The U.S. infrastructure construction landscape continues to benefit from sustained public and private investment, as demand remains resilient across transportation, utilities, energy infrastructure and mission-critical development. Sterling Infrastructure, Inc. STRL operates within this supportive environment, which is being further reinforced by easing financial conditions following recent monetary policy shifts, improving the outlook for long-dated capital projects. As funding visibility improves, contractors with diversified exposure and strong project pipelines are better positioned to convert opportunity into execution.

Against this backdrop, backlog strength has become a central indicator of operational visibility. Sterling’s backlog and broader pipeline increasingly provide a clear line of sight into activity levels beyond the near term, supporting confidence around execution heading into 2026. The company’s exposure to large, complex, multi-phase projects across E-Infrastructure, manufacturing, data centers, and e-commerce has enhanced both workload durability and planning efficiency.

In the third quarter of 2025, Sterling reported a signed backlog of approximately $2.6 billion, representing a 64% year-over-year increase. Importantly, this figure understates the full scope of visibility. When combined with negotiated but unsigned awards and future phases tied to ongoing megaprojects, total potential work now exceeds $4 billion. E-Infrastructure represents the majority of this pipeline, reflecting sustained demand for mission-critical developments that typically extend over multiple years and phases.

This depth of backlog supports more than revenue visibility alone. The company highlighted that the scale and complexity of current projects allow for improved labor planning, equipment utilization and sequencing of work, all of which are critical for consistent execution. Additionally, long-term customer planning and committed capital spending, particularly from large enterprise clients, further reduce uncertainty around project timing.

The Federal Reserve’s decision to cut interest rates by 25 basis points for the third time this year on Dec. 10, 2025, bringing the benchmark rate to a 3.5%-3.75% range, could further support infrastructure investment. With the potential for another rate cut in 2026, Sterling’s backlog-driven visibility positions the company to sustain momentum and execute efficiently into the next cycle.

STRL’s Price Performance, Valuation and Estimates

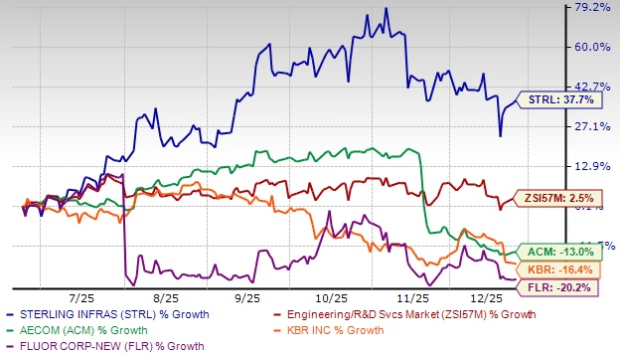

Shares of this Texas-based infrastructure services provider have surged 37.7% in the past six months, outperforming the Zacks Engineering - R and D Services industry’s 2.5% growth. In the same time frame, other industry players like AECOM ACM, Fluor Corporation FLR and KBR, Inc. KBR have declined 13%, 20.2% and 16.4%, respectively.

Image Source: Zacks Investment Research

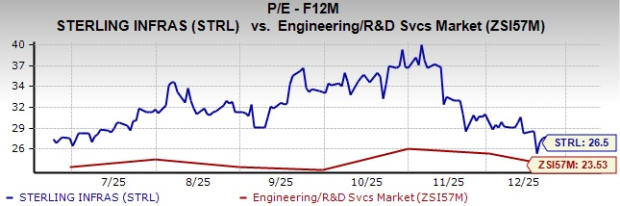

STRL stock is currently trading at a premium compared with its industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 26.5, as shown in the chart below.

Image Source: Zacks Investment Research

Conversely, industry players, such as AECOM, Fluor and KBR, have P/E multiples of 17, 18.22 and 9.61, respectively.

For 2026, estimates for STRL’s earnings have increased in the past 60 days to $11.95 from $10.98 per share. The revised estimated figures indicate 14.6% year-over-year growth.

Image Source: Zacks Investment Research

The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>Fluor Corporation (FLR) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.