One of the most sought-after semiconductor behemoths, NVIDIA Corporation NVDA, recently flashed a bearish chart pattern amid regulatory headwinds. So, what’s next for NVIDIA investors? Do they sell the stock, or do they believe in NVIDIA’s inherent strength and hang on to it? Let’s find out.

Death Cross Pattern Emerges; NVIDIA Stock Slumps

Several chip stocks, including NVIDIA, suffered losses on Wednesday. The stock slipped 5.7% yesterday, while a death cross pattern emerged last week. This means NVIDIA’s short-term 50-day moving average (DMA) has dropped below its long-term 200 DMA, signaling a looming downtrend.

On Wednesday, the NVIDIA stock finished at $113.76, while the 50-DMA was $125.86 below the 200-DMA, which was $127.72. The last time NVIDIA stock faced a death cross was in April 2022, causing its shares to tank 50% over the next six months before hitting its lowest point in October 2022.

Technical Indicator & Overlays - NVIDIA

Image Source: Zacks Investment Research

The possibility of stricter regulations on NVIDIA’s chips in China hurt its shares. Compounding the decline was the U.S. government’s move to add several Chinese companies to a trade blacklist for national security reasons, adversely impacting NVIDIA’s sales.

Can NVIDIA Stock Bounce Back?

Undeniably, regulators from China are discouraging its tech firms from buying NVIDIA’s H20 chips due to energy efficiency violations. However, sales of H20s are unaffected as rules are not strictly enforced, and NVIDIA intends to meet with regulators to address the issue.

Similarly, NVIDIA has successfully navigated U.S. regulatory challenges in the past and shown resilience to such issues. Anyhow, $100 is a strong support level for the NVIDIA stock. If it breaks below this, it could signal a long-term downward trend. NVIDIA had previously tested this level in August and September, only to rebound to an all-time high of $150.

In reality, insane demand for NVIDIA’s next-generation cutting-edge Blackwell chips and dominance in the graphic processing units (GPUs) market would drive its share price upward. Magnificent-7 stocks such as Alphabet Inc. GOOGL and Microsoft Corporation MSFT have chosen Blackwell chips due to their solid energy efficiency level and faster AI interface.

A market share of more than 80% in the discrete GPU space gives NVIDIA a competitive edge, and its CUDA software platform continues to gain prominence among developers over Advanced Micro Devices, Inc.’s AMD ROCm software platform.

NVIDIA is Financially Robust

Despite the current price fluctuations, NVIDIA remains a financially strong company. It saw its revenues climb 114% to $130 billion in fiscal 2025 (ended in January) and expects sales to jump 65% year over year in the first quarter.

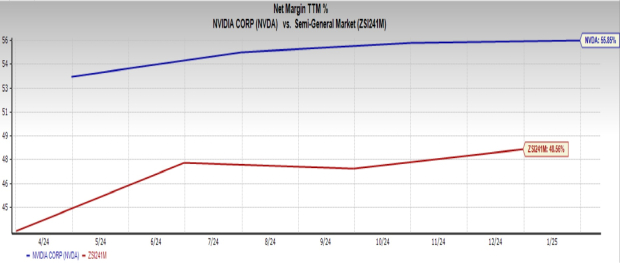

NVIDIA has often generated profits efficiently. This is because the firm’s net profit margin of 55.9% is more than the Semiconductor - General industry’s 48.6%, indicating a high margin.

Image Source: Zacks Investment Research

How to Trade NVIDIA Stock Now

Given strong financials, high demand for the Blackwell chip, and GPU dominance, the recent share price dip should not concern NVIDIA stakeholders. Instead, they should hold onto the stock for strong gains in the future.

However, new buyers should wait for an opportune moment to invest in the NVIDIA stock due to its current volatility. NVDA, at this time, has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.