Disney's DIS theme park expansion strategy faces scrutiny as the company doubles down on its Experiences business amid shifting consumer preferences. The company aims to invest approximately $60 billion in its Parks, Experiences and Products segment over the next decade, representing its largest-ever capital commitment to this division.

The expansion plan centers on adding capacity at existing domestic parks rather than building new locations. Disney intends to leverage popular intellectual properties, including Avatar, Frozen and Marvel, to create immersive experiences that justify premium pricing. The company reported operating income growth of 23% in its Experiences segment for fourth-quarter fiscal 2025, demonstrating current strength in this business.

Management provided optimistic guidance for the segment, projecting mid-to-high single-digit operating income growth for fiscal 2026. This outlook assumes continued strength in domestic parks, offsetting anticipated softness in international operations and cruise line comparisons.

However, challenges loom on multiple fronts. Rising construction costs threaten to inflate budgets beyond initial projections, while economic uncertainty could dampen consumer willingness to pay premium prices. Disney faces intensifying competition from Universal Studios, which continues aggressive expansion of its own theme park portfolio.

The strategy carries significant execution risk. Disney must maintain attendance levels while simultaneously managing capacity additions, requiring precise timing and market understanding. Early indicators suggest mixed prospects, with domestic parks showing resilience but international operations experiencing softer demand.

Six Flags and Universal Pursue Different Expansion Strategies

Six Flags FUN looks to achieve theme park growth through strategic partnerships and modest capital investments, contrasting sharply with Disney's ambitious spending plans. The regional operator focuses on enhancing existing properties rather than massive expansions. Six Flags recently completed its merger with Cedar Fair, creating North America's largest regional theme park operator with improved operational efficiency.

Comcast CMCSA-owned Universal presents a more direct competitive threat to Disney through aggressive expansion. Universal is investing billions in its Epic Universe park in Orlando, scheduled to open in 2025, directly challenging Disney's Florida dominance. Universal's strategy emphasizes creating destination experiences that compete for multi-day visits. The company reported strong performance at existing properties while advancing construction timelines. Universal's focused approach targets Disney's core market, while Six Flags serves different consumer segments with value-oriented offerings across regional markets.

DIS’ Share Price Performance, Valuation & Estimates

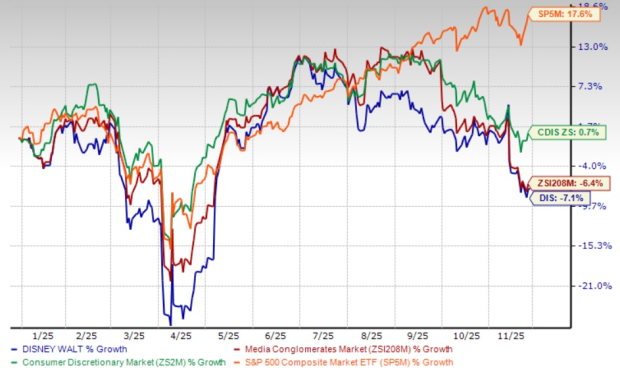

Disney shares have declined 7.1% in the year-to-date period against the Zacks Consumer Discretionary sector’s 0.7% growth.

DIS’ YTD Price Performance

Image Source: Zacks Investment Research

From a valuation standpoint, DIS stock is currently trading at a forward 12-month price/earnings ratio of 15.4X compared with the Zacks Media Conglomerates industry’s 17.97X. DIS has a Value Score of B.

Disney’s Valuation

Image Source: Zacks Investment Research

Estimates for Disney

The Zacks Consensus Estimate for Disney’s earnings is pegged at $6.59 for fiscal 2026, suggesting year-over-year growth of 11.13%.

The Walt Disney Company Price and Consensus

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

DIS currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>Comcast Corporation (CMCSA) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Six Flags Entertainment Corporation (FUN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.