Eastman Chemical Company EMN logged second-quarter 2025 earnings of $1.20 per share, a roughly 38% decline from the year-ago quarter's figure of $1.94.

EMN posted adjusted earnings of $1.60 per share, down from the year-ago quarter figure of $2.15. It lagged the Zacks Consensus Estimate of $1.72.

The company’s revenues in the second quarter were $2,287 million, down around 3% year over year. It missed the Zacks Consensus Estimate of $2,289.9 million.

EMN faced significant challenges in the second quarter and only saw a modest sign of seasonal improvement across its end markets. It took actions to mitigate the economic impact of the increased level of tariffs through continued commercial excellence and supply-chain initiatives.

Eastman Chemical Company Price, Consensus and EPS Surprise

Eastman Chemical Company price-consensus-eps-surprise-chart | Eastman Chemical Company Quote

EMN’s Segment Highlights

Advanced Materials: Sales from the segment fell 2% year over year to $777 million in the reported quarter. The figure beat our estimate of $770 million. Sales revenues declined due to lower sales volume and mix resulting from weak demand in key end markets.

Additives & Functional Products: Sales from the segment were $769 million, reflecting an upside of 7% from the year-ago quarter. The figure topped our estimate of $732 million. Sales were driven by higher selling prices, improved sales volume and mix, and favorable foreign currency exchange fluctuations.

Chemical Intermediaries: Sales from the segment were down 10% year over year to $463 million. The figure missed our estimate of $529 million. Sales declined due to lower sales volume and mix and reduced selling prices.

Fibers: The segment reported sales of $274 million, down 17% year over year. The figure beat our estimate of $252 million. Sales declined primarily due to lower sales volume and mix.

EMN’s Financials

The company ended the quarter with cash and cash equivalents of $423 million. Net debt was $4,703 million.

Cash provided by operating activities was $233 million, down around 37% year over year. EMN

returned $145 million to shareholders through dividends and share repurchases in the reported quarter.

EMN’s Guidance

EMN noted that it is seeing a challenging global macroeconomic environment entering the second half. Customers are increasingly cautious due to a changing tariff environment and soft demand. The company expects to gain from the ramp-up of cost-reduction initiatives and higher revenues from its Kingsport methanolysis facility.

EMN sees third-quarter adjusted earnings to be roughly $1.25 per share. It also expects to generate an operating cash flow of around $1 billion for the full year.

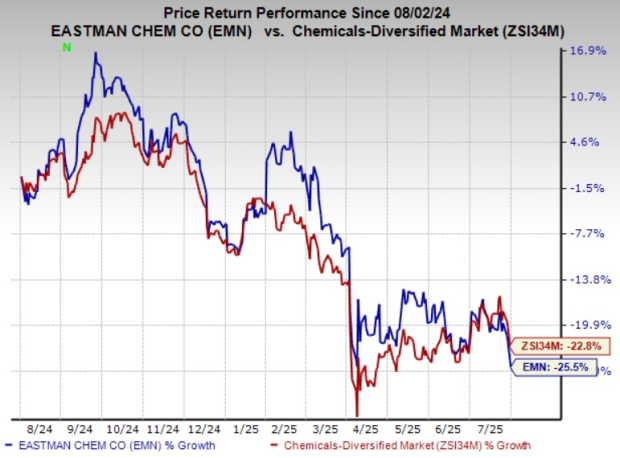

EMN’s Price Performance

EMN’s shares are down 25.5% over a year compared with a 22.8% decline recorded by the Zacks Chemicals Diversified industry.

Image Source: Zacks Investment Research

EMN’s Zacks Rank & Key Picks

EMN currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks worth a look in the basic materials space include Royal Gold, Inc. RGLD, Avino Silver & Gold Mines Ltd. ASM and Barrick Mining Corporation B.

Royal Gold is slated to report second-quarter results on Aug 6. The Zacks Consensus Estimate for earnings is pegged at $1.70. RGLD beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 9%. RGLD carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Avino Silver is scheduled to report second-quarter results on Aug 13. The Zacks Consensus Estimate for ASM’s second-quarter earnings is pegged at 3 cents. ASM beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 104.2%. ASM currently carries a Zacks Rank #1.

Barrick Mining is slated to report second-quarter results on Aug 11. The consensus estimate for Barrick’s earnings is pegged at 47 cents. Barrick, carrying a Zacks Rank #1, beat the consensus estimate in three of the last four quarters, with the average earnings surprise being 12.5%.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpEastman Chemical Company (EMN) : Free Stock Analysis Report

Barrick Mining Corporation (B) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Avino Silver (ASM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.