Comfort Systems USA, Inc. FIX benefits from a supportive demand environment that is improving long-term revenue visibility. The company operates in markets linked to infrastructure, technology and institutional spending, where project activity remains healthy. Elevated public infrastructure spending, backed by several federal and state initiatives, is supporting market confidence. At the same time, private-sector investment in technology advancement, digital innovation and sustainable alternatives is creating steady opportunities. This environment is helping Comfort Systems maintain a solid project pipeline and supports expectations for steady growth into 2026.

Comfort Systems is witnessing incremental growth driven by broad-based strength across technology, industrial and institutional markets. Data centers remain the primary growth driver. The company has a high concentration of work tied to hyperscale data centers, AI facilities and advanced manufacturing projects. This positioning stands out among U.S. MEP contractors and supports robust demand under favorable industry conditions.

In the third quarter of 2025, backlog visibility improved meaningfully as demand translated into stronger bookings. Backlog reached $9.38 billion, reflecting growth of 65% year over year from $5.68 billion and a sequential increase of 15.5%. The expansion highlights sustained customer demand across key end markets and improves confidence in future revenue flow.

Comfort Systems recorded a second consecutive same-store backlog increase of more than $1 billion despite significant project execution. The company continued to book work with favorable margins and solid working conditions. Entering the fourth quarter of 2025, backlog stood at $3.7 billion, higher than the prior year, reinforcing revenue visibility into 2026.

Overall, the size, mix and growth of backlog indicate that Comfort Systems is well positioned to support steady growth in 2026, supported by strong end-market demand, disciplined execution and favorable industry fundamentals.

Peer Backlogs Reinforce Revenue Visibility

Rising infrastructure and data center investment is also strengthening revenue visibility for Comfort Systems’ peers, particularly Quanta Services, Inc. PWR and Sterling Infrastructure, Inc. STRL. Both companies are benefiting from expanding project pipelines tied to power, grid modernization and mission-critical development.

Quanta continues to see demand momentum build as it supports essential power, transmission and grid infrastructure across the United States. In the third quarter of 2025, the company reported a record backlog of $39.2 billion, up from $33.96 billion a year ago, reflecting strong visibility across generation, battery storage, transmission and underground projects. This diversified mix of utility services and large-scale programs provides a long execution runway heading into 2026.

Sterling is similarly enhancing forward visibility through its exposure to large, multi-phase projects. In the third quarter of 2025, the company reported a signed backlog of roughly $2.6 billion, up 64% year over year, with total potential work exceeding $4 billion when including future phases. Its E-Infrastructure focus supports durable, long-term activity.

FIX Stock’s Price Performance & Valuation Trend

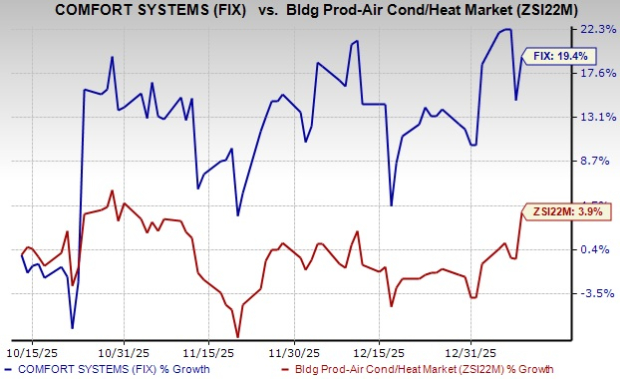

Shares of Comfort Systems have gained 19.4% in the past three months compared with Zacks Building Products - Air Conditioner and Heating industry’s 3.9% rise.

Image Source: Zacks Investment Research

From a valuation standpoint, FIX trades at a forward 12-month price-to-earnings ratio of 33.03, up from the industry’s 25.09.

Image Source: Zacks Investment Research

EPS Trend of FIX

Estimates for Comfort Systems’ 2026 earnings have remained unchanged in the past 60 days at $30.61 per share. The estimated figure for 2026 indicates 16.4% year-over-year growth.

Image Source: Zacks Investment Research

Comfort Systems currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.