Performance

Shares of Edwards Lifesciences have increased 14.5% so far this year compared with the industry's 6% rise. The S&P 500 has witnessed a 17.6% rise in the same time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Edwards Lifesciences carries a Zacks Rank #4 (Sell).

Some top-ranked stocks in the broader medical space are Quest Diagnostics DGX, Universal Health Services UHS and Haemonetics HAE, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quest Diagnostics has an estimated long-term growth rate of 5.20%. DGX’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 3.67%.

Quest Diagnostics shares have gained 3.2% compared with the industry’s 10.9% rise so far this year.

Universal Health Services has an estimated long-term growth rate of 15.20%. UHS’ earnings surpassed estimates in each of the trailing four quarters, with the average being 8.12%.

Universal Health Services has gained 17.5% compared with the industry's 10.2% rise so far this year.

Haemonetics has an estimated long-term growth rate of 12.00%. HAE’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 13.24%.

Haemonetics’ shares have increased 7.1% compared with the industry's 3.2% rise so far this year.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%... an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.