DICK'S Sporting Goods, Inc. DKS is well poised to tap the positive trends in the sporting space, thanks to its robust strategies including merchandising initiatives and store-related efforts. The company is gaining from brand strength and demand for its products that resonate well with customers. Undoubtedly, management is focused on creating a trend-right merchandise assortment, deepening relations with customers via marketing and efficiently controlling expenses.

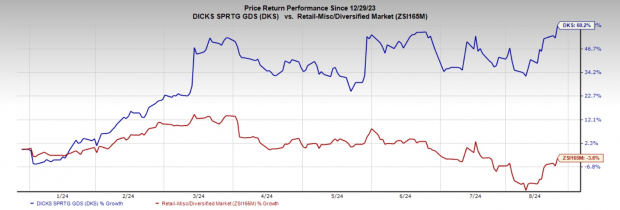

Buoyed by such strengths, shares of this sporting goods dealer have surged 60.2% versus the industry’s 3.6% decline year to date.

Analysts seem quite optimistic about the company. The Zacks Consensus Estimate for fiscal 2024 sales and earnings per share (EPS) is currently pegged at $13.2 billion and $13.76, respectively. These estimates indicate corresponding growth of 1.8% and 6.6% year over year. The consensus mark for the next fiscal year’s sales and EPS is $13.8 billion and $14.73, respectively, implying a year-over-year increase of 4.6% and 7%.

For fiscal 2024, management expects net sales in the range of $13.1-$13.2 billion and comparable store sales (comps) growth in the band of 2-3%. The gross margin is likely to expand modestly year over year. DKS envisions adjusted earnings in the band of $13.35-$13.75 per share compared with the earlier guided range of $12.85-$13.25.

