Comfort Systems USA, Inc. FIX benefits from a favorable alignment of operational momentum, end-market demand and disciplined financial execution that is reinforcing its financial stability. Increased opportunities across large-scale projects, particularly those tied to data center and chip manufacturing-related activities, are supporting business confidence. A constructive public spending environment, combined with declining Federal Reserve interest rates, is further improving customer funding visibility. Despite lingering macro uncertainty around tariffs and housing market softness, the company’s inorganic efforts, alongside a stable liquidity position, continue to underpin its mid and long-term prospects.

In the third quarter of 2025, Comfort Systems ended the period with cash and cash equivalents of $860.5 million, up from $549.9 million as of 2024, reflecting the combined impact of operating leverage and favorable market trends. In the first nine months of 2025, cash provided by operating activities totaled $717.8 million compared with $638.6 million in the year-ago period, highlighting strong earnings quality and effective working capital management. The company also maintained sufficient liquidity to meet short-term obligations of $4.7 million, underscoring balance sheet resilience.

Beyond maintaining a stable liquidity profile, disciplined capital deployment has remained evident. In the first nine months of 2025, the company repurchased approximately 0.3 million shares for about $125 million. Additionally, on Oct. 23, 2025, the board approved a 20% increase in the quarterly dividend to 60 cents per share. Overall, Comfort Systems’ cash strength meaningfully reinforces financial stability, providing flexibility to navigate uncertainty while supporting sustained growth.

Several structural and operational factors have contributed to this cash strength beyond headline revenue growth. Consistent project execution, selective bidding practices, favorable pricing dynamics and disciplined cost control have supported margin durability and reliable cash conversion. Strong collaboration across operating units and ongoing investments in automation have enhanced productivity and execution efficiency. Bookings remain exceptionally strong across both traditional construction and modular operations, with modular demand fully sold out into early 2026, aided by expanded capacity and new automation initiatives.

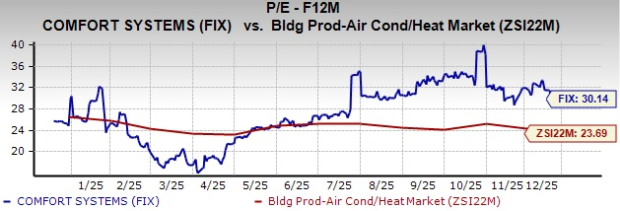

FIX’s Price Performance vs. Other Market Players

Shares of Comfort Systems have gained 11.8% in the past three months against the Zacks Building Products - Air Conditioner and Heating industry’s 4.4% fall. In the same time frame, shares of other industry players, such as Watsco, Inc. WSO, Tecogen Inc. TGEN and AAON, Inc. AAON have declined 11%, 48.1% and 19.7%, respectively.

Price Performance

Image Source: Zacks Investment Research

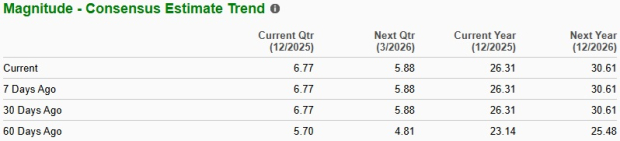

Comfort Systems’ Valuation Trend

From a valuation standpoint, FIX trades at a forward 12-month price-to-earnings ratio of 30.14X, up from the industry’s 23.69X.

Image Source: Zacks Investment Research

EPS Trend of FIX

Comfort Systems’ earnings estimate for 2026 have trended upward in the past 60 days to $30.61 from $25.48 per share. The estimated figure for 2026 indicates 16.4% year-over-year growth.

Image Source: Zacks Investment Research

Comfort Systems currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWatsco, Inc. (WSO) : Free Stock Analysis Report

AAON, Inc. (AAON) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Tecogen Inc. (TGEN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.