Few companies saw as rapid adoption during the COVID-19 pandemic as DocuSign (NASDAQ: DOCU) after meeting in person to sign documents quickly became a thing of the past. Since the company's software isn't as necessary now, signing new customers on has become increasingly difficult. However, DocuSign has a large client base that isn't leaving its platform, and if it can get those customers to expand their spending, it could still be a worthwhile stock to own.

So should you own DocuSign stock, or is it time to move on? Let's break down the bull and bear case for DocuSign and find out.

Bull case: Enterprise customers could drive demand

DocuSign has a massive customer base of 1.36 million clients. Of those, it considers 211,000 of them enterprise and commercial customers, with 1,080 spending more than $300,000 annually. If DocuSign can launch a product or feature that is a game changer, a significant cohort would likely adopt it, providing a sizable boost to the company's revenue.

DocuSign's primary focus right now is eSignature add-ons and contract lifecycle management. If the business can get existing customers to add items like identity verification or notarization, plus manage contract workflows before and after the agreements are signed, DocuSign could have significant room for revenue growth left.

While revenue isn't growing at the speeds it was one year ago, it still rose a respectable 13% to $739 million in Q4 of fiscal 2023 (ended Jan. 31). Another positive is that 98% of DocuSign's revenue is subscription-based, providing some continuity and reliability of sales.

The company is also expanding internationally, with segments outside the U.S. growing 19% in the fourth quarter and international revenue making up 25% of the total. As DocuSign attempts to capture eight key markets, this expansion will be worth watching because a significant amount of business is done outside of U.S. borders.

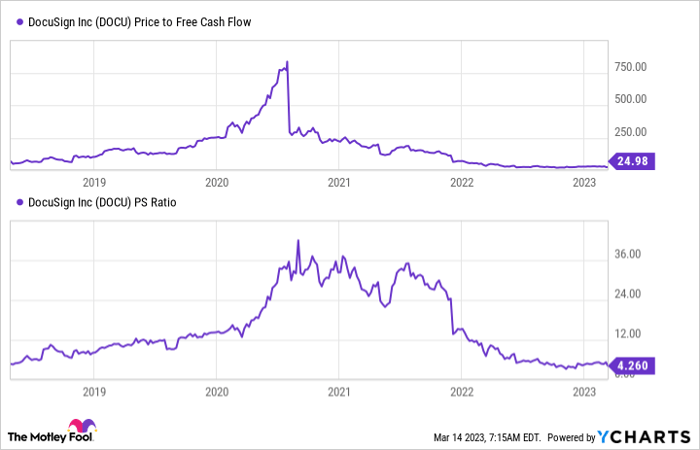

DOCU Price to Free Cash Flow data by YCharts

While investors remain cautious, there is potential for DocuSign's stock to see gains. The shares trade at 4.3 times sales -- a cheap valuation to pay for a software stock with the expansion possibilities that DocuSign has. In addition, its price-to-free-cash-flow ratio is also reasonably inexpensive. As the company changes and shifts its focus, the stock is almost too cheap to ignore.

Bear case: DocuSign's growth projections are poor

While there is a case for business expansion, DocuSign's guidance doesn't reflect that right now.

| Time Period | Revenue Growth | Billings Growth |

|---|---|---|

| Q1 FY 2024 | 8.9% | 1% |

| FY 2024 | 7.4% | 2.1% |

Data source: DocuSign. Note: Q1 FY 2024 ends April 30, 2024.

Revenue can be misleading because of service revenue (which includes onboarding and customer support). Billings give a better picture of how the actual product is selling. Unfortunately, with low single-digit billings growth for fiscal 2024 projected, DocuSign's expansion strategy is falling on its face.

As another sign of the company's struggles, it laid off 9% of its workforce in September and another 10% in February. While this could also be seen as a bullish argument because management is reducing expenses, there's not enough revenue growth here to convince me this is a good sign.

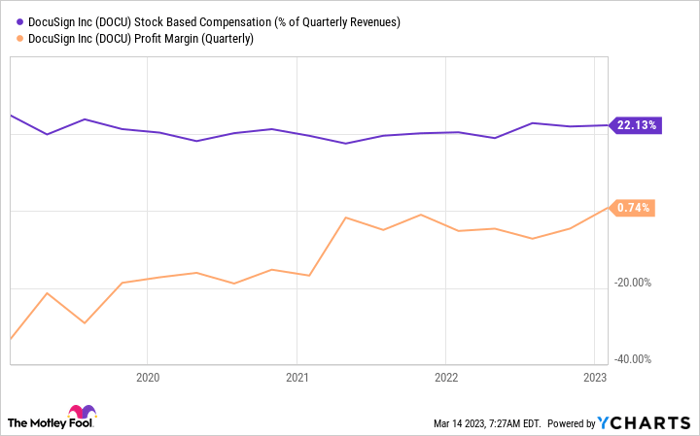

Additionally, DocuSign is barely profitable and compensates its employees heavily with stock.

DOCU Stock Based Compensation (% of Quarterly Revenues) data by YCharts

This heavy compensation bill has taken a toll on investors, with its outstanding shares rising 11% since the start of 2020. With each share becoming diluted and controlling less of the company, and growth that is unlikely to cover any operating expense increase, DocuSign doesn't seem like a strong company right now.

So which camp do I fall in? I'd say I'm a short-term bear and a long-term bull. Because enterprise budgets are tight due to expectations of an economic downturn, it's tough to convince customers to add an additional capability to a software package many companies only signed on to within the past three years. However, after this period passes, I wouldn't be surprised if DocuSign kicks back into growth mode because its product add-ons are useful.

So does that mean you should back the truck up on DocuSign's stock? Absolutely not. Just because I think it will happen doesn't mean it will. I've already got enough exposure to DocuSign's stock in my portfolio and am willing to wait and see how the company does over the next three years. In the meantime, many better buys don't have the same headwinds DocuSign is dealing with right now, and you should consider those for investments instead.

10 stocks we like better than DocuSign

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and DocuSign wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of March 8, 2023

Keithen Drury has positions in DocuSign. The Motley Fool has positions in and recommends DocuSign. The Motley Fool recommends the following options: long January 2024 $60 calls on DocuSign. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.