Stocks remained volatile this triple-witching Friday, ultimately closing mixed. Investors continued to monitor the Israel-Iran conflict, after President Trump paused his decision on the U.S.' involvement by two weeks. Also in focus is Fed interest rate rhetoric, as well as the semiconductor sector slide, which came after news the U.S. may revoke previously awarded waivers to manufacturers overseas.

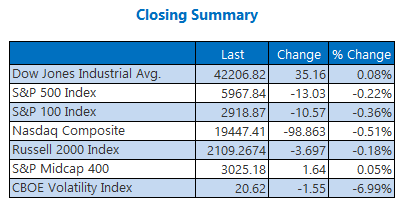

The Dow finished the day modestly higher, while the Nasdaq dropped 98 points, with both managing to eke out weekly wins. The S&P 500, meanwhile, marked its third-straight daily loss and settled into the red for the week.

Continue reading for more on today's market, including:

- Which stocks made big moves this past week.

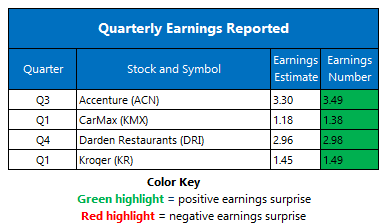

- CarMax stock popped after strong quarter.

- Plus, behind GMS' surge; and two stocks rising after upbeat earnings.

5 Things to Know Today

- U.K. parliament voted in favor of assisted dying, with the bill now headed to the House of Lords. (Reuters)

- Meta Platforms (META) is making several efforts to bolster its artificial intelligence (AI) efforts, including reportedly approaching startup Perplexity. (CNBC)

- Bidding war began for homebuilding name GMS.

- Olive Garden parent hit record high after earnings.

- Stocks posing interesting technical setups right now.

Oil Rises for the Week

Oil prices moved quietly today, still finishing sharply higher on the week. July-dated West Texas Intermediate (WTI) crude rose 4 cents to $75.18 per barrel today.

Bullion notched a weekly loss. For the day, U.S. gold futures settled 0.7% lower to $3,385.70.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.