DTE Energy DTE recently revealed that it has joined forces with multimodal transportation network provider, Lyft, to offer incentives to drivers who will buy or lease an electric vehicle (EV). Per the terms, drivers will get the incentive only if the EV is used on the Lyft network.

The DTE Lyft partner program is currently open and eligible drivers residing in the DTE Electric service territory can apply up to Sep 30, 2022.

Benefits of the Partnership

Under the DTE Lyft partnership, administered through DTE Energy’s Charging Forward program, drivers will get $2,000 of the incentive as a rebate for the purchase or lease of an EV, once they apply and get accepted into the program.

Next, they will receive four equal quarterly payments of $750, provided they complete 200 rides per quarter. So, the total rebate that a driver on the Lyft network can get by adopting an EV is $5,000.

To this end, it is imperative to mention that 60% of Lyft rides start or end in low-income areas, per the 2022 Economic Impact Report for Detroit. In addition, a University of Michigan research project has identified that approximately 2,000 drivers in Metro Detroit could save up to $4,000 a year in fuel and maintenance fees by switching to an EV.

Considering these, the DTE Lyft partnership provides drivers in low-income areas an added incentive to drive an EV, thereby bringing more clean energy to Southeast Michigan. Also, the partnership will support Lyft in achieving its goal of 100% EVs on its network by 2030.

DTE’s EV Adoption

DTE Energy’s Charging Forward is a five-year EV charging program, which received the Michigan Public Service Commission’s authorization to offer charger rebates, in 2021. The program promotes the transition to eFleets and helps integrate charger load efficiently with the DTE Electric distribution system.

It also offers a variety of services that include a customized roadmap for customers to electrify their fleets. DTE Energy is investing more than $1 billion annually to improve electric reliability and help build the grid of the future with increased capacity for growing EV adoption.

Growing EV Market Prospects & Utilities

The Edison Electric Institute estimates that more than 100,000 EV fast-charging ports will be needed to support 22 million EVs that are projected to be on U.S. roads in 2030. Naturally, utility companies like DTE Energy — which is capable of constructing safe and reliable charging ports — are leading this transition. The latest partnership between DTE Energy and Lyft is a testament to that.

Other utilities that are leading the EV market growth include CMS Energy CMS, Ameren Corp. AEE and PG&E Corp. PCG. CMS Energy’s subsidiary, Consumers Energy is accelerating Michigan's electric vehicle transformation, committing to powering an additional 200 new EV charging stations across the state — including 100 fast chargers — by 2023-end. This is part of Consumers Energy's commitment to powering 1 million EVs in the communities it serves by 2030.

CMS Energy boasts a long-term earnings growth rate of 9.2%. The Zacks Consensus Estimate for CMS’ 2022 earnings indicates an 8.7% improvement from 2021’s reported figure.

Ameren aims for 100% of its new light-duty vehicle purchases to be electric by 2030. The company also aims to electrify 35% of the overall vehicle fleet — including light-duty, medium-duty, heavy-duty, forklifts and ATV/UTV — by 2030.

Ameren boasts a long-term earnings growth rate of 7.2%. The consensus estimate for AEE’s 2022 earnings suggests a 5.5% improvement from 2021’s reported figure.

In 2021, PG&E Corp. installed approximately 5,000 charging ports for EVs at workplaces and multi-family dwellings, including the installation of 39% of these charging ports in disadvantaged communities. More than 360,000 EVs are currently registered in the company’s service area, representing nearly 20% of all EVs in the country.

PG&E Corp. boasts a long-term earnings growth rate of 2.5%. The consensus estimate for PCG’s 2022 earnings implies a 0.9% improvement from 2021’s reported figure.

Price Movement

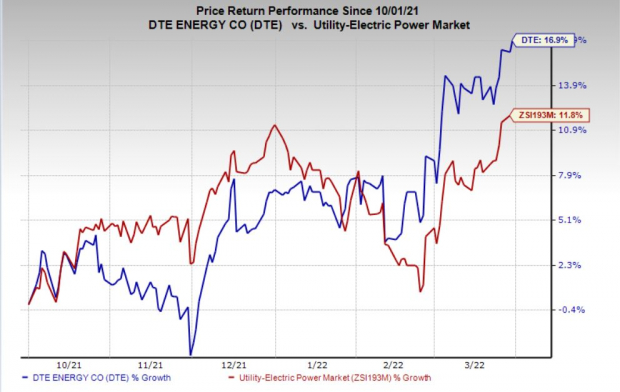

In the past six months, DTE Energy’s shares have rallied 16.9% compared with the industry’s growth of 11.8%.

Image Source: Zacks Investment Research

Zacks Rank

DTE Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the Zacks Top 10 Stocks portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE): Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

CMS Energy Corporation (CMS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.