Image Source: Zacks Investment Research

Buoyed by such strengths, shares of this sporting goods dealer have surged 60.2% versus the industry’s 3.6% decline year to date. Analysts seem quite optimistic about the company. The Zacks Consensus Estimate for fiscal 2024 sales and earnings per share (EPS) is currently pegged at $13.2 billion and $13.76, respectively. These estimates indicate corresponding growth of 1.8% and 6.6% year over year. The consensus mark for the next fiscal year’s sales and EPS is $13.8 billion and $14.73, respectively, implying a year-over-year increase of 4.6% and 7%. For fiscal 2024, management expects net sales in the range of $13.1-$13.2 billion and comparable store sales (comps) growth in the band of 2-3%. The gross margin is likely to expand modestly year over year. DKS envisions adjusted earnings in the band of $13.35-$13.75 per share compared with the earlier guided range of $12.85-$13.25. What’s More? DICK’S Sporting is emphasizing the omnichannel athlete experience to drive solid athlete engagement. It continues to invest in the digital capabilities. The company has been enhancing service levels at its digital and store experiences to cater well to athletes. It has been experiencing solid growth in the omnichannel athletes’ performance. Further, the company is making significant investments to reposition its portfolio to deliver an elevated omnichannel athlete experience. Management expects House of Sport and the next-generation 50,000 square-foot DICK'S store to boost strong omnichannel athlete engagement and in turn, generate huge sales and profitability. DICK’S Sporting’s store-related efforts are on track. The company has launched DICK'S House of Sport, Golf Galaxy Performance Center, Public Lands and Going, Going, Gone!, which have been performing well. In the first quarter of fiscal 2024, it opened two House of Sport locations. It remains on track to introduce six additional stores this year. The company also opened two next-generation 50K locations in the fiscal first quarter and looks forward to opening stores in another 14 locations in the current year. The total store count was 863, including 106 Golf Galaxy stores, seven Public Lands stores and 18 Going Going Gone! stores and other specialty concept stores, as of May 4. By 2027, it anticipates opening 75-100 House of Sport stores nationwide. On the flip side, DICK’S Sporting has been witnessing an uncertain macroeconomic environment. In addition, increased investments in talent and technology to create a better athlete experience, as well as investments in marketing, led to elevated costs in the fiscal first quarter. The SG&A expense rate of 24.6% expanded 20 basis points and in dollar terms, grew 7.1% year over year. Nevertheless, DICK’S Sporting Goods has been benefiting from continued market share gains. The company is on track with business optimization to streamline the overall cost structure. Also, strong comps and gaining from healthy transaction growth are aiding the company’s overall results. Given all the positives, this Zacks Rank #3 (Hold) company will continue to perform well on the bourses. Key Picks We have highlighted three better-ranked stocks, namely Gap (GPS), Abercombie (ANF) and Deckers (DECK). Gap, a fashion retailer of apparel and accessories, currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. The company has a trailing four-quarter earnings surprise of 202.7%, on average. The Zacks Consensus Estimate for Gap’s current financial-year EPS implies growth of 21.7% from the year-ago reported figure. Abercrombie, a leading casual apparel retailer, currently sports a Zacks Rank #1. ANF delivered an earnings surprise of 28.9% in the last reported quarter. The Zacks Consensus Estimate for Abercrombie’s current financial-year sales indicates growth of 11.5% from the year-ago reported figure. Deckers, a footwear and accessories dealer, currently carries a Zacks Rank of 2 (Buy). DECK delivered an average earnings surprise of 47.2% in each of the trailing four quarters. The Zacks Consensus Estimate for Deckers’ current financial-year sales indicates growth of 11.5% from the year-ago reported figure.DICK'S Sporting’s (DKS) Brand Strength & Store Efforts Aid Teaser: DICK'S Sporting (DKS) benefits from brand strength and solid market share. Its store-expansion actions also bode well. DICK'S Sporting Goods, Inc. (DKS) is well poised to tap the positive trends in the sporting space, thanks to its robust strategies including merchandising initiatives and store-related efforts. The company is gaining from brand strength and demand for its products that resonate well with customers. Undoubtedly, management is focused on creating a trend-right merchandise assortment, deepening relations with customers via marketing and efficiently controlling expenses. Buoyed by such strengths, shares of this sporting goods dealer have surged 60.2% versus the industry’s 3.6% decline year to date. Analysts seem quite optimistic about the company. The Zacks Consensus Estimate for fiscal 2024 sales and earnings per share (EPS) is currently pegged at $13.2 billion and $13.76, respectively. These estimates indicate corresponding growth of 1.8% and 6.6% year over year. The consensus mark for the next fiscal year’s sales and EPS is $13.8 billion and $14.73, respectively, implying a year-over-year increase of 4.6% and 7%. For fiscal 2024, management expects net sales in the range of $13.1-$13.2 billion and comparable store sales (comps) growth in the band of 2-3%. The gross margin is likely to expand modestly year over year. DKS envisions adjusted earnings in the band of $13.35-$13.75 per share compared with the earlier guided range of $12.85-$13.25. What’s More? DICK’S Sporting is emphasizing the omnichannel athlete experience to drive solid athlete engagement. It continues to invest in the digital capabilities. The company has been enhancing service levels at its digital and store experiences to cater well to athletes. It has been experiencing solid growth in the omnichannel athletes’ performance. Further, the company is making significant investments to reposition its portfolio to deliver an elevated omnichannel athlete experience. Management expects House of Sport and the next-generation 50,000 square-foot DICK'S store to boost strong omnichannel athlete engagement and in turn, generate huge sales and profitability. DICK’S Sporting’s store-related efforts are on track. The company has launched DICK'S House of Sport, Golf Galaxy Performance Center, Public Lands and Going, Going, Gone!, which have been performing well. In the first quarter of fiscal 2024, it opened two House of Sport locations. It remains on track to introduce six additional stores this year. The company also opened two next-generation 50K locations in the fiscal first quarter and looks forward to opening stores in another 14 locations in the current year. The total store count was 863, including 106 Golf Galaxy stores, seven Public Lands stores and 18 Going Going Gone! stores and other specialty concept stores, as of May 4. By 2027, it anticipates opening 75-100 House of Sport stores nationwide. On the flip side, DICK’S Sporting has been witnessing an uncertain macroeconomic environment. In addition, increased investments in talent and technology to create a better athlete experience, as well as investments in marketing, led to elevated costs in the fiscal first quarter. The SG&A expense rate of 24.6% expanded 20 basis points and in dollar terms, grew 7.1% year over year. Nevertheless, DICK’S Sporting Goods has been benefiting from continued market share gains. The company is on track with business optimization to streamline the overall cost structure. Also, strong comps and gaining from healthy transaction growth are aiding the company’s overall results. Given all the positives, this Zacks Rank #3 (Hold) company will continue to perform well on the bourses. Key Picks We have highlighted three better-ranked stocks, namely Gap (GPS), Abercombie (ANF) and Deckers (DECK). Gap, a fashion retailer of apparel and accessories, currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. The company has a trailing four-quarter earnings surprise of 202.7%, on average. The Zacks Consensus Estimate for Gap’s current financial-year EPS implies growth of 21.7% from the year-ago reported figure. Abercrombie, a leading casual apparel retailer, currently sports a Zacks Rank #1. ANF delivered an earnings surprise of 28.9% in the last reported quarter. The Zacks Consensus Estimate for Abercrombie’s current financial-year sales indicates growth of 11.5% from the year-ago reported figure. Deckers, a footwear and accessories dealer, currently carries a Zacks Rank of 2 (Buy). DECK delivered an average earnings surprise of 47.2% in each of the trailing four quarters. The Zacks Consensus Estimate for Deckers’ current financial-year sales indicates growth of 11.5% from the year-ago reported figure.

