Fintel reports that on July 11, 2023, DA Davidson maintained coverage of MP Materials (NYSE:MP) with a Buy recommendation.

Analyst Price Forecast Suggests 49.10% Upside

As of July 6, 2023, the average one-year price target for MP Materials is 37.65. The forecasts range from a low of 26.26 to a high of $58.80. The average price target represents an increase of 49.10% from its latest reported closing price of 25.25.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for MP Materials is 526MM, an increase of 15.04%. The projected annual non-GAAP EPS is 1.32.

What is the Fund Sentiment?

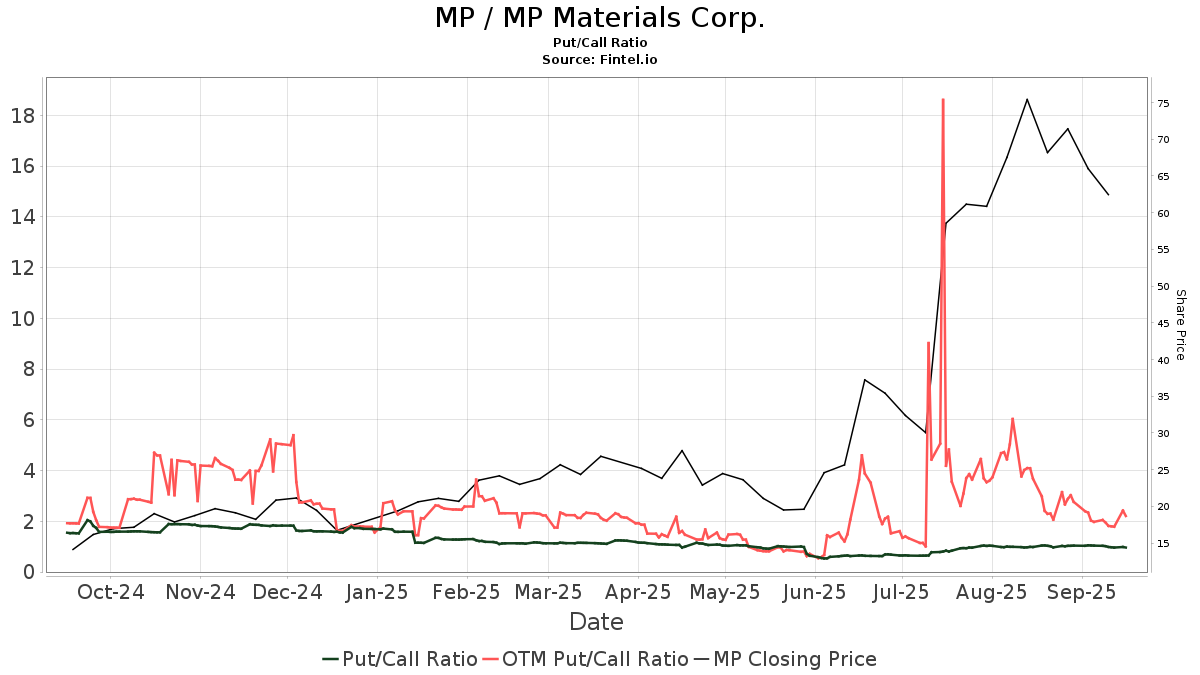

There are 771 funds or institutions reporting positions in MP Materials. This is an increase of 14 owner(s) or 1.85% in the last quarter. Average portfolio weight of all funds dedicated to MP is 0.22%, an increase of 0.15%. Total shares owned by institutions increased in the last three months by 0.95% to 125,011K shares.  The put/call ratio of MP is 0.65, indicating a bullish outlook.

The put/call ratio of MP is 0.65, indicating a bullish outlook.

What are Other Shareholders Doing?

JHL Capital Group holds 28,573K shares representing 16.09% ownership of the company. No change in the last quarter.

QVT Financial holds 13,502K shares representing 7.60% ownership of the company. No change in the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 3,306K shares representing 1.86% ownership of the company. In it's prior filing, the firm reported owning 3,247K shares, representing an increase of 1.79%. The firm increased its portfolio allocation in MP by 9.16% over the last quarter.

XME - SPDR(R) S&P(R) Metals & Mining ETF holds 3,272K shares representing 1.84% ownership of the company. In it's prior filing, the firm reported owning 2,807K shares, representing an increase of 14.22%. The firm increased its portfolio allocation in MP by 16.26% over the last quarter.

IJH - iShares Core S&P Mid-Cap ETF holds 2,848K shares representing 1.60% ownership of the company. In it's prior filing, the firm reported owning 2,851K shares, representing a decrease of 0.10%. The firm increased its portfolio allocation in MP by 11.01% over the last quarter.

MP Materials Background Information

(This description is provided by the company.)

MP Materials Corp. is the largest producer of rare earth materials in the Western Hemisphere. With over 270 employees, the Company owns and operates Mountain Pass, an iconic American industrial asset, which is the only rare earth mining and processing site of scale in the Western Hemisphere and currently produces approximately 15% of global rare earth content. Separated rare earth elements are critical inputs for the magnets that enable the mobility of electric vehicles, drones, defense systems, wind turbines, robotics and many other high-growth, advanced technologies. MP Materials’ integrated operations at Mountain Pass uniquely combine low production costs with best-in-class environmental standards, thereby restoring American leadership to a critical industry with a strong commitment to sustainability.

Additional reading:

- Form of MP Materials Corp. 2020 Stock Incentive Plan Restricted Stock Unit Agreement with Performance Conditions.

- Mine Safety Disclosure pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MP Materials Reports First Quarter 2023 Results REO Sales and Production Volumes of 10,215 and 10,671 Metric Tons, Respectively Revenue of $95.7M and Net Income of $37.4M Adjusted EBITDA of $58.7M Diluted EPS of $0.20 and Adjusted Diluted EPS of $0.2

- MP Materials Elects Arnold W. Donald to Board

- Subsidiaries of the Registrant.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.