Fintel reports that on April 3, 2025, DNB MARKETS upgraded their outlook for Beijer Ref AB (OM:BEIJ B) from Hold to Buy.

Analyst Price Forecast Suggests 52.47% Upside

As of April 1, 2025, the average one-year price target for Beijer Ref AB is 199,82 kr/share. The forecasts range from a low of 175,74 kr to a high of 252,00 kr. The average price target represents an increase of 52.47% from its latest reported closing price of 131,05 kr / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Beijer Ref AB is 36,928MM, an increase of 3.55%. The projected annual non-GAAP EPS is 5.25.

Beijer Ref AB Maintains 1.07% Dividend Yield

At the most recent price, the company’s dividend yield is 1.07%.

Additionally, the company’s dividend payout ratio is 0.30. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company’s 3-Year dividend growth rate is 0.27% , demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

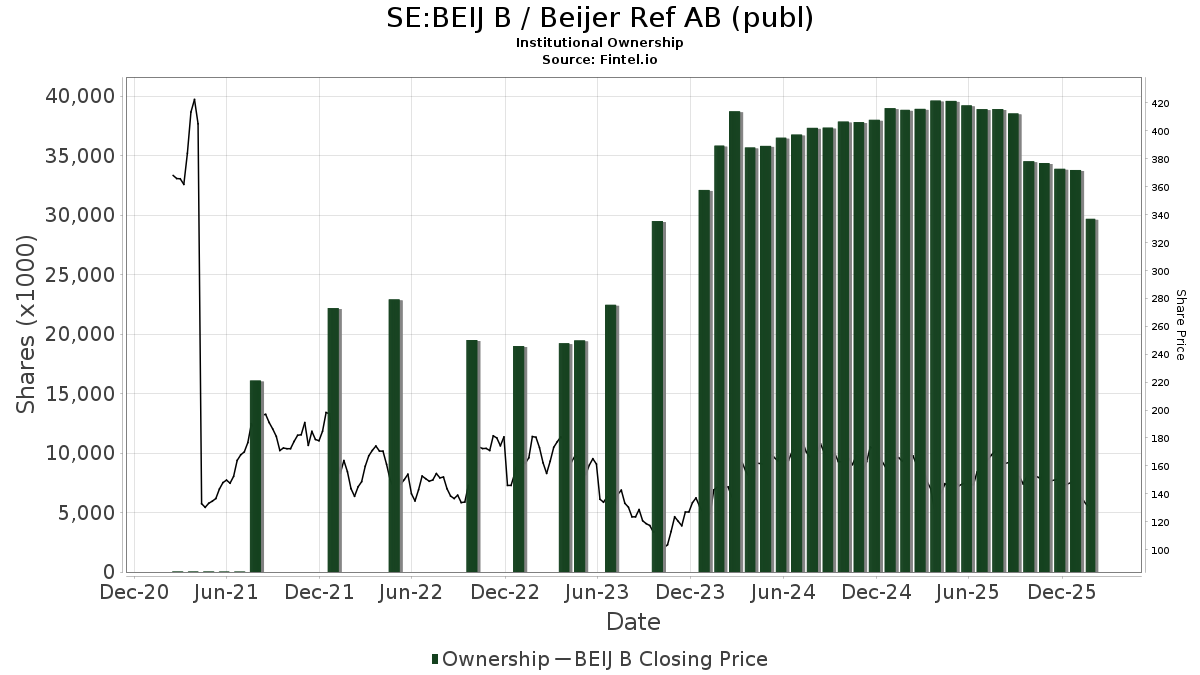

There are 186 funds or institutions reporting positions in Beijer Ref AB. This is an decrease of 4 owner(s) or 2.11% in the last quarter. Average portfolio weight of all funds dedicated to BEIJ B is 0.10%, an increase of 19.50%. Total shares owned by institutions increased in the last three months by 1.63% to 39,633K shares.

What are Other Shareholders Doing?

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 5,718K shares representing 1.19% ownership of the company. In its prior filing, the firm reported owning 5,697K shares , representing an increase of 0.37%. The firm decreased its portfolio allocation in BEIJ B by 1.96% over the last quarter.

AIM INTERNATIONAL MUTUAL FUNDS (INVESCO INTERNATIONAL MUTUAL FUNDS) - Invesco Oppenheimer International Growth Fund Class C holds 4,315K shares representing 0.90% ownership of the company. No change in the last quarter.

VTMGX - Vanguard Developed Markets Index Fund Admiral Shares holds 3,537K shares representing 0.74% ownership of the company. In its prior filing, the firm reported owning 3,481K shares , representing an increase of 1.57%. The firm decreased its portfolio allocation in BEIJ B by 1.58% over the last quarter.

IEFA - iShares Core MSCI EAFE ETF holds 2,520K shares representing 0.53% ownership of the company. In its prior filing, the firm reported owning 2,352K shares , representing an increase of 6.65%. The firm increased its portfolio allocation in BEIJ B by 3.38% over the last quarter.

SMCWX - SMALLCAP WORLD FUND INC holds 1,783K shares representing 0.37% ownership of the company. No change in the last quarter.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.