What’s More?

DICK’S Sporting is emphasizing the omnichannel athlete experience to drive solid athlete engagement. It continues to invest in the digital capabilities. The company has been enhancing service levels at its digital and store experiences to cater well to athletes. It has been experiencing solid growth in the omnichannel athletes’ performance.

Further, the company is making significant investments to reposition its portfolio to deliver an elevated omnichannel athlete experience. Management expects House of Sport and the next-generation 50,000 square-foot DICK'S store to boost strong omnichannel athlete engagement and in turn, generate huge sales and profitability.

DICK’S Sporting’s store-related efforts are on track. The company has launched DICK'S House of Sport, Golf Galaxy Performance Center, Public Lands and Going, Going, Gone!, which have been performing well. In the first quarter of fiscal 2024, it opened two House of Sport locations. It remains on track to introduce six additional stores this year.

The company also opened two next-generation 50K locations in the fiscal first quarter and looks forward to opening stores in another 14 locations in the current year. The total store count was 863, including 106 Golf Galaxy stores, seven Public Lands stores and 18 Going Going Gone! stores and other specialty concept stores, as of May 4. By 2027, it anticipates opening 75-100 House of Sport stores nationwide.

On the flip side, DICK’S Sporting has been witnessing an uncertain macroeconomic environment. In addition, increased investments in talent and technology to create a better athlete experience, as well as investments in marketing, led to elevated costs in the fiscal first quarter. The SG&A expense rate of 24.6% expanded 20 basis points and in dollar terms, grew 7.1% year over year.

Nevertheless, DICK’S Sporting Goods has been benefiting from continued market share gains. The company is on track with business optimization to streamline the overall cost structure. Also, strong comps and gaining from healthy transaction growth are aiding the company’s overall results. Given all the positives, this Zacks Rank #3 (Hold) company will continue to perform well on the bourses.

Key Picks

We have highlighted three better-ranked stocks, namely Gap GPS, Abercombie ANF and Deckers DECK.

Gap, a fashion retailer of apparel and accessories, currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has a trailing four-quarter earnings surprise of 202.7%, on average. The Zacks Consensus Estimate for Gap’s current financial-year EPS implies growth of 21.7% from the year-ago reported figure.

Abercrombie, a leading casual apparel retailer, currently sports a Zacks Rank #1. ANF delivered an earnings surprise of 28.9% in the last reported quarter. The Zacks Consensus Estimate for Abercrombie’s current financial-year sales indicates growth of 11.5% from the year-ago reported figure.

Deckers, a footwear and accessories dealer, currently carries a Zacks Rank of 2 (Buy). DECK delivered an average earnings surprise of 47.2% in each of the trailing four quarters. The Zacks Consensus Estimate for Deckers’ current financial-year sales indicates growth of 11.5% from the year-ago reported figure.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.