Coherent Corp.’s COHR ability to capture the growing AI markets is at the apex of its growth strategy. The company’s keen interest in AI and datacom is yielding results, as evidenced by a 23% year-over-year increase in its AI datacenter business in the first quarter of fiscal 2026.

COHR registered a high demand for its products, which grew sharply due to direct bookings. Per James Anderson, CEO, the company witnessed the broad adoption of 800G, whereas 1.6T transceivers were adopted rapidly. Banking on this heightened demand, Anderson anticipates the demand for these products to grow exponentially in 2026.

On the Indium Phosphide (InP) production front, which is crucial in next-gen AI infrastructure, Coherent registered a higher yield of the 6-inch InP than the 3-inch ones. It highlights the robust experience gained by the production team over the past five years in manufacturing 2 billion VSCEL devices on its 6-inch gallium arsenide technology. The company has started the production of 6-inch InP in Jarfalla, Sweden, to cater to its rising demand, which we anticipate will grow with increasing AI demand.

Optical Circuit Switch, another product in COHR’s arsenal, is vital for the AI datacenter. Per management, this product adds more than $2 billion in addressable market opportunity in the long run. Coherent’s diverse product portfolio addresses the AI market directly.

Per Grand View Research, the global AI market size is expected to see a CAGR of 30.6% through 2033. With the rising adoption of this technology, we expect Coherent’s demand to climb further in the long run, making it an investor-favorite.

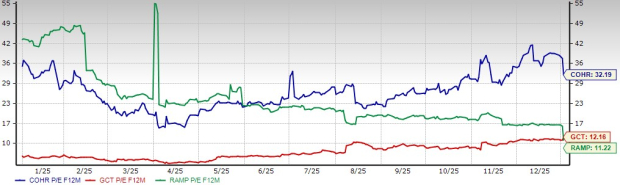

COHR’s Price Performance, Valuation & Estimates

Coherent stock has surged 73.7% in a year against the industry’s 14% growth. COHR’s industry peer LiveRamp RAMP has lost 3.6%, while GigaCloud Technology GCT has skyrocketed 100.5% in a year.

1-Year Share Price Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

From a valuation perspective, COHR trades at a forward 12-month price-to-earnings ratio of 32.19X, higher than LiveRamp’s and GigaCloud Technology’s 11.22 and 12.16, respectively.

P/E - F12M

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Coherent has a Value Score of D. LiveRamp and GigaCloud Technology carry a Value Score of C and A, respectively.

The Zacks Consensus Estimate for COHR’s earnings for 2026 and 2027 has increased 11.4% and 5.1%, respectively, over the past 60 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

COHR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Coherent Corp. (COHR) : Free Stock Analysis Report

LiveRamp Holdings, Inc. (RAMP) : Free Stock Analysis Report

GigaCloud Technology Inc. (GCT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.